Bitcoin ETFs face new year exodus, BlackRock loses 3,500 BTC amid price rally

Bitcoin ETFs face new year exodus, BlackRock loses 3,500 BTC amid price rally The first trading day of the year saw notable outflows from spot Bitcoin and Ethereum exchange-traded funds (ETFs), totaling over $310 million.

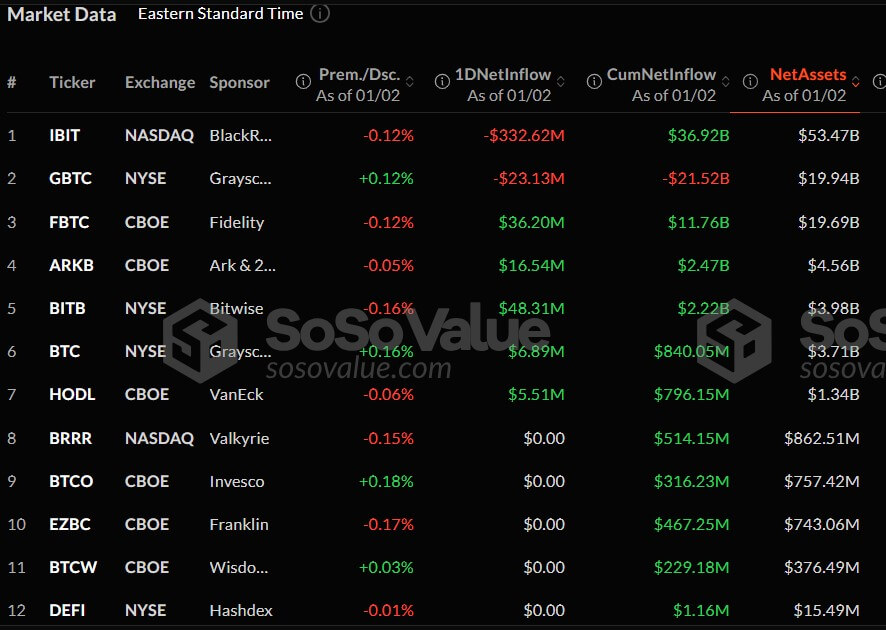

On Jan. 2, data from SoSoValue revealed that Bitcoin-focused ETFs experienced $242.3 million in outflows.

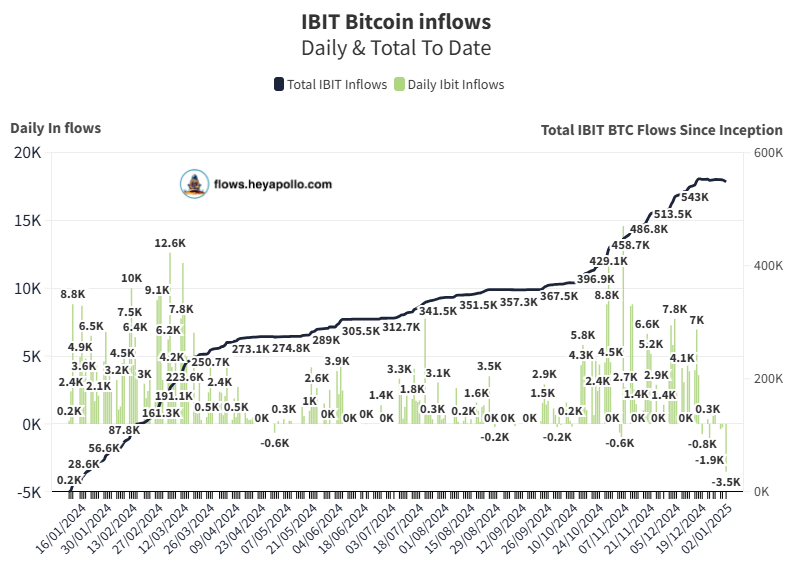

BlackRock’s iShares Bitcoin Trust (IBIT), the largest Bitcoin ETF, recorded its highest outflow since its inception, losing $332 million—or more than 3,500 BTC. This figure surpasses the previous record of $188 million set during the holiday season last year.

The latest outflow marks IBIT’s third consecutive trading day of losses, amounting to $392.6 million in the past week. Despite these challenges, IBIT remains the leading spot Bitcoin ETF, with total net inflows of $36.9 billion and assets under management nearing $53.5 billion.

While IBIT struggled, competitors showed resilience. Bitwise’s BITB, Fidelity’s FBTC, and Ark 21Shares’s ARKB reported inflows of $48.3 million, $36.2 million, and $16.5 million, respectively.

Meanwhile, Grayscale’s Bitcoin products recorded divergent fates on the day. Per the data, the firm’s smaller Bitcoin Mini Trust attracted $6.9 million in fresh capital, though its flagship GBTC fund saw outflows of $23.1 million.

As of Jan. 2, spot Bitcoin ETFs have a cumulative flow of $35 billion and hold $109 billion in assets.

Ethereum ETFs have modest outflows.

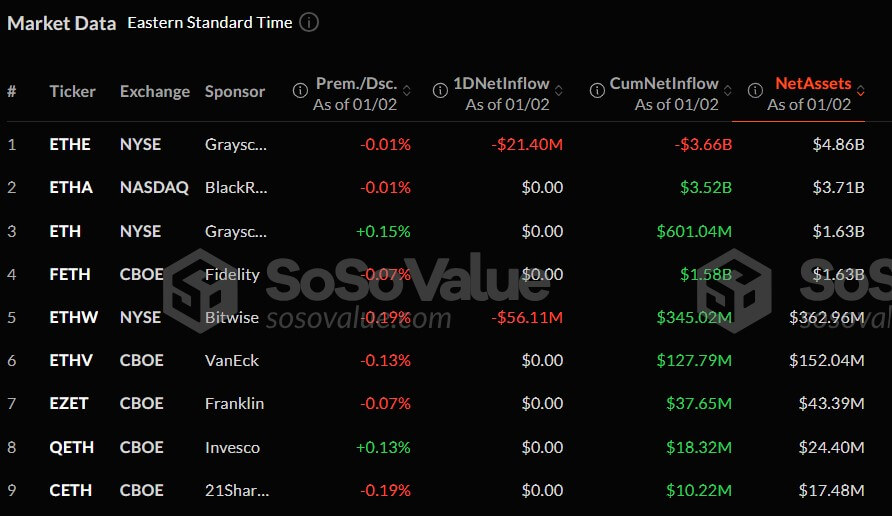

Ethereum ETFs also faced challenges, recording a combined outflow of $77.5 million.

Bitwise’s ETHW fund led these losses with $56.1 million withdrawn, while Grayscale’s ETHE product followed, shedding $21.4 million.

Other Ethereum-linked ETFs, including BlackRock’s ETHA, reported no changes in fund flows for the day.

Ethereum-focused ETFs held a combined total of $2.58 billion in net inflows, with $12.4 billion in assets.

CryptoQuant

CryptoQuant