Introduction

Vertex Protocol is the first highly-performant decentralized exchange (DEX) that combines spot, perpetual, and money markets into one robust trading platform. Users enjoy some of the lowest fees in the industry, lightning-fast order execution, and universal cross-margin accounts for maximum capital efficiency. Vertex is built on Arbitrum, a prominent Ethereum L2 first launched in 2021.

The protocol’s mission is to combine the efficiency, speed, and broad range of features typically associated with CEXs with the self-custody, transparency, and security of DEXs. This unique combination addresses a crucial need in the cryptocurrency market, especially in light of the recent turmoil and trust issues surrounding centralized platforms.

Here are some of Vertex’s highlights:

- Industry Leading Fees: Makers always trade for free. Takers pay between 0.02% – 0.04% of the trade size.

- Vertical Integration: Vertex has spot, perpetuals, and money markets all in one place. Traders can also provide liquidity to Vertex AMMs while using their LP tokens for margin. Unrealized PNL is automatically used to offset margin requirements via universal cross-margin accounts.

- Maker Rewards Program: Besides enjoying free maker trades, market makers are rewarded for providing orderbook liquidity. Through Vertex’s partnership with Elixir Protocol, retail users can participate in algorithmic market making and earn these maker rewards.

- Trading Rewards Program: Traders earn VRTX rewards through ongoing incentive emissions. VRTX is the protocol’s utility token.

- Earn Participation Rewards: VRTX tokenomics ensures that those participating in the exchange can earn rewards from protocol revenue.

Market

Vertex Protocol positions itself in the rapidly evolving decentralized finance (DeFi) market, aiming to bridge the gap between the high functionality of centralized exchanges (CEXs) and the transparency and self-custody of decentralized exchanges (DEXs).

The DeFi landscape, particularly the segment focusing on cryptocurrency exchanges, has witnessed substantial growth. Vertex is entering a space traditionally dominated by two main types of platforms.

On the one hand, there are CEXs like Binance and Coinbase, renowned for their robust infrastructure, high liquidity, and advanced trading features but often criticized for their centralized control.

On the other hand, DEXs like Uniswap and Sushiswap provide a decentralized trading experience, but they often don’t have the featuressame liquidity and transaction speed level as their centralized counterparts.

Vertex Protocol seeks to stand out by combining the operational efficiency and diverse features of CEXs with the trustless, secure trading environment typical of DEXs. Its innovative model offers advanced trading features typically not in traditional DEXs, such as cross-margin trading and integrated money markets.

