Professor: Ethereum could “eat” Wall Street in 5 to 10 years for 3 reasons

Professor: Ethereum could “eat” Wall Street in 5 to 10 years for 3 reasons Professor: Ethereum could “eat” Wall Street in 5 to 10 years for 3 reasons

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Aaron Wright, a professor at Cardozo School of Law, believes Ethereum could “eat” Wall Street in the next 10 years.

The professor outlined three key reasons why Ethereum could compete against the traditional financial sector. They are decentralized autonomous organizations (DAOs), non-fungible tokens (NFTs), and personal tokens.

Why Ethereum could rapidly evolve in the upcoming years

Decentralized finance (DeFi) has taken over Ethereum and the cryptocurrency space by storm. There is now over $14.9 billion in value locked in across DeFi protocols and the cumulative market cap of DeFi tokens has reached $18.8 billion.

But, Ethereum goes far beyond DeFi. Wright explained that DAOs, NFTs, and personal tokens could massively expand Ethereum’s usability. He said:

“DeFi isn’t starting to eat Wall Street. Ethereum is. Over the next 5-10 years, it could eat: * Sillicon valley with DAOs * Art/gaming, market with NFTs * Social networks, media, and influencer networks with personal tokens.”

DAOs, in particular, could become the focal point of Ethereum’s next growth phase because it can be adapted in many different ways.

In concept, a DAO is an organization that is run in a decentralized way. Members of the DAO would vote to make decisions, allowing the community to run the organization.

A DAO could be a fund, a project, or a community. Typically, a DAO has an underlying token, called a governance token. With it, members of the organization can vote to approve proposals.

For instance, a DAO could be used in a venture capital fund. Under a DAO-based fund, holders of the governance token would be able to dictate the operations of the fund.

If these decentralized governance systems get applied in both financial and non-financial sectors, it could massively increase the usability and adoption of Ethereum.

Eth2 only makes everything better

In the past, when Ethereum saw a significant increase in user activity on both DeFi, DAO, and other decentralized applications, problems with scaling often became a roadblock.

But, with the release of the Eth2 mainnet, the Ethereum blockchain network would be able to process thousands of transactions per second.

On-chain activity shows that the demand to stake ETH is only increasing, which would make Eth2 more stable.

1.08% of $ETH supply is staked on the ETH 2.0 contract.

View Chart ? https://t.co/MvovMDShNY#eth2 pic.twitter.com/rQbzGARZdw

— CryptoQuant.com (@cryptoquant_com) December 8, 2020

In the medium to long term, Eth2 would provide a strong foundation for decentralized applications. As such, if Ethereum sees widespread usage in the upcoming years, the blockchain network would be able to handle the increase in demand.

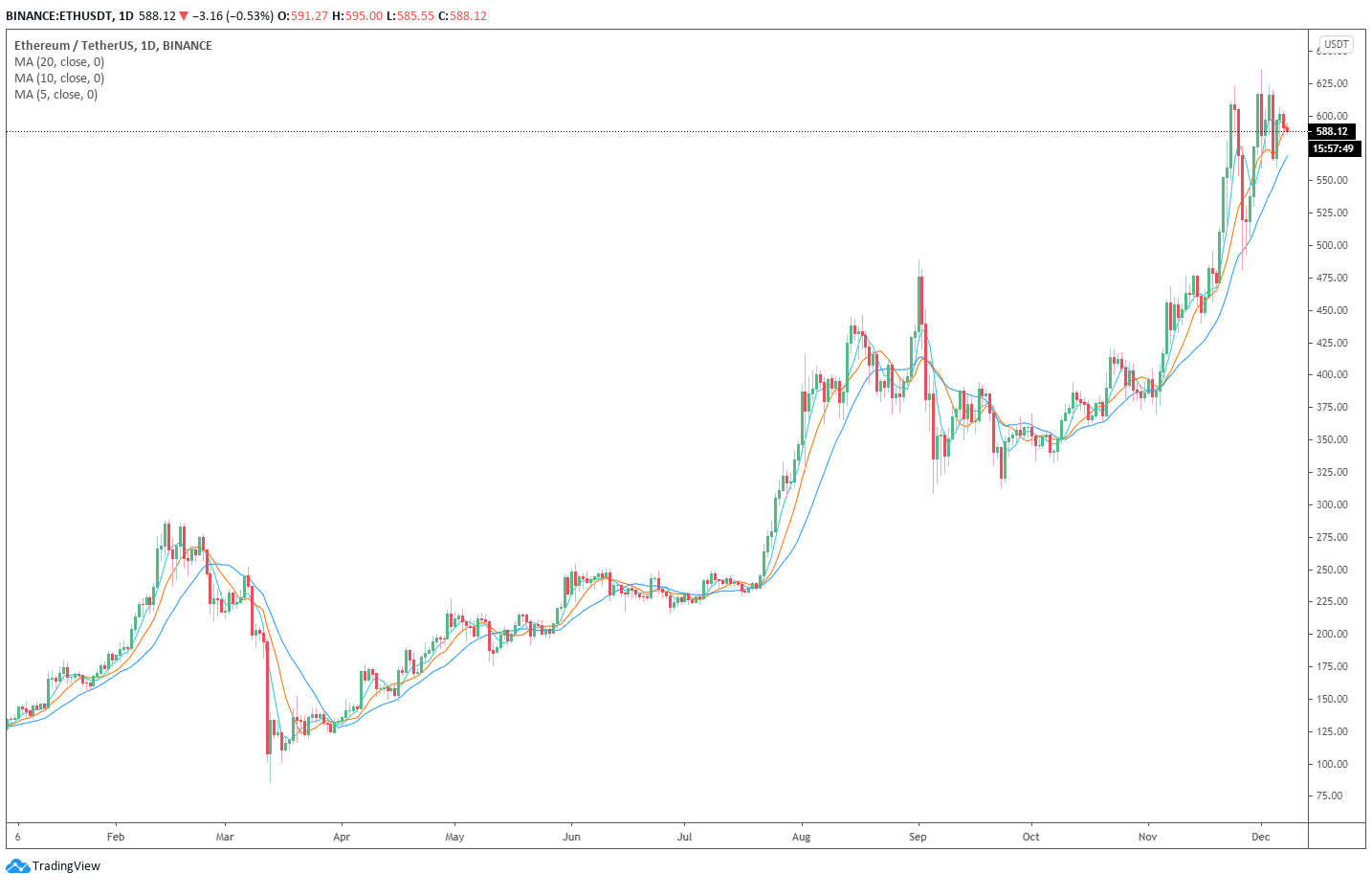

Especially during a period in which there is a considerable spike in demand for ETH and the Ethereum blockchain, the probability of mainstream ETH adoption can increase rapidly if the current level of user activity can be sustained.