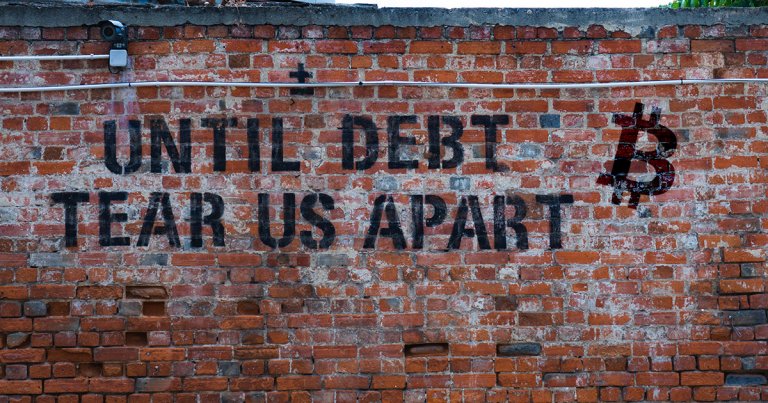

It’s time for Plan B, Bitcoin: Global government debt doubles in deficit-filled decade

It’s time for Plan B, Bitcoin: Global government debt doubles in deficit-filled decade It’s time for Plan B, Bitcoin: Global government debt doubles in deficit-filled decade

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

From its all-time high of $20,000, Bitcoin has fallen by 65 percent, trading far lower than it did at the end of 2017, at the top of the frothy crypto market bubble that has long since passed.

But don’t be disillusioned, analysts are coming to the conclusion that despite what may seem like bearish or weak price action over the past few months and years, from a macro view, Bitcoin is more likely to succeed now than ever before.

This may sound crazy, I know, but according to a prominent industry executive, one single statistic conveys this point rather well: the global debt of governments.

Global government debt doubles, and it’s far from stopping

Although the world seems more prosperous now than ever before, it’s somewhat of an illusion.

To prop up what some would describe as a facade of wealth and success, the world’s governments have gone beyond their means, taking on spending habits and projects that exceed what they get through tax receipts and through other streams of revenue. This spending has undoubtedly accelerated over recent years as governments have had to patch up growing issues in society.

According to Dan Held of Kraken, formerly an executive at Blockchain.com, this trend has resulted in global government debt rising from $30 trillion in 2007, prior to the Great Recession, to $70 trillion and “approaching infinity” today. This comes as global debt has hit nearly $250 trillion.

Global government debt:

2007: $30 Trillion

2020: $70 Trillion approaching infinityIt’s time for plan ₿

— Dan Hedl (@danheld) April 14, 2020

This 130 percent increase in global government debt over the span of just over a decade, Held claims, makes it certain that it is “time for plan ₿,” referencing Bitcoin’s potential to benefit from all this.

What’s crazy is that the $70 trillion is likely to explode even higher in the coming year, simply due to the outsized response governments and central banks have had to commit to due to the widespread economic effects of the COVID-19 outbreak.

Case in point: we’ve seen the national debt of the U.S. rise to $24.3 trillion as of Apr. 16, up a jaw-dropping $1 trillion from the ~$23.3 trillion it started the year at. The especially-rapid growth of this metric is due specifically to the $6 trillion stimulus bill by the White House and Congress, which includes a measure to give a majority of tax-paying Americans $1,200 checks — checks that have been spent on Bitcoin and much more.

Bitcoin is the solution

With the rapidly-increasing amount of government debt — and debt in general — and seemingly no concrete or sustainable plans to pay the sum back, there are seemingly three main scenarios that can transpire to “end the debt super cycle.”

In these three cases, whatever happens, Bitcoin seemingly stands to benefit.

- Governments try and inflate their way out of debt, or a “debt jubilee” takes place: With an ever-increasing debt load, there are many expecting to see a scenario in which the government tries to inflate the money supply to help decrease the real value of their debt payments. This would cause rampant inflation, boosting the value of the scarce Bitcoin, whose value is derived by its low inflation rate. Similarly but not exactly the same, there’s something called a “debt jubilee,” whereas debts are written off in a way that may spark outrage, proving the demand for an alternative system.

- Due to monetary and economic factors, deflation actually sets in: A scenario that may have seemed irrational years ago but could actually play out now is, deflation. Deflation would rapidly increase the real value of the debt loads of governments to a point where they may be unsustainable. This, according to Real Vision’s Raoul Pal, will cause the world’s largest insolvency event, where companies and governments may have to default on large sums of debt. This would cause societal unrest, proving demand for Bitcoin, as explained by author and technologist Jeff Booth.

- Fiat is abandoned: We could see a shift from the fiat system we know today to a new monetary paradigm. As Ray Dalio says, there will be a “new world order.” Bitcoin stands to benefit from this as it is being proven as a store of value, and some say it also has the potential to be the basis for the world’s next monetary epoch.

Of course, the boiling down of an ever-changing macro landscape into three scenarios is somewhat of an oversimplification and glosses over some ideas, but many seem certain that the ongoing crisis will only expose the value in Bitcoin and other decentralized systems in many ways.

As put best by Michael Novogratz, a Goldman Sachs partner turned CEO of Galaxy Digital:

“In the last year [BTC] has become a macro weapon, and investment choice. Hedge funds and high net worth individuals who had never bought it before are buying it.”

Farside Investors

Farside Investors