Bull run indications: 79% of Bitcoin’s circulating supply in profit

Bull run indications: 79% of Bitcoin’s circulating supply in profit Quick Take

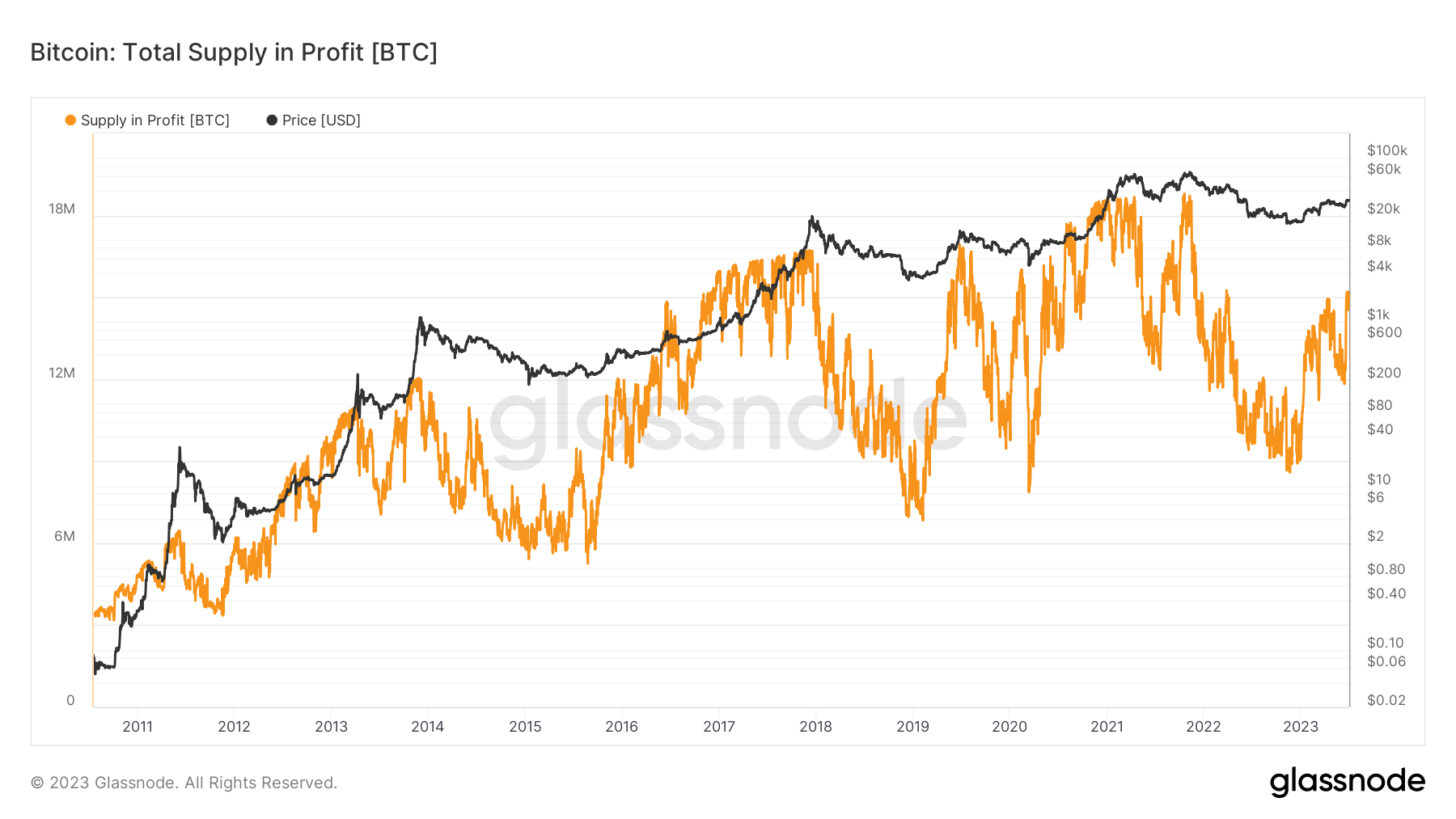

The current profit rate for Bitcoin’s circulating supply signals a healthy outlook for the cryptocurrency’s future. With 15,079,000 coins – approximately 79% of the circulating supply – now worth more than when they last moved, Bitcoin investors are witnessing substantial profitability.

