CryptoSlate Wrapped Daily: Grayscale taking SEC to court over spot BTC ETF, CoinCenter sues US Treasury for Tornado Cash ban

CryptoSlate Wrapped Daily: Grayscale taking SEC to court over spot BTC ETF, CoinCenter sues US Treasury for Tornado Cash ban CryptoSlate Wrapped Daily: Grayscale taking SEC to court over spot BTC ETF, CoinCenter sues US Treasury for Tornado Cash ban

Arbitrium's Offchain Labs acquires leading Ethereum client, 21Shares launches its spot BTC ETP in Dubai, and much more in this edition of CryptoSlate Wrapped Daily.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The biggest news in the cryptosphere for Oct. 12 includes Grayscale’s lawsuit against the SEC for not approving a U.S. spot Bitcoin ETF, CoinCenter’s lawsuit against the U.S. Treasury for overstepping its legal authority by banning Tornado Cash, and Arbitrium’s parent company Offchain Labs’ acquisition of leading Ethereum client Prysmatic Labs.

CryptoSlate Top Stories

Grayscale files opening brief in Bitcoin ETF battle against SEC

Grayscale Investments have been trying to get the Securities and Exchange Commission (SEC) to approve a U.S. spot Bitcoin (BTC) exchange-traded fund (ETF). The SEC has rejected all attempts of Grayscale so far.

Grayscale’s parent company Digital Currency Group (DCG) CEO Barry Silbert, said it is time the SEC approved a spot Bitcoin ETF and filed a lawsuit against the SEC, claiming it is discriminatory to allow Bitcoin futures ETFs but not a spot ETF.

Coin Center sues US Treasury over Tornado Cash sanctions

Coin Center filed a lawsuit against the U.S. Treasury Department for sanctioning Tornado Cash (TORN), arguing that it overstepped its legal authority by banning a protocol that protected Americans’ privacy rights.

The lawsuit stated:

“As a result of the Biden administration’s criminalization of Tornado Cash, these donors are less likely to contribute to Coin Center. They are effectively banned from engaging in expressive advocacy.”

Arbitrium’s Offchain Labs acquires leading Ethereum client

Arbitrium’s parent company Offchain Labs announced that it acquired a core Ethereum (ETH) development team, Prysmatic Labs.

Prysmatic Labs is behind Ethereum’s leading consensus layer client, Prysm, which is an Ethereum PoS client that pioneered the Ethereum Merge.

21Shares spot Bitcoin ETP goes live on Nasdaq Dubai

Crypto exchange traded-product (ETP) issuing company 21Shares listed its first physically-backed Bitcoin ETP on Nasdaq Dubai. The new ETP will be traded under the ticker ABTC.

With ABTC, 21Shares increased its ETP products to 46, which are listed across 12 exchanges in seven different countries.

TRON becomes legal tender in Dominica

Dominica announced making TRON (TRX) authorized digital currencies in the Caribbean Island. The new adoption includes all TRON-based native tokens like BTT, JST, NFT, USDD, USDT, and TUSD as well.

The news was announced by TRON’s CEO, Justin Sun, on his Twitter account.

It is official! All #TRON cryptos including #TRX #BTT #JST #NFT #USDD #USDT #TUSD are granted statutory status as authorized digital currency and medium of exchange in the commonwealth of Dominica effective on October 7th 2022 🇩🇲 https://t.co/p97zJkzhUe pic.twitter.com/kbejwXrkXt

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) October 12, 2022

Polygon powers new Indian police complaints portal

Police in India’s Firozabad region used Polygon’s (MATIC) blockchain to develop a web portal citizens can use to report crimes.

The portal is live and accessible through policecomplaintonblockchain.in address. The portal allows citizens to report a crime in an immutable and transparent manner. This also implies that a reported crime can’t be deleted or edited.

Bitcoin Amsterdam panel discussion throws light on unfixable debt-based system

The three-day Bitcoin Amsterdam event started on Oct. 12. In the first-panel session, participants agreed that the debt-based system is inherently flawed and incapable of resolving inflation.

Panelists agreed that Bitcoin offered an alternative system that is completely opposite to the traditional ways and much more capable of combatting existing financial predicaments.

STEPN to lay off over 100 staff

Walk-to-earn platform STEPN (GMT) announced it would begin laying off over 100 of its staff, including MODs and ambassadors. The company pointed at the bear market conditions as the reason for downsizing.

