Metaverse demand remains high despite bear market

Metaverse demand remains high despite bear market Metaverse demand remains high despite bear market

DappRadar's recent report revealed that the sales count of top metaverses decreased only by 11.55%, which is a bullish sign considering the current market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

DappRadar‘s latest report revealed that the Metaverse’s growth is driven by demand despite the current conditions of the bear market.

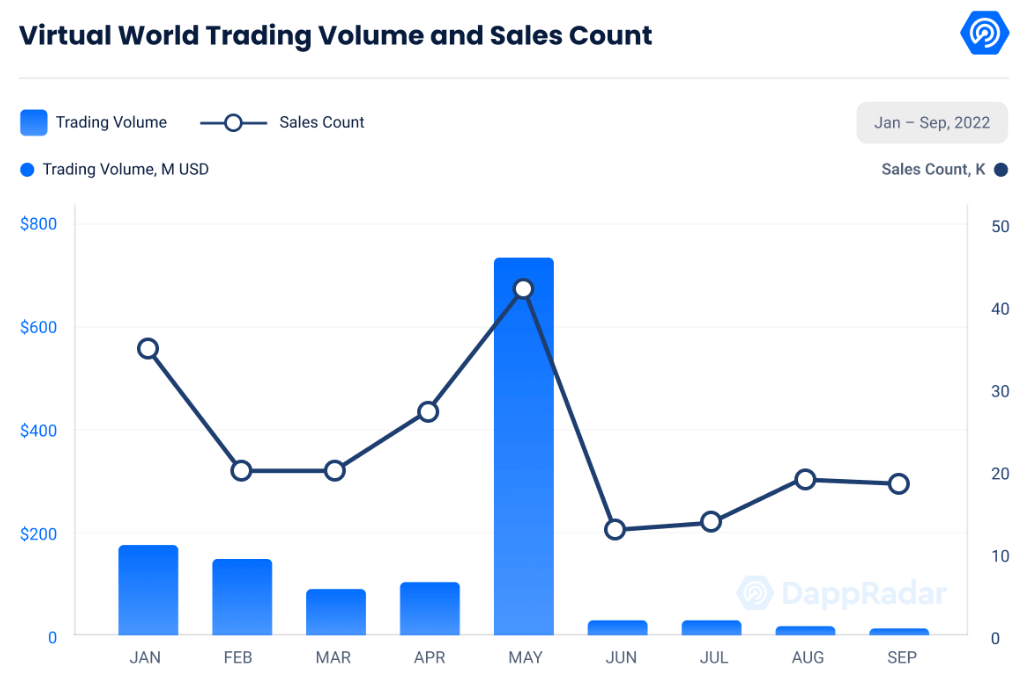

The report took the data on land sales and trading volumes from the third quarter of 2022. Even though the numbers still decreased, it was minor compared to the overall crypto market. The report concluded that demand for Metaverse-related projects is still high enough to drive its growth.

Virtual worlds

The numbers show that the trading volume of all virtual worlds decreased by 91.61% in the third quarter of 2022, falling from $893 million to around $83 million. The report noted that the high trading volume of the second quarter is mostly the result of the hype revolving around the Otherside Land sale.

In the meantime, the number of land transactions for all virtual worlds was around 52,224 in the second quarter. This number declined by 37.54% to reach around 32,620 in the third quarter. The report argues that this is an indicator of a strong interest in Metaverse.

The report states:

“The number of land transactions declined by 37.54% from the previous quarter to 52,224, indicating that the excitement surrounding these types of projects has not subsided but is approaching a consolidation period.”

Top Metaverses

The report also examines the trading volumes of the top 10 metaverse projects to reveal that their trading volume decreased by around 80% compared to the second quarter. However, their sales volume seemed to decrease by only 11% on average, which supported the argument that the demand for metaverse continues strong.

