Comparing bitcoin fundamentals at $8,000 in 2017 vs. 2019, what has changed?

Comparing bitcoin fundamentals at $8,000 in 2017 vs. 2019, what has changed? Comparing bitcoin fundamentals at $8,000 in 2017 vs. 2019, what has changed?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The last time bitcoin broke above $8,000 was in November of 2017 (following a 26 percent pullback 16 days earlier). The break marked a pivot point for the bull market of 2017, where BTC pushed upwards another 150 percent to reach all-time highs three weeks later.

Today, bitcoin is surging above $8,000 level once again, but under different conditions. For over a year, the crypto has slogged through a bear market that pulled its valuation down 85 percent from its peak, hitting a low of $3,130 in December of 2018.

Until now, where since April a series of continued surges have pushed bitcoin to its current highs. And, since 2017, Bitcoin has changed tremendously.

$8,000 bitcoin: 2017 vs. 2019

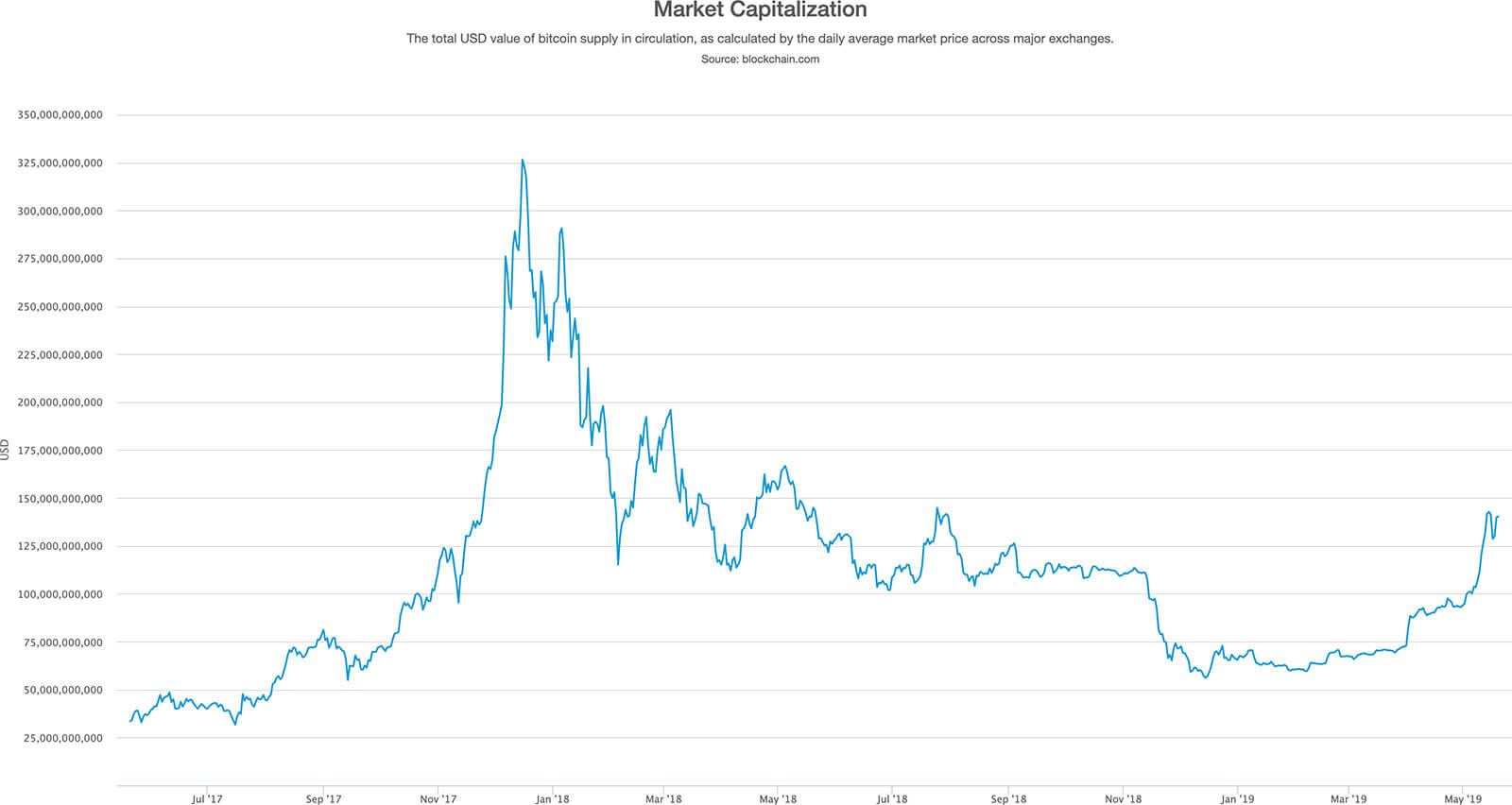

When bitcoin was trading around $8,000 on Nov. 25, 2017, it dominated the market, achieving 52 percent of overall market capitalization across all cryptocurrencies.