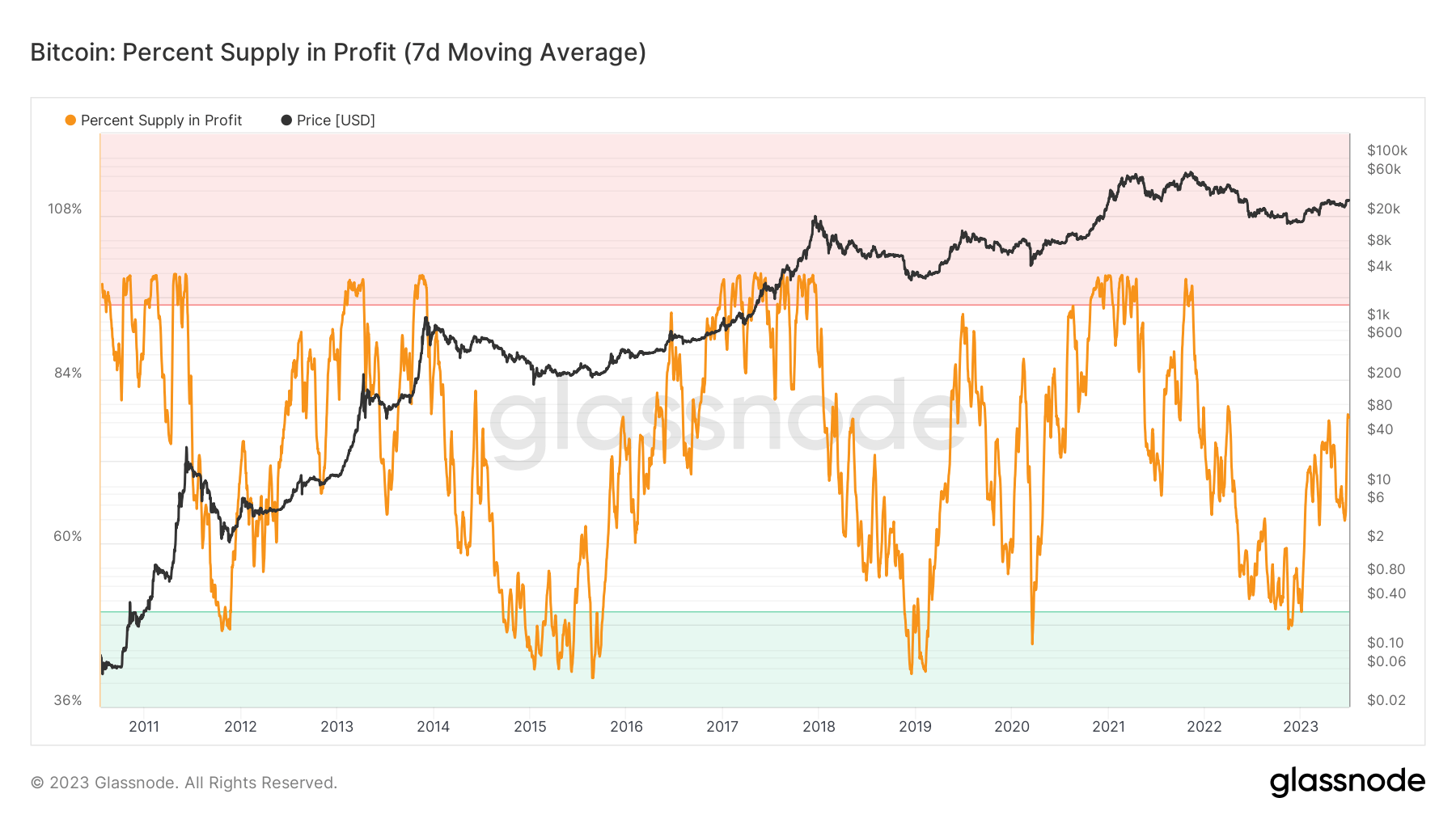

The percentage of supply in profit is a crucial indicator of the cryptocurrency’s cyclical highs and lows. Each cycle’s lower limit typically sees less than 50% of the supply in profit, while cycle peaks are characterized by close to 100% of the supply in profit.

With Bitcoin trading above $30,000, many investors are in a profitable position. This healthy scenario signifies that the ongoing run has room for further growth and the market is not overheated. The substantial percentage of the supply in profit suggests a potential for sustained upward movement in Bitcoin’s price cycle.

Investors are encouraged to keep a close eye on this key metric, as it offers valuable insights into the current health of the Bitcoin market and potential future trends.