Kraken to list Internet Computer (ICP) despite 98% crash from all-time high

Kraken to list Internet Computer (ICP) despite 98% crash from all-time high Kraken to list Internet Computer (ICP) despite 98% crash from all-time high

Investors remain spooked following Internet Computer's price crash. Nonetheless, Kraken will list $ICP this week.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

San Francisco-based Kraken will list Internet Computer on the Kraken and Kraken Pro platforms this Friday.

On its debut in May 2021, Internet Computer stormed the market cap rankings, peaking as high as fourth place. It’s rare for newcomers to have such an impact from the off, which triggered massive interest across the board at the time.

Indeed, its game plan, which can be summarized as building a free and open internet controlled by users, not “big tech,” had mass appeal and still does today.

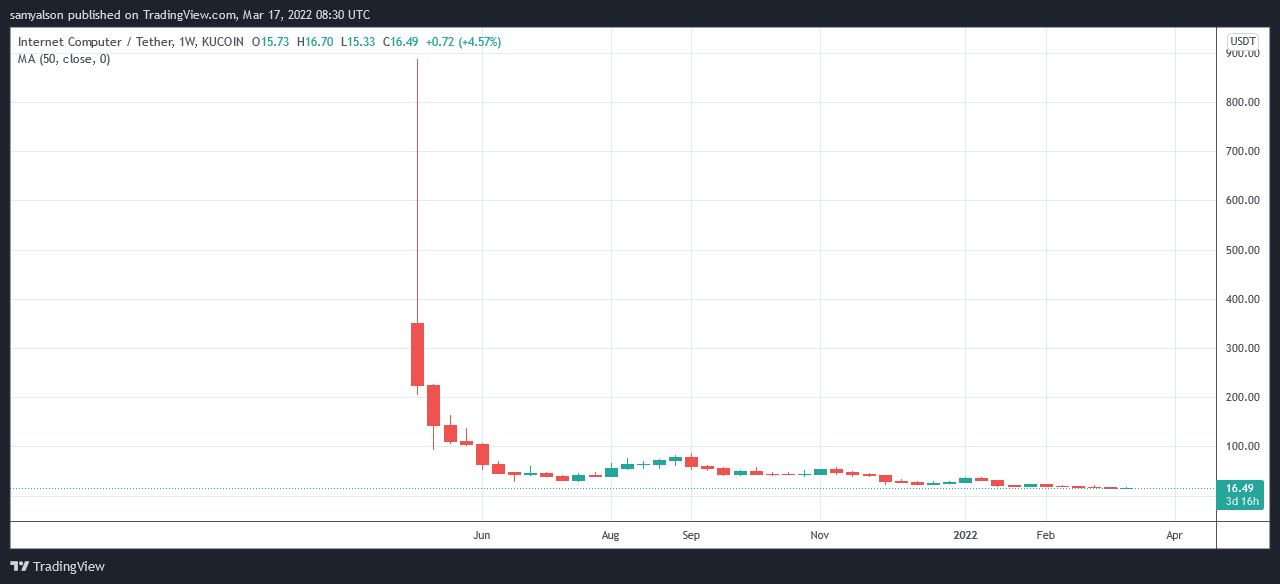

But huge drawdowns followed, and within a month of launching, $ICP was down 88% from its $885 all-time high (ATH). Currently, it’s down 98% from its ATH, with February 24 marking an all-time low of $14.88.

Based on this performance, the project became a prime example of not FOMO’ing in. However, that hasn’t deterred Kraken from listing the project.

What is Internet Computer?

Internet Computer is looking to build a decentralized, scalable cloud solution to store data, perform computational tasks, and enable community governance – a blockchain internet.

“We aim to create a “blockchain singularity” in which every system and service is rebuilt and reimagined using smart contracts and runs entirely from infinite public blockchain without need for traditional IT.”

It will achieve this by developing an open algorithmic governance system called the Network Nervous System (NNS). Managing this system are ICP nodes, which also manage subnets (or applications) that execute a unique type of smart contract called canisters.

Through this system, apps or software have no fixed or physical address, as they move between servers hosted by independent data centers. Thus software can exist without any entity owning or controlling it.

Why did $ICP crash and burn?

According to blockchain architect Rohas Nagpal, the reason for Internet Computer’s price collapse was not to do with inherent flaws within the project. Instead, the price crash came about through poor token distribution.

Nagpal claims whale activity, as exchange inflows, triggered panic, leading to selling pressure which tanked the price.

“Project insiders transferred $2 billion worth of ICP to crypto exchanges. This spooked the markets. Investors felt that the insiders were planning to dump their holdings, and this triggered a massive price drop.”

Yet this explanation doesn’t account for the continued price depression some ten months on.

Kraken says listings are not recommendations “to buy, sell, or participate in the associated network.” But it remains the case that exchanges, in general, list tokens based on projected volume, amongst other criteria.

As such, despite low investor sentiment towards the project, Kraken, at the least, has concluded that the listing could be profitable.

CryptoQuant

CryptoQuant