Forty-year leap: US national debt nearing $1T in interest alone

Forty-year leap: US national debt nearing $1T in interest alone Quick Take

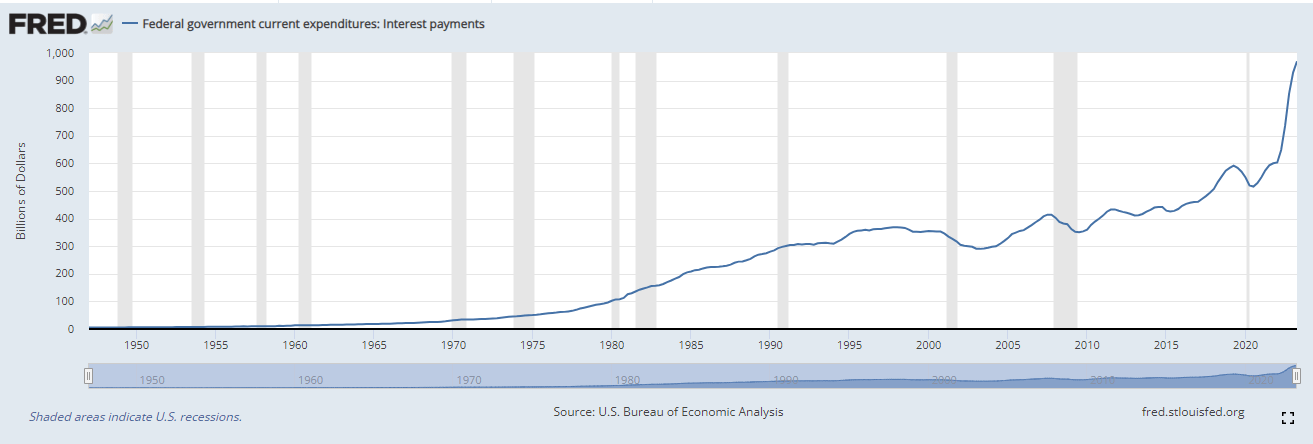

The United States is experiencing a steep surge in interest payments, now reaching approximately $970 billion. According to financial analyst Joe Consorti, this constitutes an escalation of $41 billion within the second quarter alone.

The rapid growth rate implies that the U.S. interest payments will soon reach the daunting $1 trillion threshold, marking a pivotal point in the nation’s financial history.

Consorti further demonstrated that tax receipts persistently lag behind the country’s sovereign debt growth. Such a scenario necessitates the U.S. to overly depend on an unsustainable funding strategy — issuing more debt. This cyclic process leads to a situation where interest payments are increasingly financed by revenues derived from additional debt issuance, potentially worsening the country’s financial quagmire.

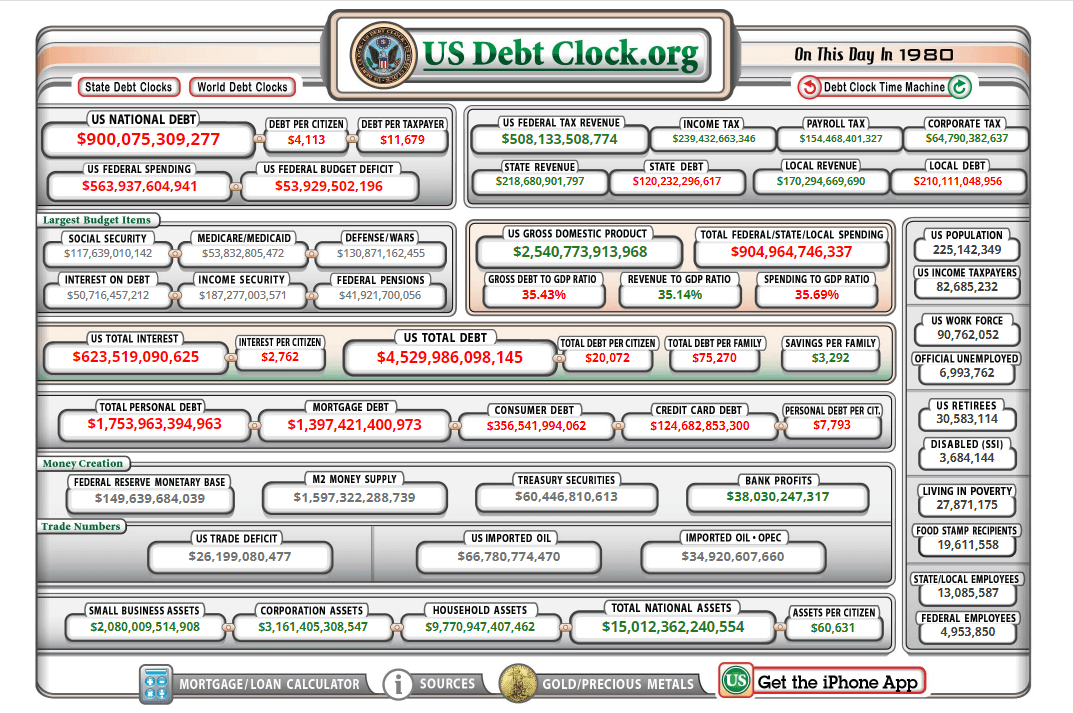

In a striking comparison to the state of affairs four decades ago, on this very day in 1980, the United States national debt was less than $1 trillion. This figure marked the total obligation of the U.S. government; the U.S. is now facing almost $1 trillion of interest expenses alone.