Like gold with previous crises, Bitcoin will thrive after coronavirus, research shows

Like gold with previous crises, Bitcoin will thrive after coronavirus, research shows Like gold with previous crises, Bitcoin will thrive after coronavirus, research shows

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

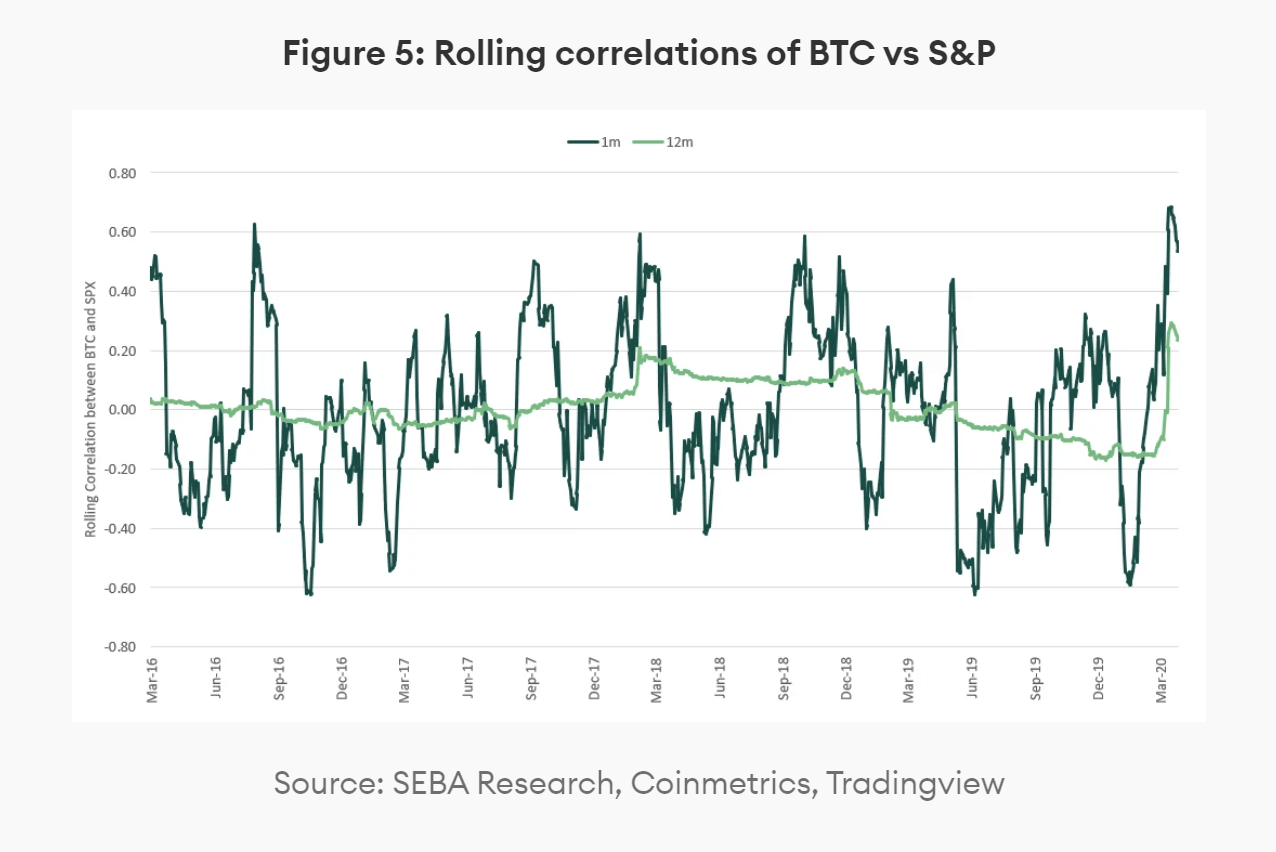

Bitcoin showed a tight correlation with the U.S. stock market for about two weeks from March 12, raising concerns among investors that cryptocurrencies are just as vulnerable to a financial crisis as stocks and other high-risk assets.