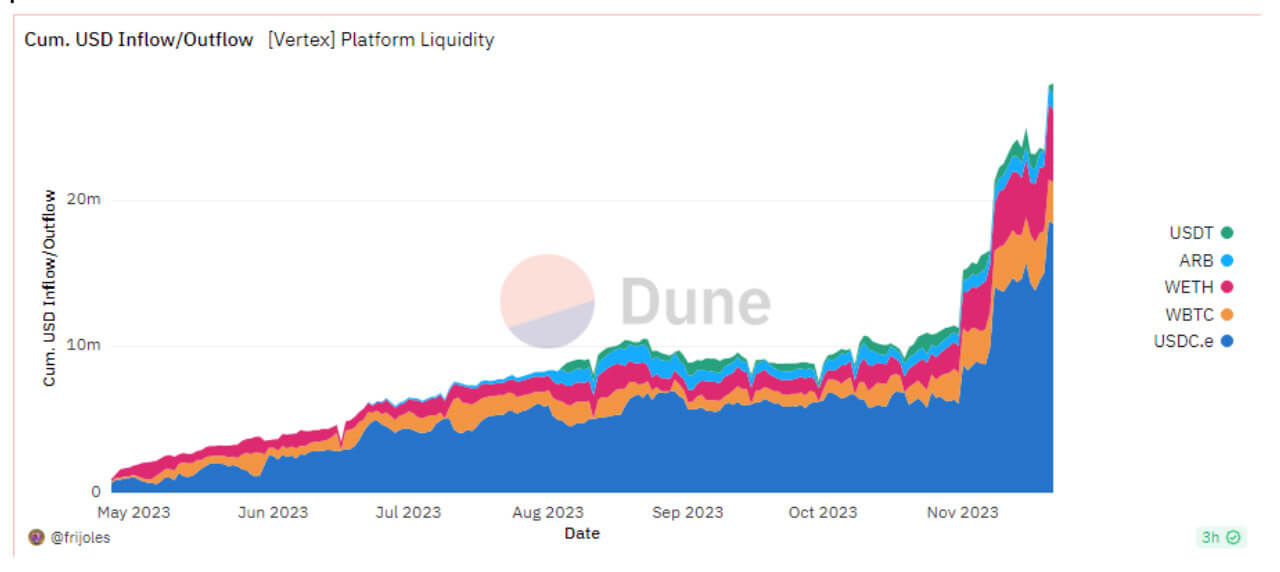

Since its launch, Vertex Protocol has seen steady growth and currently has $28.06 million in total value locked on the platform, with roughly 8,400 unique traders. Cumulative USD inflows and outflows more than doubled in November as the crypto market sentiment shifted to a more positive note.

Meanwhile, the platform’s total trading volume has grown by $6.59 billion USDC over the past 30 days and totaled $15.89 billion as of Nov. 22.

Technology

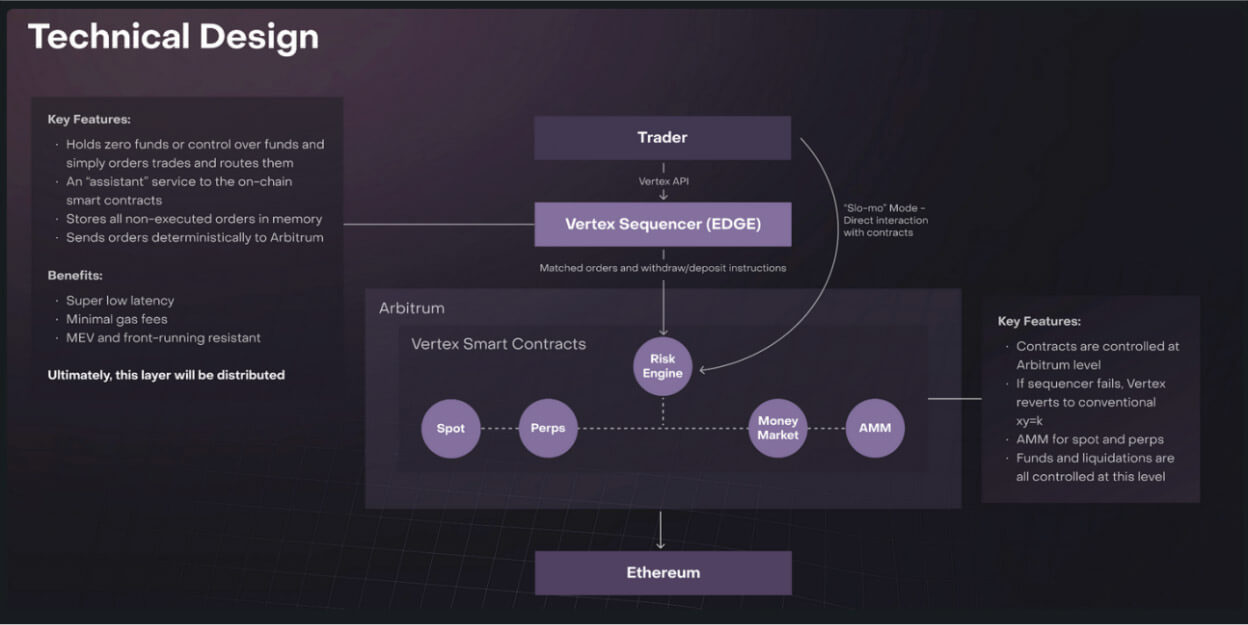

Vertex Protocol leverages cutting-edge technology to unify the best features of centralized and decentralized exchanges in the DeFi space. At its core, the protocol operates on Arbitrum, a Layer 2 scaling solution for Ethereum.

