Norwegian sovereign wealth fund’s indirect Bitcoin holdings soar 62% in first half of 2024

Norwegian sovereign wealth fund’s indirect Bitcoin holdings soar 62% in first half of 2024 Norwegian sovereign wealth fund’s indirect Bitcoin holdings soar 62% in first half of 2024

The fund increased its holdings in several Bitcoin-related companies like MicroStrategy and Marathon Digitals.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

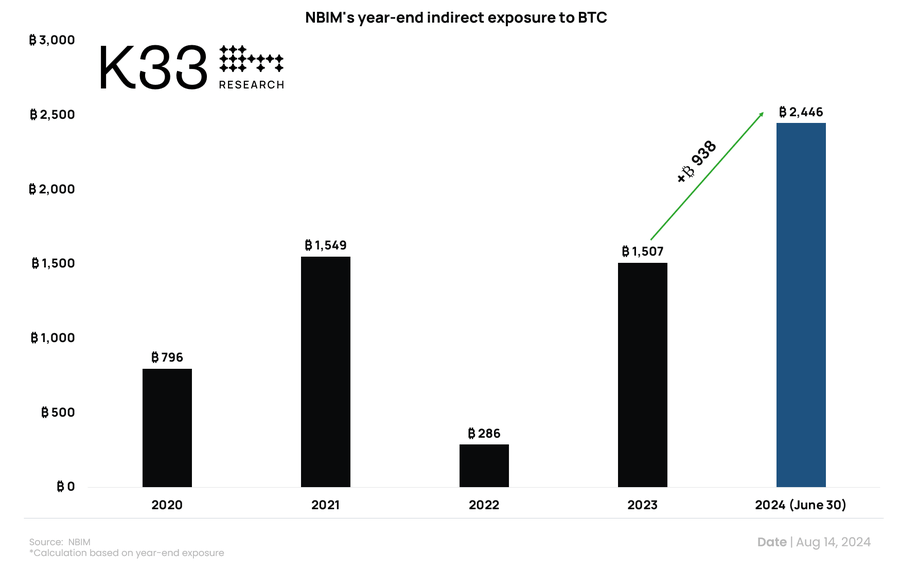

The Norwegian Government Pension Fund, commonly known as the Oil Fund, has indirect exposure to Bitcoin that rose by 62% during the first half of this year to the equivalent of 2,446 BTC, according to the Senior Analyst at K33 Research Vetle Lunde.

This equates to an increase of 938 BTC since December 2023, when the firm indirectly held the equivalent of 1,507 BTC.

The Norwegian Pension Fund is the world’s largest sovereign wealth fund, with assets amounting to $1.7 trillion, according to its latest reports.

NIBM’s Bitcoin exposure

Lunde attributed this growth more to automated sector adjustments and risk diversification than a deliberate strategy to increase Bitcoin holdings.

He explained:

“[This increase was] unlikely to stem from an intentional choice to amass exposure—if increased BTC exposure was the target, we’d see more evidence of direct exposure initiatives (and significantly larger exposure).”

Meanwhile, the fund’s Bitcoin exposure comes from investments in leading Bitcoin-related companies, including MicroStrategy, Marathon Digital, Coinbase, and Block Inc.

In the first half of 2024, the fund’s stake in MicroStrategy rose from 0.67% to 0.89%, as MicroStrategy boosted its holdings in Bitcoin terms by 37,181 BTC. Additionally, the fund increased its shares in Coinbase from 0.49% to 0.83% and Block Inc from 1.09% to 1.28%. It also added a 0.82% position in Marathon Digital.

Lunde pointed out that the fund’s indirect Bitcoin exposure amounted to 44,476 sats (approximately $27) per capita at the end of the year’s first half.

Other funds exposure

The Norwegian fund’s exposure to Bitcoin aligns with current trends observed in other pension funds, such as the Wisconsin Pension Fund, which have also increased their exposure to the top crypto.

Market observers noted that these investments reflect the growing acceptance of BTC as a viable alternative investment. This shift began earlier this year after spot Bitcoin exchange-traded fund (ETF) products were introduced in the US, making the asset class a viable option among traditional investors.

Lunde explained that these moves showed that “Bitcoin is maturing as an asset and getting woven into any well-diversified portfolio!”

CoinGlass

CoinGlass

Farside Investors

Farside Investors