STEPN’s parent company, Find Satoshi Lab, also decided to redirect its investments to STEPN towards promoting upcoming projects like its new NFT exchange platform.

Crypto.com to invest €150M in France

Leading exchange Crypto.com announced that it spared €150 million to invest in France to expand in the region and establish a regional headquarters in France.

The exchange has been focusing on extending all around the globe, and it already acquired the necessary licenses to operate in Singapore, Italy, and Cyprus.

Research Highlight

Research: Whales selling at the 3rd most aggressive rate in BTC history

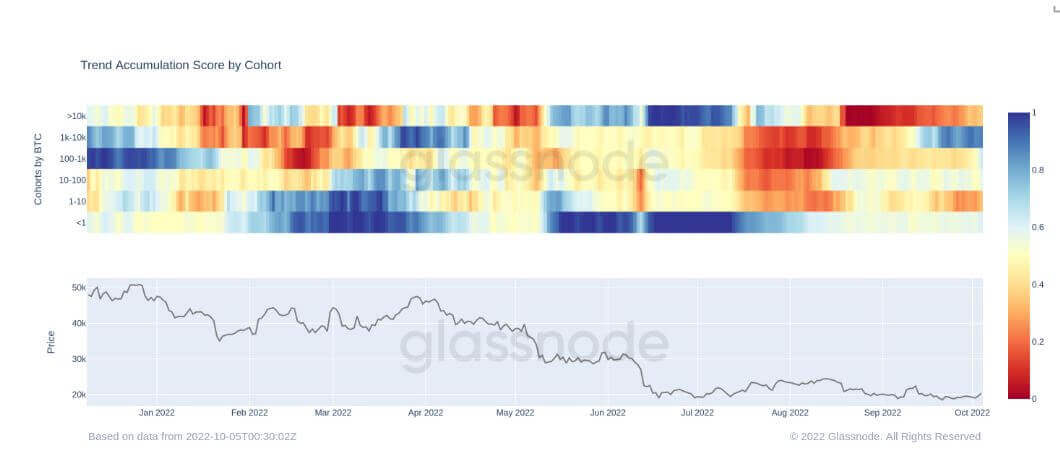

CryptoSlate analysts examined the Accumulation Trend Score (ATS) and revealed that this is the third most aggressive dumping by Bitcoin whales in crypto history.

The ATS is a metric that gauges the behavior of various wallet cohorts and indicates each entity’s relative strength of accumulation. If it’s close to 1, it indicates that the entity is accumulating. If it’s close to 0, it means that the group is distributing.

The ATS shows that whales have been the net sellers for most of 2022, especially recently. Shrimps, on the other hand, have been actively accumulating.

News from around the Cryptoverse

nxyz hits $40M in Series A funding

Web3 data infrastructure provider nxyz announced it gained $40 million in its Series A funding round. The round was led by the likes of Paradigm, Coinbase Ventures, Sequoia Capital, and Greylock Partners.

Crypto Market

Bitcoin (BTC) increased by 0.72% to reach $19,152 in the last 24 hours, while Ethereum (ETH) also spiked by 1.25% to trade at $1,298.

Biggest Gainers (24h)

- Huobi Token (HT): +23.89 %

- Terra (LUNA): +14.71%

- Hedera (HBAR): +7.36%

Biggest Losers (24h)

- TerraUSD (USTC): -14.83%

- Maker (MKR): -5.61%

- Klaytn (KLAY):-4.44%

Mentioned in this article

Bitcoin

Bitcoin  Ethereum

Ethereum  TRON

TRON  BitTorrent

BitTorrent  JUST

JUST  APENFT

APENFT  USDD

USDD  Tether

Tether  TrueUSD

TrueUSD  Polygon

Polygon  GMT

GMT  Mango Markets

Mango Markets  Solana

Solana  ApeCoin

ApeCoin  XRP

XRP  Tornado Cash

Tornado Cash  Terra

Terra  HTX Token

HTX Token  Hedera

Hedera  TerraClassicUSD

TerraClassicUSD  Maker

Maker  Klaytn

Klaytn  Grayscale Investments

Grayscale Investments  Yuga Labs

Yuga Labs  Paradigm

Paradigm  Coinbase Ventures

Coinbase Ventures  Crypto.com

Crypto.com  Barry Silbert

Barry Silbert  Justin Sun

Justin Sun

Deribit

Deribit