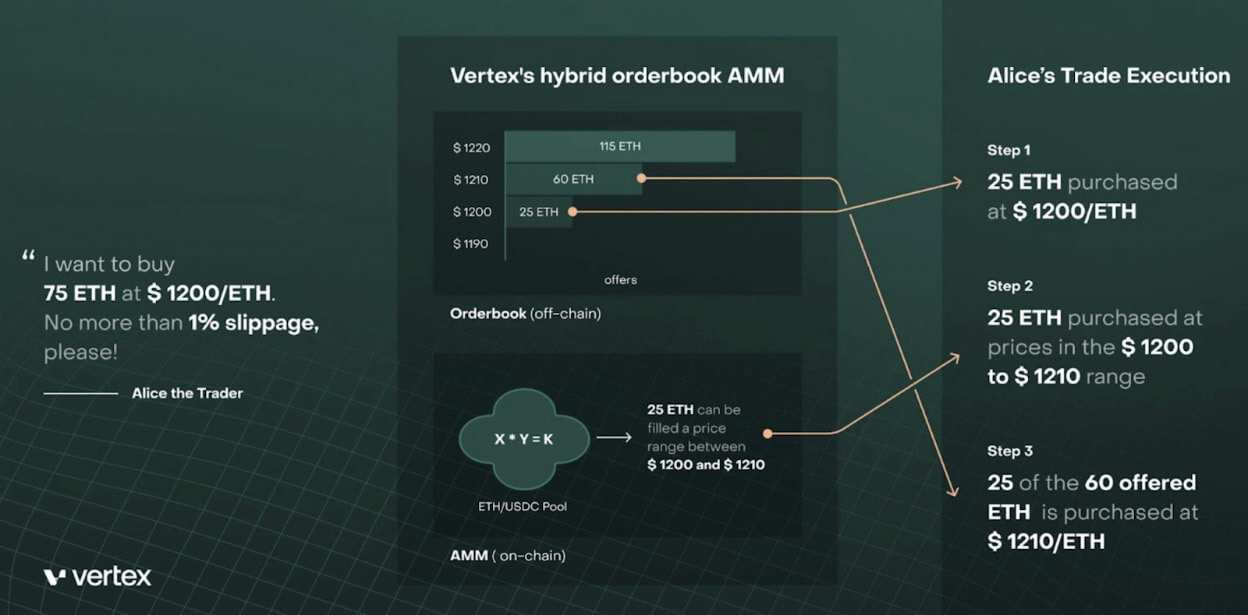

Vertex’s trading infrastructure combines a Constant Product AMM with an off-chain orderbook. The orderbook provides lightning-fast order matching and execution, and a guarantee of MEV-protection. Latency is a mere 15 milliseconds, competitive with the leading centralized exchanges.

If the off-chain orderbook ever becomes temporarily unusable, users can execute their trades through the fully decentralized on-chain AMM. All settlement happens on-chain, so users enjoy self-custody of their assets. This Hybrid Orderbook-AMM model provides the best of both worlds: the speed of a centralized exchange mixed with the self-custodial nature of a decentralized exchange.

Vertex’s product suite is designed to cater to the diverse needs of its users. Vertex offers spot, perpetuals, and money markets in one platform. All three markets are integrated via universal cross-margin accounts, allowing users to use an account’s entire balance, including unrealized PNL and LP tokens, as collateral for their positions, providing greater capital efficiency and flexibility in trading strategies.

Here are Vertex’s trading options:

- Spot Trading: This feature allows users to buy and sell crypto assets for immediate settlement

- Perpetual Futures Trading: Vertex offers perpetual futures, a type of derivatives product that allows users to speculate on the price movements of cryptocurrencies without an expiration date. Vertex offers perps with up to 10x leverage.

- Integrated Money Market: Vertex integrates a money market directly into the platform, enabling users to lend and borrow crypto assets. This feature not only offers additional liquidity to traders but also provides opportunities for earning interest on idle assets.

- Automated Market Maker (AMM): In addition to the traditional order book model, Vertex incorporates an AMM, enhancing liquidity and enabling users to earn LP fees by providing liquidity to the platform.

