Shift to cash-margined futures intensifies as Bitcoin surpasses $62,000

Shift to cash-margined futures intensifies as Bitcoin surpasses $62,000 Shift to cash-margined futures intensifies as Bitcoin surpasses $62,000

CME gains traction with increasing preference for cash-margined Bitcoin futures

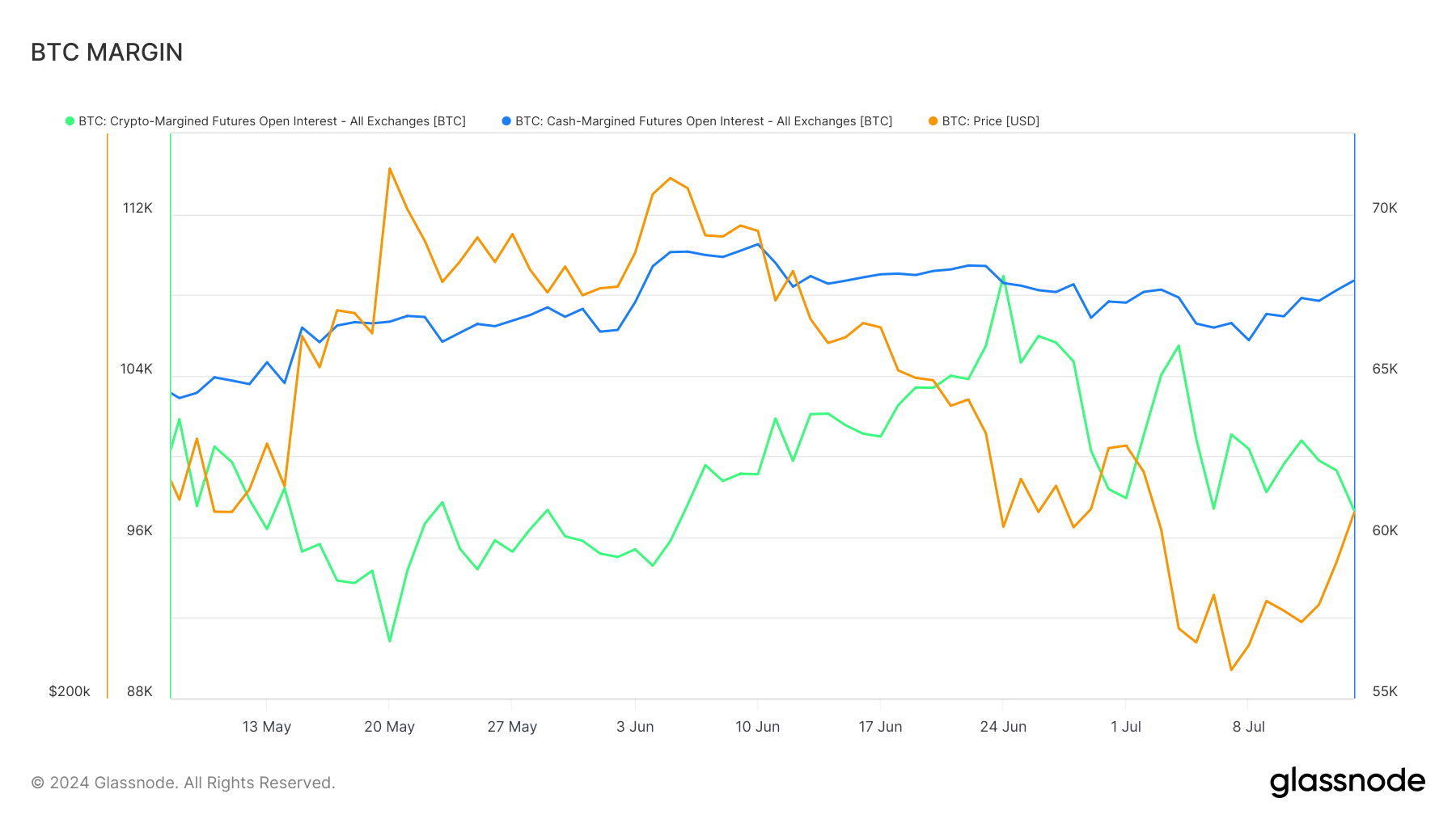

Bitcoin’s recent price action has seen a notable divergence in futures market activity. Data from Glassnode reveals a marked increase in cash-margined futures open interest across all exchanges, while crypto-margined futures open interest has declined.

This trend coincides with Bitcoin’s price surging past $62,000 following bullish momentum on former President Trump’s assassination attempt at the weekend.

The blue line, representing cash-margined futures, demonstrates a steady upward trajectory, suggesting increased interest in these instruments. Conversely, the green line, indicating crypto-margined futures, shows a decline over the same period. The orange line tracking Bitcoin’s price correlates with the uptick in cash-margined futures.

This shift implies a growing preference for cash-margined futures, particularly on platforms like the Chicago Mercantile Exchange (CME), as traders seek to hedge positions or gain exposure without holding the underlying asset—the divergence between cash and crypto-margined futures highlights differing market sentiments and risk management strategies among participants.

This trend emphasizes the evolving landscape of Bitcoin derivatives trading, where institutional engagement through cash-settled products appears to be gaining traction.