Changes in old supply shows selling pressure came from short-term holders

Changes in old supply shows selling pressure came from short-term holders Quick Take

A sell-off from short-term holders appears to have mostly fueled Bitcoin’s drop to $25,000.

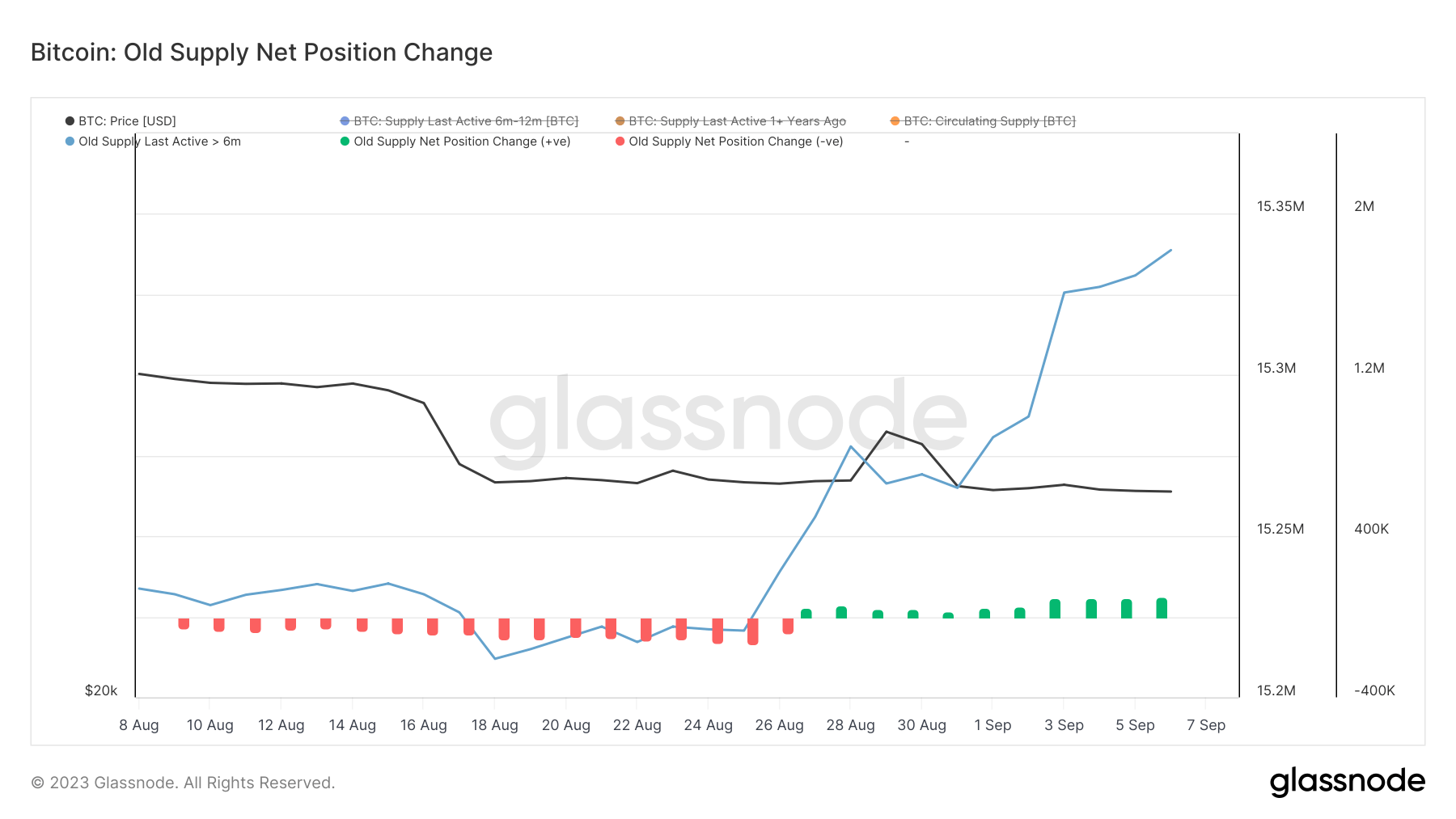

While there are many on-chain metrics pointing to this fact, it becomes clear when analyzing the changes in Bitcoin’s old coin supply — i.e., supply that was last active more than six months ago.

Positive values indicate a net increase in old coin supply, showing that coins acquired less than six months ago are maturing faster than 6-month-old and older coins are being spent. Negative values show a net decrease in old supply, indicating that the rate of 6-month-old and older coins being spent is higher than that of coins maturing into this cohort.

The 30-day change in old coin supply shows a significant increase at the end of August, with over 92,000 BTC entering old supply on Sep. 5. This indicates the sell-pressure Bitcoin experienced at the end of August was mostly fueled by coins acquired less than six months ago, which fall into the category of short-term holders.