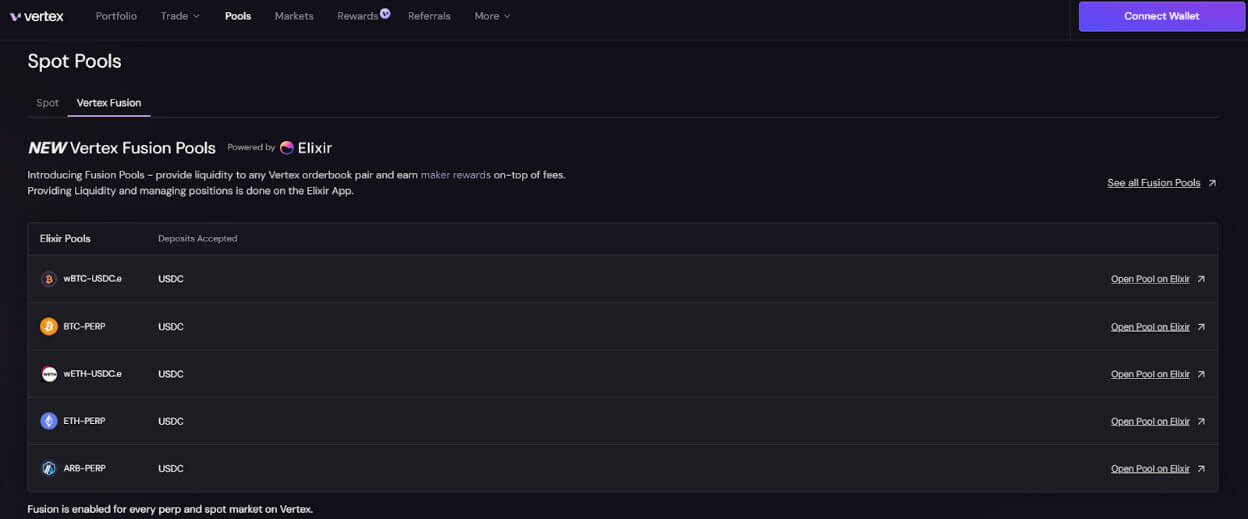

- Fusion Pools by Elixir: Fusion pools enable anyone to participate in CLOB market-making via Elixir Protocol’s integration with Vertex. Participants can earn marker rewards with their capital.

The integration of all these unique features is made possible by Vertex’s advanced on-chain risk engine, ensuring that accounts are within their margin requirements for their open positions. Positions not meeting margin requirements are promptly liquidated and the revenue goes into the insurance fund. The insurance fund helps remove bad debt from the system in case of a giant liquidation event.

Vertex relies on USDC.e as the quote asset. This is USDC on Ethereum Mainnet that was bridged into Arbitrum. USDC.e is different from USDC, which is native to Arbitrum. Vertex is working on reconciling these two to reduce the friction of using the exchange.

Aside from these on-chain components, Vertex is special because its API and SDK offer solutions for automated traders, market makers, and HFT firms to integrate into the exchange easily. This brings massive liquidity to Vertex, minimizes slippage, and gives all traders a better trading experience.

The Vertex Protocol GitHub repository has code for smart contracts, Python and TypeScript SDKs, and the Vertex Dashboard. Please visit the Vertex API documentation on GitBook to learn how to use the API to build automated strategies or just query data.

The real-world implications of Vertex’s technology are significant. It offers users a more efficient trading experience, typically associated with CEXs, within a DEX’s secure and autonomous realm. This combination of speed, security, and advanced functionality positions Vertex as an innovative solution in the cryptocurrency trading landscape.

