Only 0.01% of Ethereum holders are in profit; are DeFi liquidations fueling ETH’s downtrend?

Only 0.01% of Ethereum holders are in profit; are DeFi liquidations fueling ETH’s downtrend? Only 0.01% of Ethereum holders are in profit; are DeFi liquidations fueling ETH’s downtrend?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

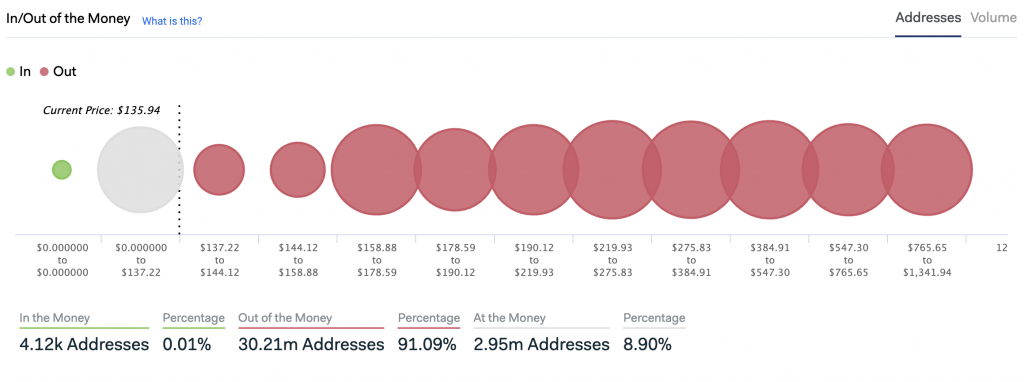

According to IntoTheBlock, 99.99 percent of Ethereum addresses are at a loss or break-even after ETH’s weeks-long decline, a rally that has seen the second-largest cryptocurrency by market capitalization shed more than 23 percent in USD terms since the start of the month.

While the crypto market has in recent weeks seen red across the board, November has been particularly tough for Ethereum holders. At the end of October when ETH sat at $187, more than 27 percent of holders were in profit — in contrast to 76.7 percent of Bitcoin holders.

Now with ETH’s current level of $136, just 0.01 percent of Ethereum addresses (precisely 4,120 addresses) are “in the money” according to the crypto analytics platform IntotheBlock, that is, addresses containing a balance of tokens with an average purchase price lower than the current spot price.

Bitcoin holders better off, significantly

Today, Bitcoin holders are still in a remarkably better situation than Ethereum holders in terms of holding paper gains, even after BTC’s equally spirited downtrend. Almost 55 percent of Bitcoin addresses remain in profit with BTC at $6,731.

As can be visualized by the red bubbles seen above, the vast majority of Ethereum addresses bought in well above $200, meaning ETH will need to stage an extended bull run in order for most holders to recoup paper losses.

The periodic distribution of addresses “out of the money” could pose a significant barrier to such a rally occurring, however. These indicate the location of potential sell walls—price bands that are likely to see notable selling pressure as ETH holders exit their positions to break-even, or take profit.

DeFi lockups could be driving prices down

There is another crucial variable that could diminish Ethereum’s immediate chances of recovery—the usage of ETH as collateral in decentralized finance (DeFi).

Many have anticipated DeFi could significantly bolster Ethereum’s on-chain-activity—one of the keys to catalyzing the recovery in price evidently awaited by more than 99 percent of ETH holders.

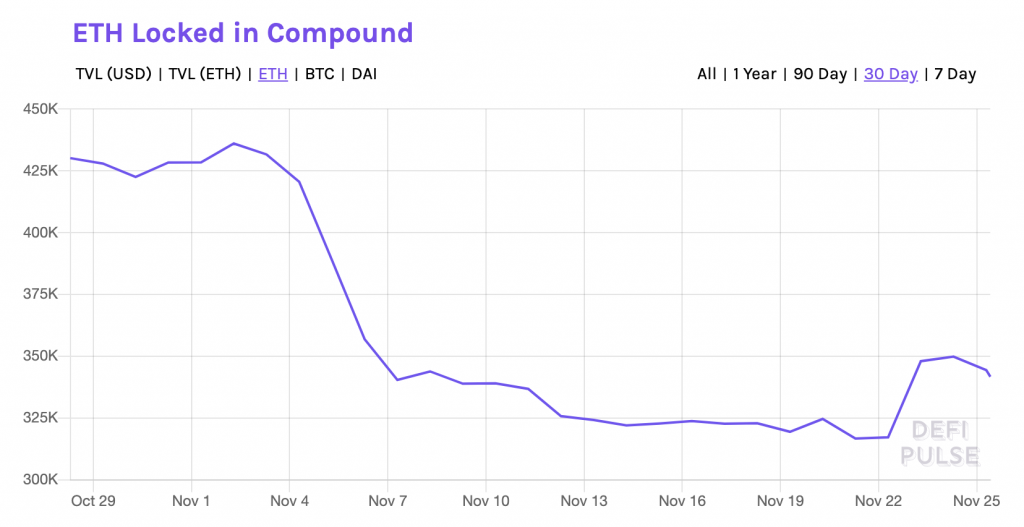

While this may be true for Ethereum’s chances in the mid-long-term, DeFi may, in fact, be exacerbating the coin’s current decline as various platforms liquidate ETH to meet debt obligations. The quantity of ETH locked in lending platforms like Compound has dropped sharply in recent weeks, affirming this trend.

Ethereum Market Data

At the time of press 4:59 am UTC on May. 28, 2020, Ethereum is ranked #2 by market cap and the price is up 0.82% over the past 24 hours. Ethereum has a market capitalization of $16.02 billion with a 24-hour trading volume of $11.15 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 4:59 am UTC on May. 28, 2020, the total crypto market is valued at at $196.17 billion with a 24-hour volume of $124.78 billion. Bitcoin dominance is currently at 66.48%. Learn more about the crypto market ›