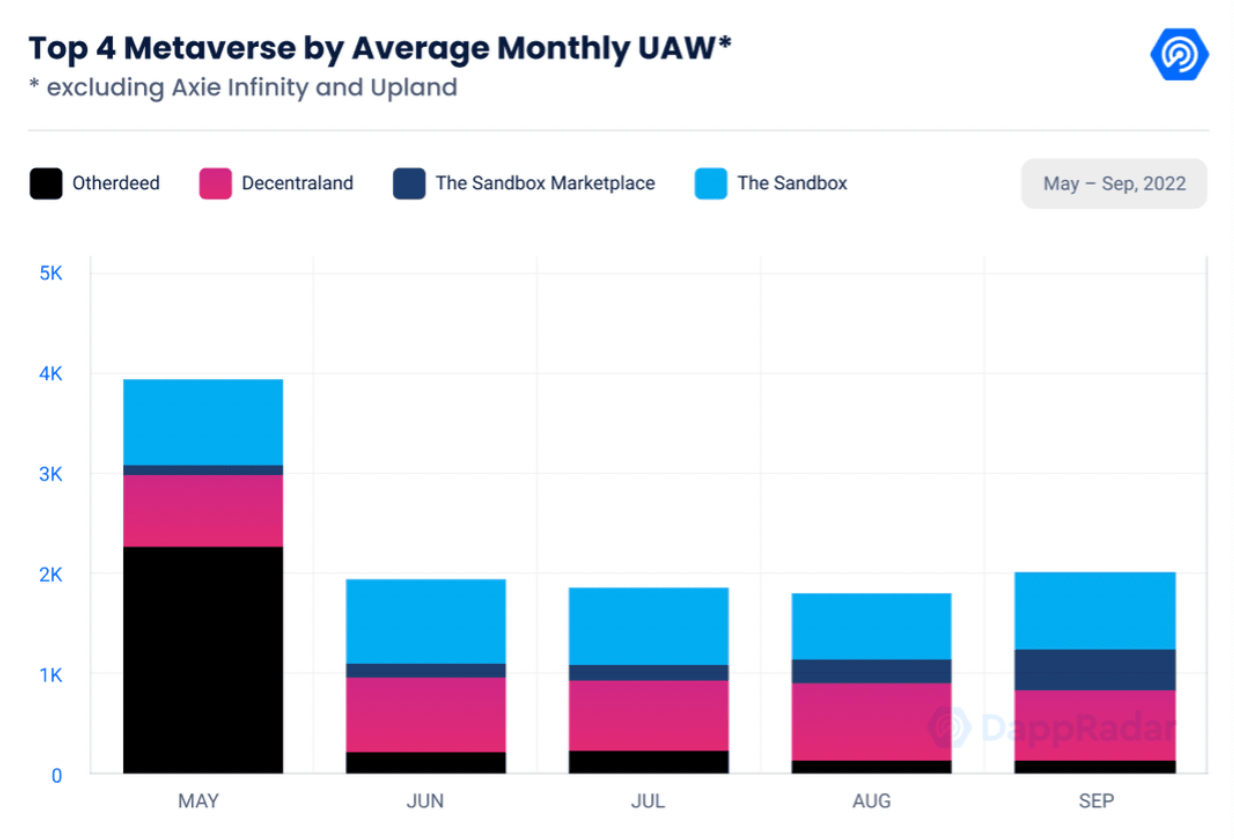

The report also determined the top four metaverse projects, judging by the number of Unique Active Wallets (UAW) on their platform. Excluding Axie Infinity and Upland, the top four emerged are Otherdeed, Decentraland (MANA), The Sandbox Marketplace, and the Sandbox (SAND).

The chart above demonstrates the number of UAW of the top four metaverse projects. Based on the numbers, Otherdeed came out as the most popular metaverse in May, while The Sandbox and Decentraland managed to remain amongst the top three.

The Sandbox maintained its average of 750 daily UAWs since May, while the activity in the Sandbox Marketplace has been increasing since. The UAW’s on the Sandbox Marketplace recorded an uptick of 348% to reach 395 in September.

Similarly, Decentraland also remained at the same number of average UAWs as 792. However, Decentraland also hosted a series of events in September, which attracted around 56,000 daily active users (DAU) to the platform. This number marked a 6% increase compared to the DAU numbers of August.

Demand for ENS domains and investments

Other highlights from the report indicate that the demand for ENS domains, investments in building in the metaverse, and mass brand adoption also increased.

Throughout September, a total of 437,365 users registered with new ‘.eth’ domains, which recorded an all-time high. The previous ATH was recorded as 378,805 in July, which indicates an increase of over 13%.

During the third quarter of 2022, blockchain games and metaverse projects received a total of $1.2 billion in funding. Blockchain games and metaverse received the most funding with $462 million, which compensated for the 38.5% of the total amount.

Metaverse infrastructure investments came as a close second, collecting $402 million, which is 33.5% of the total amount.

Deribit

Deribit