Tokenomics

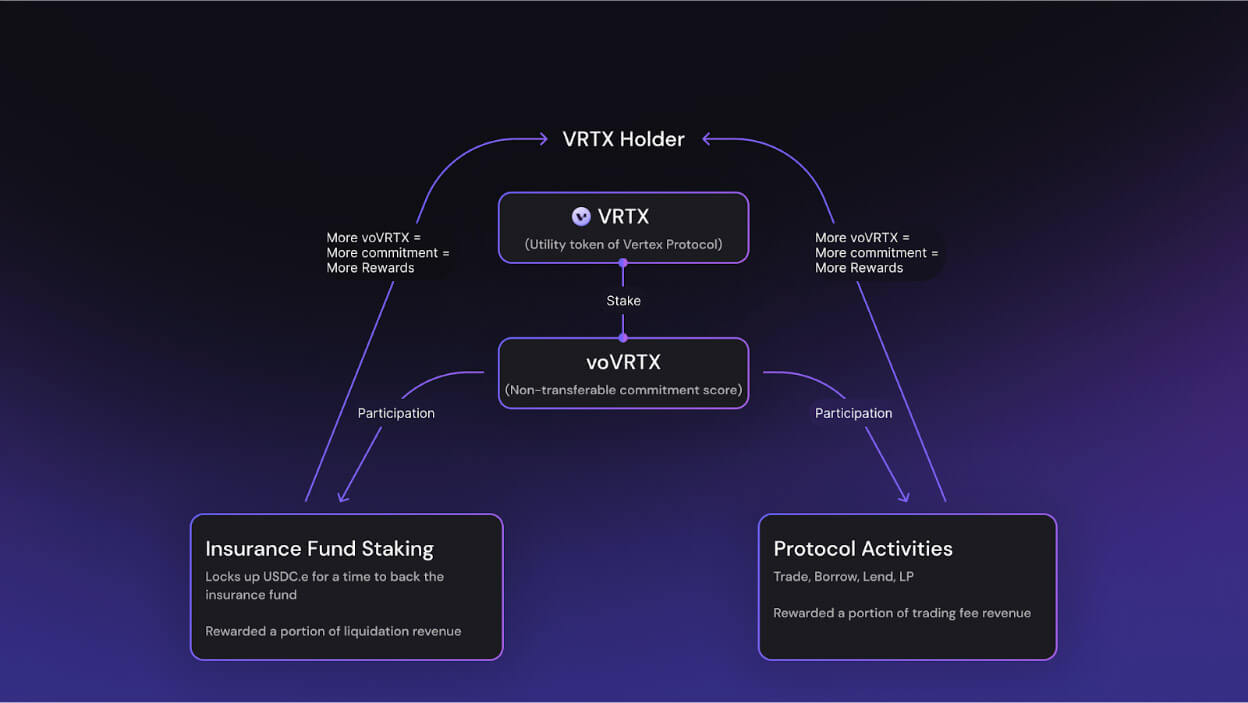

Vertex Protocol’s tokenomics revolves around its native token, VRTX, which is integral to its governance, utility, and incentive structure. The tokenomics are designed to foster long-term stability and growth for the platform.

- Fixed Total Supply: VRTX has a capped total supply of 1 billion tokens to curb inflationary pressures and maintain the token’s value over time.

- Emission Schedule: The tokens are distributed over five years, ensuring a controlled and steady release into the market, thus preventing oversupply issues.

The allocation of VRTX is strategically divided among early investors, team members, community incentives, and an ecosystem fund — with a significant portion reserved for liquidity and user incentives.

VRTX will align the incentives of community members and exchange participants. An initial batch of VRTX will be distributed based on the trading incentives program (first 6 epochs after mainnet launch, which was roughly 6 months long). After the first 6 epochs, an “ongoing incentives” phase will continue for 36 months to incrementally release the rest of the VRTX.

VRTX is meant to be staked as a signal of confidence in the long-term viability of the Vertex Protocol. Staking VRTX generates voVRTX, a non-transferable user metric that signals long-term commitment and participation in the exchange. voVRTX scores will be used to determine rewards to users. Overextended durations, users who demonstrate a long-term commitment to the protocol, measured by their voVRTX score, are eligible to receive rewards derived from a percentage of the protocol’s revenue.

The first method of exchange participation for voVRTX-determined rewards is to use the exchange – trading, lending, borrowing, and providing liquidity. Up to 50% of all trading fee revenue generated by Vertex in a single epoch, excluding sequencer fees, will be allocated to the Protocol Treasury and used as rewards. Rewards are disbursed to users based on their long-term participation and commitment to Vertex, which is measured by their voVRTX score.

The second method of exchange participation for voVRTX-determined rewards is to help back the insurance fund with USDC.e. When a user does this, they are eligible to receive a portion of liquidation revenue, and they receive a boosted portion if they have a higher voVRTX score.

The Vertex Protocol Liquidity Bootstrap Auction (LBA), which took place from November 13 to 20, 2023, bootstraps the first liquid market for VRTX. The LBA starts with two liquidity pools, a VRTX pool, and a USDC.e pool.

