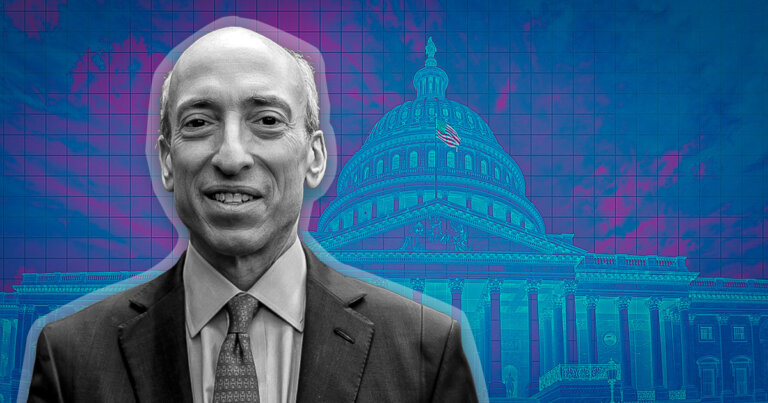

Gensler defends extensive rule-making record in congressional grilling Jacob Oliver · 1 year ago · 2 min read

Gensler defends extensive rule-making record in congressional grilling Jacob Oliver · 1 year ago · 2 min read Gensler defends extensive rule-making record in congressional grilling

The SEC chair faced strong criticisms, particularly from Republican members of the Committee, on his record of regulation and enforcement after more than two years in office.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler defended the agency’s record of regulation, enforcement, and its rulemaking authority during a contentious hearing before the Senate Committee on Banking, Housing, and Urban Affairs this Tuesday, Sept. 12.

The hearing highlighted the tension between the SEC’s extensive rulemaking under Gensler’s tenure and those who believe it exceeds the SEC’s congressional mandate.

Gensler, disparagingly labeled an “unelected bureaucrat” by Sen. Steve Daines of Montana, was tasked with justifying the SEC’s approach to cryptocurrency regulation and its broader rulemaking authority amidst numerous criticisms. The chair replied the SEC has been appropriately following facts and laws in its oversight of cryptocurrencies. This comes in the wake of a slew of enforcement actions against the cryptocurrency space and its biggest participants, including Binance, Coinbase, and more.

When queried about a recent court decision that criticized the SEC for blocking a spot Bitcoin (BTC) exchange-traded fund, Gensler stated that the agency is still reviewing the ruling and multiple similar filings.

Limits on authority

Gensler’s extensive rulemaking activities drew criticism from multiple Republicans who argued it exceeded the SEC’s congressional mandate and risked detrimental consequences for businesses and investors. Nonetheless, Gensler stood firm, citing precedents in defending the scope of rulemaking and asserting it aligns with the actions of previous chairs. He emphasized the agency values input from all types of investors on proposed rules.

Sen. Elizabeth Warren (D-MA), criticized Gensler for not implementing stronger private equity fund regulation quickly enough. Gensler pointed to a recently finalized rule requiring additional disclosures as an indication of progress.

Gensler’s stance on cryptocurrency regulation has consistently emphasized the need for greater oversight. Despite the presence of good faith actors within the industry, he has persistently argued that the crypto environment is “rife with fraud” and lacks comprehensive investor protections

He has repeatedly argued that the crypto space is “rife with fraud,” lacks comprehensive protections for investors, and can be effectively regulated under current law. “I’ve been around finance for around 44 years now,” Gensler said today in regarding the crypto industry, “And I’ve never seen a field that’s so rife with misconduct… It’s daunting.”

Jacob Oliver

Former Editor at CryptoSlateJacob Oliver is a recovering academic and English teacher turned crypto journalist and web3 writer. He holds a Ph.D. from the University of Washington.

News Desk

Editor at CryptoSlateCryptoSlate is a comprehensive and contextualized source for crypto news, insights, and data. Focusing on Bitcoin, macro, DeFi and AI.

Latest US Stories

Latest Press Releases

Commitment to Transparency: The author of this article is invested and/or has an interest in one or more assets discussed in this post. CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article. Please take that into consideration when evaluating the content within this article.

Disclaimer: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

Featured Story

Advertise HereIn this article

Bitcoin, a decentralized currency that defies the sway of central banks or administrators, transacts electronically, circumventing intermediaries via a peer-to-peer network.

Ro Khanna

Ro Khanna