Investor cohorts outpace Bitcoin’s monthly mined supply for the first time since early December

Investor cohorts outpace Bitcoin’s monthly mined supply for the first time since early December Quick Take

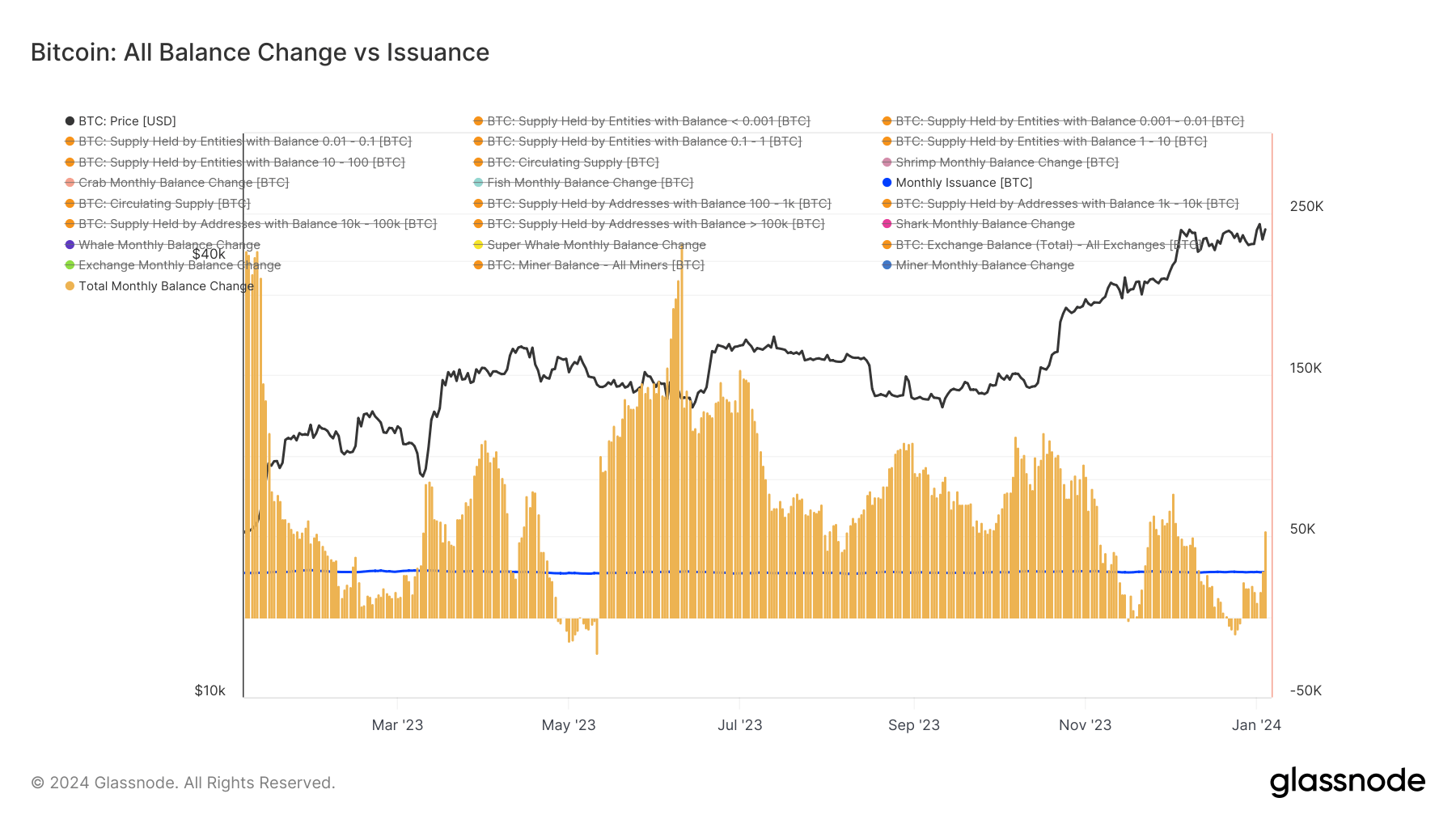

When juxtaposed with the volume of newly mined BTC, the balance change of Bitcoin investor cohorts offers intriguing insights into the dynamics of the digital asset markets’ ecosystem. This analysis reveals a relative measure of new Bitcoin issuance absorbed by all different investor cohorts. Impressively, values above the blue line indicate a cohort’s aggregate balance increasing beyond the total coins mined in a given month, acting as a net absorber.

Contrarily, values on the blue line suggest a relatively flat balance for the cohort over a month against issuance, while negative values indicate a reduction in the cohort’s aggregate balance, indicating a distribution along with fresh coin issuance. A daily mining rate of approximately 900 BTC translates into a monthly volume of around 27,000 BTC.

For the first time since Dec. 4th, the aggregate balance of all cohorts is surpassing this monthly issuance. As of Jan. 4th, the total monthly balance change stood at 53,800, implying roughly 25,000 Bitcoins plus issuance were absorbed from the market. This absorption marks a halt in the preceding distribution phase, a phenomenon only previously seen in May 2023.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass