DeFi TVL down 30% YoY yet liquid staking and Tron based projects defy trend

DeFi TVL down 30% YoY yet liquid staking and Tron based projects defy trend DeFi TVL down 30% YoY yet liquid staking and Tron based projects defy trend

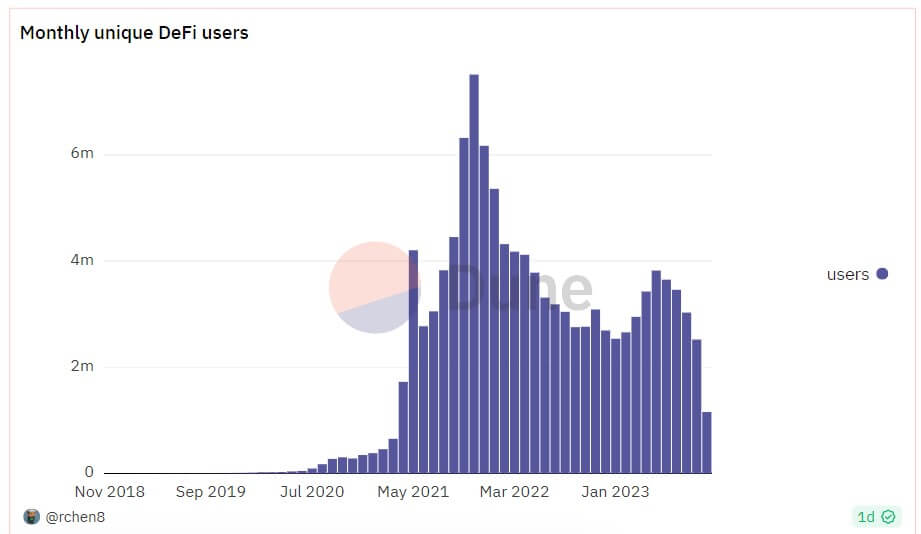

2.5 million active monthly users lost by DeFi projects since May.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The total value of assets locked (TVL) on decentralized finance (DeFi) projects recorded a 30% year-on-year decline to drop to its lowest point for this year at $36.95 billion, per data from DeFillama.

While DeFi projects started the year strongly, peaking at more than $52 billion in April, the sector has witnessed six months of consistent underperformance, dragging it to its current low.

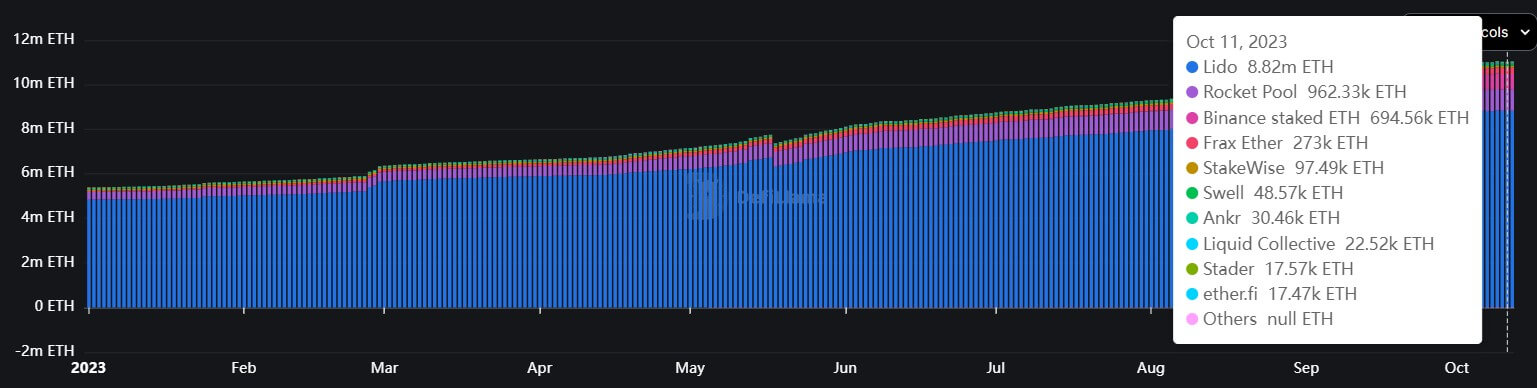

Liquid staking projects thrive

In the ever-evolving landscape of the DeFi sector, liquid staking projects have emerged as a beacon of resilience, contrasting with the broader decline seen in other DeFi categories.

Despite the prevailing bearish sentiments, liquid staking projects have thrived, returning almost 300% from their 2022 low to nearly $20 billion in TVL, according to DeFillama data. As of the latest figures, TVL now stands at $17.67 billion.

Lido is the dominant player within this niche, maintaining over 50% of the market share, outpacing major contenders like Binance, Coinbase, and Kraken, as per insights from Nansen data shared with CryptoSlate.

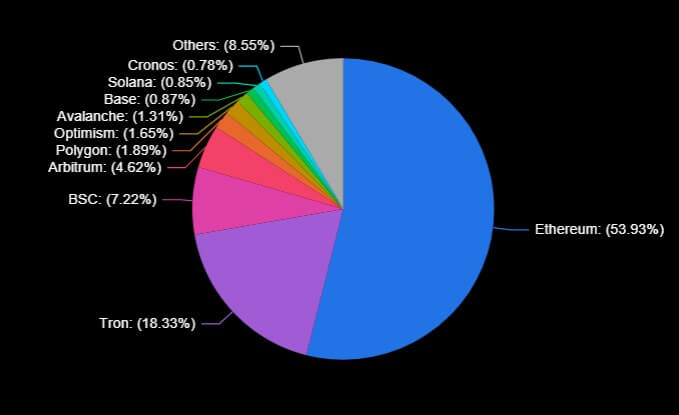

Tron-based projects TVL rise

The Tron network, too, has witnessed significant growth in its DeFi projects, with their contribution to the overall TVL hitting an all-time high of 18.23% from the 6.5% recorded earlier in the year.

On-chain sleuth Patrick Scott attributed Tron’s increased TVL to the growth of the first Real-World Assets (RWA) on the network, stUSDT. According to DeFillama data, the project’s TVL is nearing $2 billion in just four months since its launch.

However, CryptoSlate reported that the project has come under scrutiny, primarily due to its governance and transparency, while some of its claimed partners, like Tether (USDT), have denied any affiliations.

Meanwhile, Ethereum remains the primary platform for DeFi projects and applications, controlling more than 50% of the market. Other networks like Binance Smart Chain, Polygon, Arbitrum, and others also host many projects.

DeFi projects lost 2.5M monthly users.

As the TVL has flatlined, DeFi projects have encountered another challenge: a decrease of approximately 2.5 million active monthly users throughout the year, Altindex reported, citing a Dune Analytics dashboard by rchen8. Per the report, the decline commenced in May and has maintained a downward trend.

In May, the DeFi sector boasted over 3.8 million monthly users, but by October, this figure had dwindled to around 1.15 million, compared to the 2.7 million users reported the previous October. Overall, monthly unique users have dropped by 66% from the all-time high of 7.51 million recorded in November 2021.