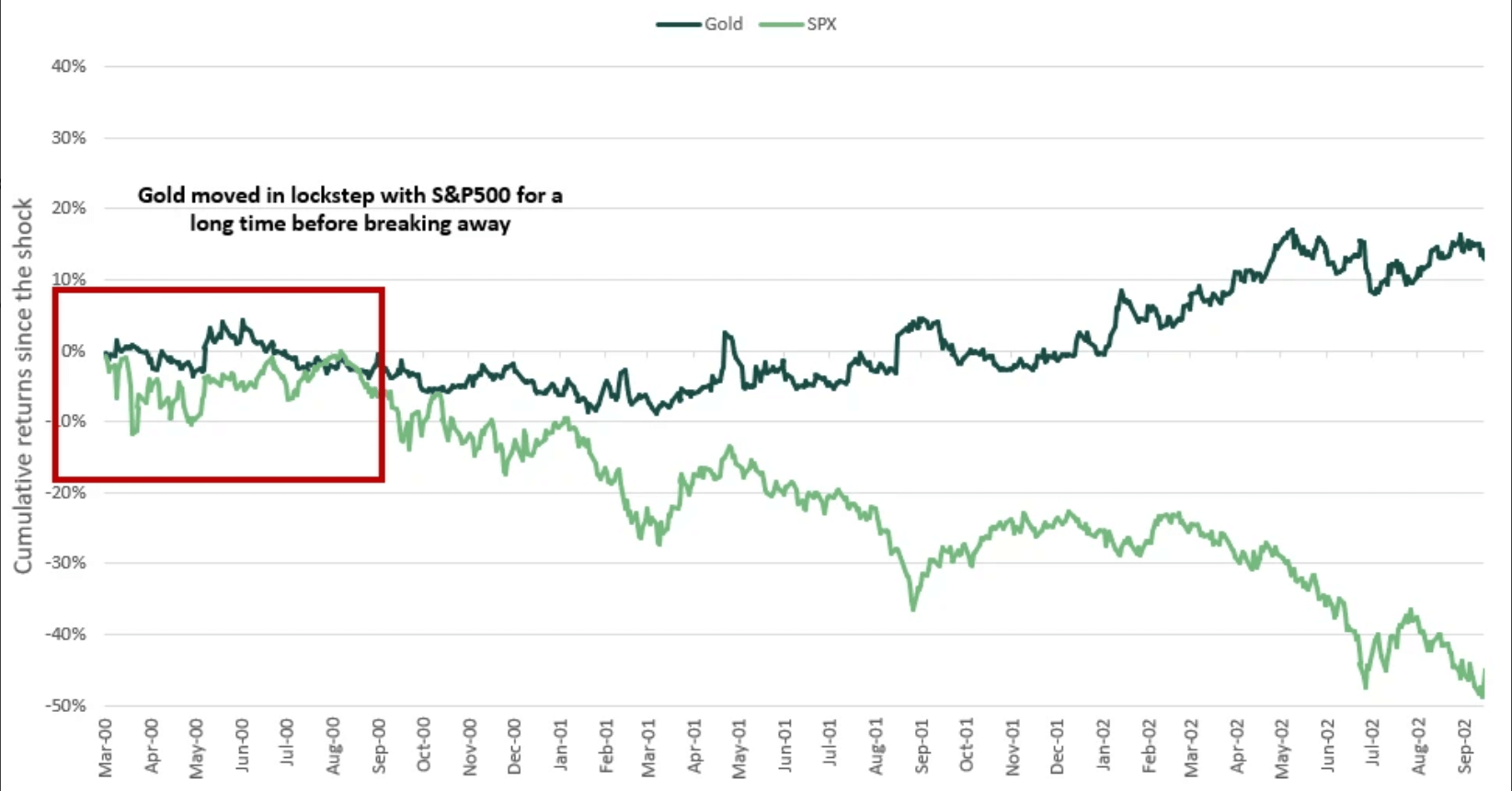

A study from Seba, a Swiss banking startup that raised $103 million in 2018, showed that gold performed similarly to Bitcoin in previous crises. Over time, however, gold broke out from its correlation with the stock market, and Bitcoin could do the same.

Still a chance for Bitcoin to work as a safe haven asset

During the Dot-com bubble in 2000, for example, the price of gold moved in tandem with the stock market for about three months before the correlation broke down.

After the initial panic period where the overwhelming majority of investors and institutions frantically sold off assets, markets stabilized and gold began to see an upward trend.

Seba’s research read:

“Gold performed differently in the three crises. Gold’s correlation with S&P saw sharp spikes during crisis periods, however, over the longer term, there are no doubts regarding gold’s position as a diversifier. Over the past 30 years, the correlation between gold and S&P500 averages -0.05.”

Gold behaved similarly to how the Bitcoin price moved as the U.S. stock market crashed following an abrupt spike in the number of coronavirus cases in the U.S.

Bitcoin fell when the Dow Jones slipped, even during pre-market trading, and it recovered as the Dow Jones rebounded. But, eventually, within less than two weeks, the correlation has worn off and the Bitcoin price started to rally despite the downtrend in the equities market.

Observing the low level of correlation between Bitcoin and the stock market as of late, researchers at Seba said:

“After the recent sell-off, the correlation has shrunk. This behaviour is similar to what we have observed with gold and S&P 500 during the dot-com bubble burst. Therefore, dismissing that bitcoin offers diversification based on short bursts of high correlation is not a good strategy in our view.”

Currently, the market cap of Bitcoin is hovering at around $125 billion. That is a market cap lower than most major corporations in the U.S.

As the market cap of Bitcoin grows with stronger infrastructure and a larger base of investors, it is likely to see lower volatility and correlation with the broader financial market.

Long-term future of BTC still bright

Seba’s paper emphasized that the correlation between Bitcoin and the stock market in the latter half of March does not indicate a gloomy long-term outlook for BTC.

The paper further read:

“The outside money characteristics of bitcoin coupled with bitcoin’s ability to continue to operate in phases where the price remains low, and unaffected demand for stablecoins even after the recent crash suggest that the long-term future of the field is intact.”

Following the crash of Bitcoin to $3,600, many investors moved their funds to stablecoins rather than moving their capital out of exchanges completely to fiat, which indicates that investors are readying to enter the market in the near-term.