Bitcoin accumulation addresses see steady rise

Bitcoin accumulation addresses see steady rise Onchain Highlights

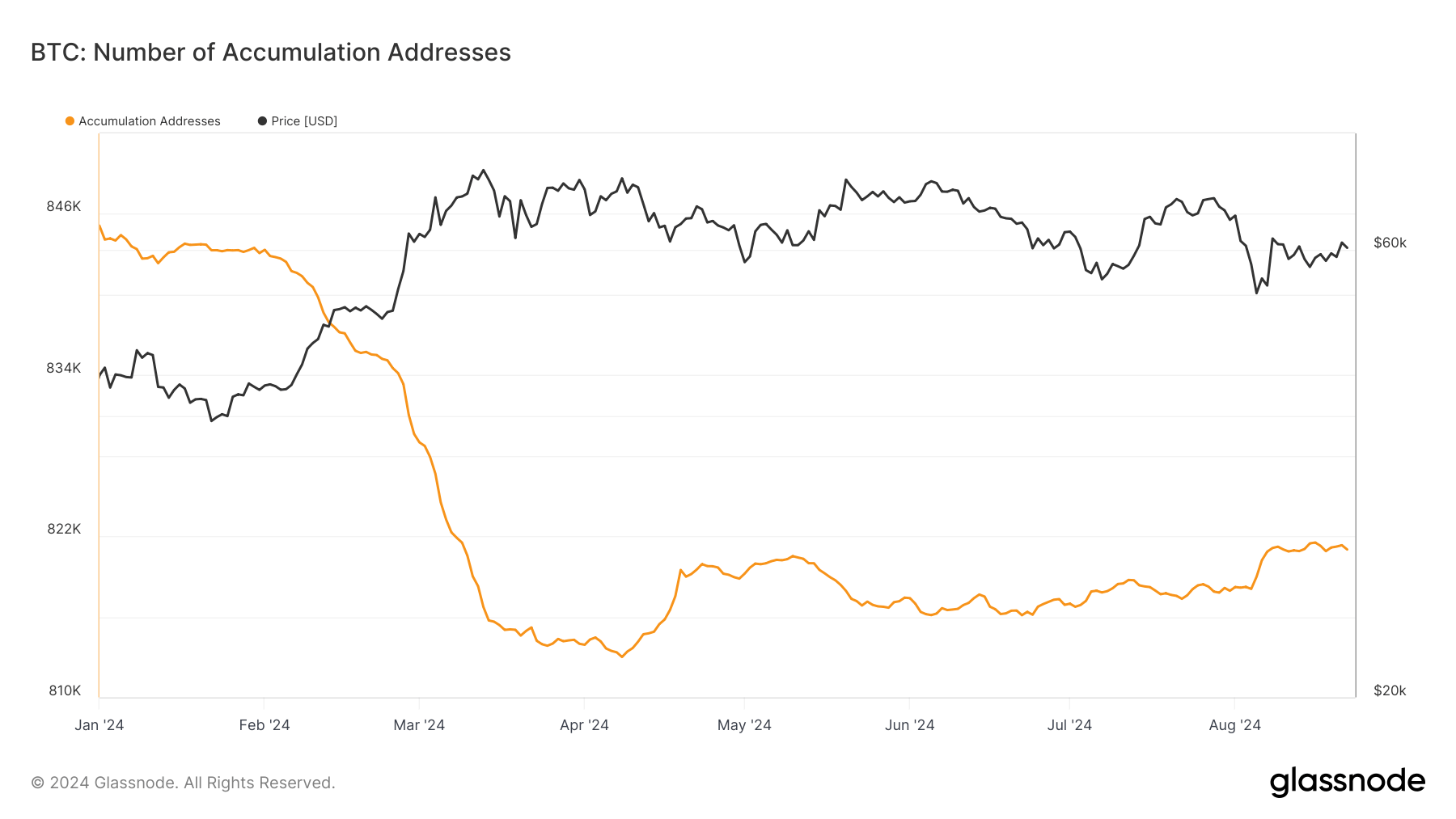

DEFINITION: The number of unique accumulation addresses. Accumulation addresses are defined as addresses that have at least 2 incoming non-dust transfers and have never spent funds. Exchange addresses and addresses receiving from coinbase transactions (miner addresses) are discarded. To account for lost coins, addresses that were last active more than 7 years ago are omitted as well.

Bitcoin’s accumulation addresses have experienced a notable decline in 2024. Historically, these addresses steadily increased, reflecting long-term holder confidence as Bitcoin’s price appreciated over the past decade.

By 2022, accumulation addresses almost surpassed 800,000, growing further in 2023 to a peak of around 846,000 at the start of 2024.

However, following the halving in April, accumulation addresses saw a sharp drop, dipping below 815,000 by March. This decline coincided with Bitcoin’s price pullback from its March highs, suggesting that some holders may have liquidated or reduced their positions as the market adjusted to the new supply conditions.

A slight recovery in these addresses began in May, with numbers stabilizing around 822,000 by August. The overall trend reflects the cautious approach by long-term holders amid a volatile post-halving environment.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass