Ethereum price plummets despite strong network activity growth

Ethereum price plummets despite strong network activity growth Ethereum price plummets despite strong network activity growth

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum’s intense uptrend seen throughout 2020 reached a boiling point in early-February, with ETH’s break above $200 allowing it to incur parabolic momentum that led it to highs of $290.

Although the crypto has retraced from these highs, its mid-term market structure still remains firmly bullish, and many analysts are now noting that this will likely allow the crypto to soon rally to fresh year-to-date highs.

This potential bullishness may also be driven by the fundamental growth seen by ETH over the past couple of months, with its strong network activity making it a convincing value investment for long-term investors.

At the time of writing, Ethereum is trading down just over five percent at its current price of $264, which marks a significant decline from daily highs around $285 that were set at the peak of its recent rally.

It does appear that ETH is moving in close tandem with Bitcoin, which means that where it goes next could be highly dependent on whether or not BTC is able to recover from the intense selloff it experienced this afternoon and reclaim its position within the five-figure price region.

One bullish factor that could allow Ethereum to see some independent momentum is the fact that it has incredible fundamental strength, with on-chain transactions and net network growth both climbing at a rapid rate.

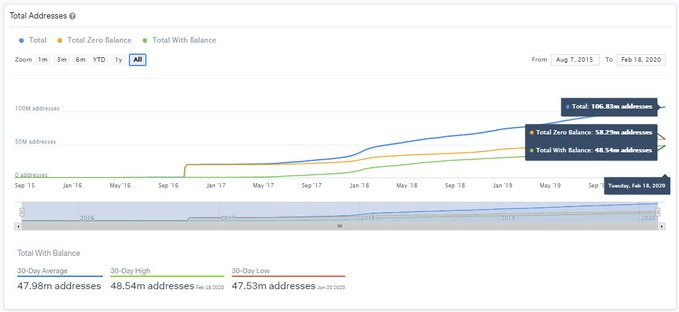

IntoTheBlock — a blockchain analytics firm — spoke about this in a recent tweet, referencing a chart showing the rapid growth of various fundamental factors underpinning the Ethereum blockchain.

“Ethereum price keeps rising. On Feb18 – The number of addresses with a balance in ETH reached its ATH with 48.54m addresses – With the price increase, we saw a total of 717k on-chain transactions moving a total of 3.13m ETH and $853.76m – Net network growth of 41.8k address.”

ETH’s technical situation suggests short-term bearishness is imminent

Despite Ethereum’s strong fundamentals, it is important to note that today’s sharp selloff led the crypto to drop beneath a key support level that was one of the primary contributors to its technical strength.

Bagsy, a prominent cryptocurrency trader on Twitter, spoke about this level in a tweet from prior to the selloff, explaining that ETH had previously been able to reclaim its weekly and daily point-of-control, with the crypto being highly bullish as long as it sustains above this level.

“ETH BTC: Despite yesterday’s wick to the downside on Mex, we reclaimed the weekly and daily POC (Point-of-Control) as support, which in itself is bullish as long as we’re trending above it.”

Although Ethereum has now dropped below this level, it is still highly possible that its fundamental strength will allow it to once again start climbing higher, with this level acting as key resistance that bulls must reclaim.