Here’s why data regarding Ethereum’s investor composition may be extremely bullish

Here’s why data regarding Ethereum’s investor composition may be extremely bullish Here’s why data regarding Ethereum’s investor composition may be extremely bullish

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The past few years have not been kind to Ethereum, with the cryptocurrency finding itself caught within an intense downtrend that led it to plummet from early-2018 highs of over $1,400 to lows in the $80 region.

This intense selloff has left a trail of proverbial “bag holders” in its wake, with the vast majority of ETH investors currently being underwater on their positions.

In spite of this, one venture capitalist is noting that the embattled cryptocurrency’s investor composition may actually be a highly bullish sign, as it suggests that it is comprised of “true believers” that have all passed on opportunities to exit their positions.

68% of Ethereum investors are currently holding underwater ETH positions

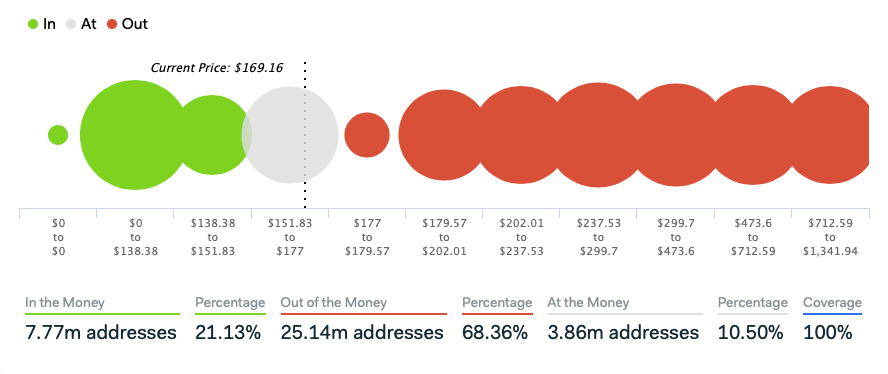

According to data from the on-chain analytics platform IntoTheBlock, over 68 percent of Ethereum investors are holding tokens that are currently worth less than what they bought them for.

This is compared to a mere 21 percent who hold profitable positions, and 10 percent whose positions are at a break-even.

These numbers have shifted significantly in recent times due to the aggregated crypto market’s recent uptrend, as CryptoSlate reported in late-March that at the time 88 percent of Ethereum investors were underwater.

In the nine days following this report, Ethereum has climbed from lows of $130 to highs of nearly $180, with this price rally coming about in tandem with that seen by Bitcoin and many other major altcoins.

The rise in the percentage of profitable Ethereum investors has been disproportionate from the number of wallets that acquired their ETH between $130 and $180, which indicates that a large number of investors entered positions towards the bottom of the recent selloff.

Here’s why ETH’s investor composition could be highly bullish

Although the face value of there being a significant number of underwater investors seems to be overtly bearish, one prominent investor is noting that he believes it is a positive sign for ETH, emblematic of the crypto having an investor base comprised of “true believers.”

Spencer Noon, the head of crypto investments at DTC Capital, mused this notion in a recent tweet, explaining that he believes it is emblematic of their optimism and enthusiasm for the crypto.

“In the last 20 mths there were < 100 days when the agg. cost basis of ETH holders wasn’t underwater. The # of holders (unique addr) has 2x’d from ~19M to 37M over this span. You can try to spin this as bearish but it’s bullish. Everyone’s had a chance to sell—these are believers.”

If investors continue buying Ethereum’s dips and holding onto their positions, the number of underwater positions is likely to steadily decline.

Ethereum Market Data

At the time of press 4:42 pm UTC on Apr. 9, 2020, Ethereum is ranked #2 by market cap and the price is up 0.84% over the past 24 hours. Ethereum has a market capitalization of $18.82 billion with a 24-hour trading volume of $15.36 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 4:42 pm UTC on Apr. 9, 2020, the total crypto market is valued at at $208.72 billion with a 24-hour volume of $127.78 billion. Bitcoin dominance is currently at 63.99%. Learn more about the crypto market ›