Users who earned some VRTX by trading on Vertex Protocol during the first 6 epochs could opt to seed the VRTX liquidity pool during the 7-day LBA. Anyone could provide liquidity to the USDC.e pool over that time. After the LBA, the two pools were combined to form a standard constant product AMM, the initial liquid market for the VRTX token. The initial launch price of VRTX was 0.313365232240038557 USDC.e. Currently, about 42% of released VRTX is staked.

Team & Investors

Vertex Protocol has garnered the support of prominent investors and partners, signaling strong confidence in its market potential and technological prowess. The backing comes from a blend of industry-leading market makers and venture capital firms, each bringing experience, resources, and strategic value.

Team

Darius Tabatabai and Alwin Peng co-founded Vertex to build an on-chain forex market on the now-defunct Terra blockchain. The founders raised $8.5 million in late 2021. After the infamous de-peg of UST, the team pivoted to building a vertically integrated DEX on Arbitrum.

Darius had an exceptional career in TradFi as an options trader for various big financial institutions. Alwin is the youngest full-time hire at Jump Trading, a renowned proprietary trading firm known for algorithmic and high-frequency strategies.

Among the key investors are:

- Wintermute: A cutting-edge trading firm providing liquidity across various cryptocurrency exchanges and platforms, enhancing the market efficiency for the assets they cover.

- Dexterity Capital: A firm known for its algorithmic trading strategies in the crypto space, Dexterity Capital’s involvement suggests a commitment to sophisticated trading mechanisms and financial instruments.

- Hack VC: A venture capital firm specializing in early-stage tech startups, Hack VC’s investment indicates a belief in Vertex’s technological foundation and long-term vision.

- GSR: With a focus on cryptocurrency trading and market-making, GSR’s partnership indicates Vertex’s commitment to liquidity and trading volume.

- Jane Street: A quantitative trading firm with a deep understanding of global financial markets, Jane Street’s engagement with Vertex could be pivotal in bridging traditional finance with DeFi.

- Collab+Currency: A crypto-native investment firm that supports projects at the intersection of blockchain and financial innovation, their expertise could drive further development and integration of Vertex’s offerings.

- HRT (Hudson River Trading): As a global quantitative trading firm, HRT’s support suggests an alignment with Vertex’s mission to enhance trading experiences through technology.

- Big Brain Holdings: A firm that invests in the convergence of technology, finance, and blockchain, their involvement could signal a strategic advisory role in Vertex’s development.

These investors bring capital and unique insights, network access, and industry expertise, contributing to Vertex Protocol’s growth trajectory and potential to become a significant force in the DeFi ecosystem.

Partnerships

Elixir enables retail users to participate in decentralized market-making on the Vertex orderbook via Fusion Pools. Users may deposit their assets and receive ELP tokens which represent their share of maker rebates and market-making profits.

Audits & Security

Vertex Protocol strongly emphasizes security, which is fundamental to reliability and user safety. The platform’s security infrastructure is rooted in its integration with Ethereum and Arbitrum, combining the robust security model of Ethereum with the scalability and efficiency of Arbitrum’s Layer 2 solutions.

The choice of Ethereum as the underlying blockchain for its smart contracts brings Vertex into the realm of one of the most secure and tested blockchains. Ethereum’s security model is renowned for its resilience, a crucial factor for DeFi platforms handling complex financial transactions. Solidity further adds to this security, as the widespread adoption of the language has led to extensive testing and refinement over numerous blockchain projects.

Arbitrum’s optimistic rollups contribute significantly to Vertex’s security posture. This technology streamlines transaction validation by assuming transactions are valid by default, reducing the potential attack surface while maintaining accuracy in transaction processing.

The platform’s commitment to security is also evident in its approach to smart contract development and maintenance. Using a mature and widely recognized programming language for smart contracts, coupled with a robust development and testing framework, minimizes the risk of vulnerabilities and ensures the platform’s reliability.

The protocol has partnered with OtterSec, a renowned blockchain security firm, to enhance the platform’s security. OtterSec is known for its extensive Web3 and traditional security expertise. The firm has conducted thorough audits of Vertex’s core protocol, mainly focusing on its on-chain contracts on Arbitrum.

The collaboration between Vertex and OtterSec is ongoing to continually enhance the platform’s security framework, with results and findings of the audits available online.

Vertex Protocol’s security strategy, underpinned by Ethereum’s solid security framework and enhanced by Arbitrum’s efficient technology, plays a pivotal role in ensuring the platform’s safety and reliability. This comprehensive approach to security is key in building trust among users and establishing Vertex as a secure and dependable player in the DeFi market.

Risks & Opportunities

Vertex’s strengths lie in its innovative approach to combining the benefits of CEXs and DEXs, technological advancements, and alignment with the growing trend toward DeFi. These factors could significantly drive its adoption and success. However, the platform faces notable challenges arising from its complexity, competitive environment, regulatory uncertainties, and inherent security risks of DeFi.

Opportunities

Vertex Protocol’s unique positioning in the DeFi market presents several opportunities that could significantly contribute to its success:

- Industry Leading Fees: Vertex Protocol has some of the lowest fees in crypto trading. Makers trade for free. Takers pay 0.02% – 0.04% on their trades, depending on the market. The weighted average fee size since Vertex’s launch has been 0.023% of trade size.

- Market Gap Fulfillment: Vertex addresses a critical gap between the operational efficiency of CEXs and the security of DEXs. This model could attract a wide range of users seeking efficiency and security in their trading experiences.

- Technological Innovation: The integration of advanced features such as cross-margin trading and an integrated money market on a Layer 2 solution like Arbitrum can position Vertex at the forefront of technological innovation in DeFi, potentially leading to high user adoption.

- Growing DeFi Market: The expanding DeFi ecosystem offers fertile ground for Vertex to grow. As more users and institutional investors turn to DeFi, platforms like Vertex offering enhanced functionality and security will likely benefit.

- Community and Governance Engagement: With VRTX tokenomics encouraging community participation in governance, Vertex can leverage community insights and engagement for continuous improvement and adaptation to market needs.

Risks

Conversely, Vertex Protocol faces several risks that could impact its long-term success:

- Intense Competition: The DeFi space is highly competitive, with established platforms already dominating the market. Gaining a significant market share could be challenging for Vertex, especially against platforms with solid user bases.

- Regulatory Uncertainty: The regulatory landscape for DeFi is still evolving. Regulation changes could impact Vertex’s operations, especially in jurisdictions with stringent financial laws.

- Technical Complexity: While innovative, the platform’s advanced features also add complexity and could pose a barrier to entry for less tech-savvy users — limiting its user base.

- Security Concerns: Smart contracts and blockchain technology carry inherent risks that can only be minimized rather than eliminated by robust security measures. Any security breach could significantly harm Vertex’s reputation and user trust.

- Market Volatility: The cryptocurrency market is known for its volatility. Sudden market shifts can impact DeFi platforms like Vertex, affecting liquidity and user confidence.

Vertex must effectively navigate these risks to ensure long-term success while capitalizing on its unique offerings and market opportunities. Balancing innovation with user accessibility, maintaining robust security measures, and adapting to regulatory changes will be key to its sustained growth and market presence.

Conclusion

Vertex Protocol emerges as a distinct and promising entity in the blockchain market, blending the efficiency of centralized exchanges with the transparency and self-custody of decentralized platforms.

This innovative approach sets Vertex apart in the DeFi space, potentially positioning it as a significant player in the broader cryptocurrency market. At the heart of Vertex’s appeal is its technological innovation and the enhanced scalability and transaction efficiency due to operating on Arbitrum.

Vertex’s market positioning to bridge the gap between centralized and decentralized exchanges taps into a growing user base seeking platforms that offer efficient trading and robust security.

While facing challenges like intense competition and a volatile market, Vertex’s focus on innovation, safety, and user-centric features places it in a solid position to attract a diverse user base and adapt to evolving market conditions.

The protocol’s success in leveraging these strengths and overcoming the inherent challenges in the DeFi space will be crucial to its long-term impact and influence in the broader cryptocurrency market.

For more information, please visit Vertex Protocol’s official social channels, including:

Disclaimer: CryptoSlate was compensated to produce this project report by Vertex Protocol.

Binance

Binance

VRTX

VRTX