BTC Market Cap

Now that BTC has broken $8,000 again, its dominance over the market has increased, accounting for over 57 percent share of the overall market this time around.

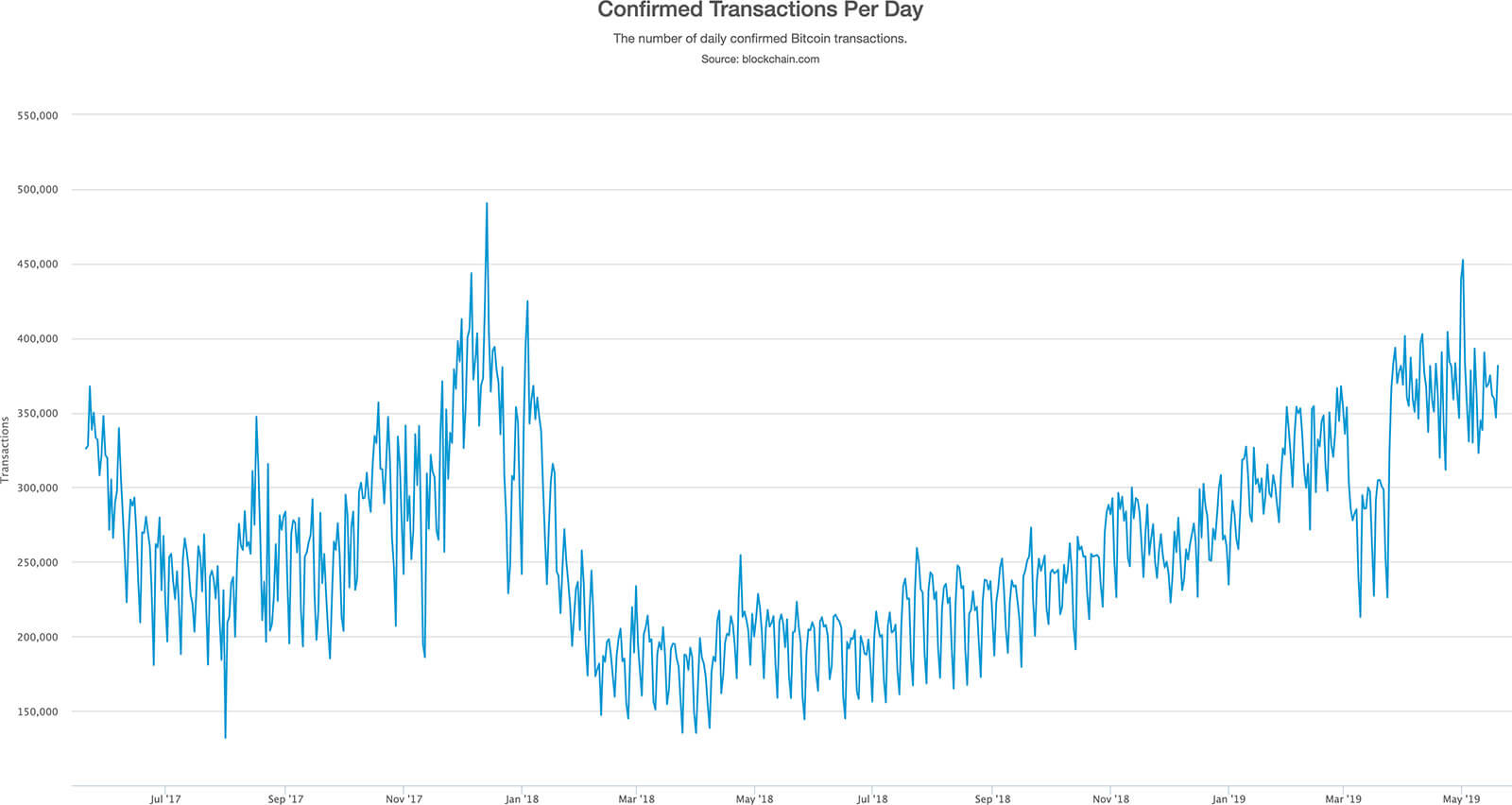

BTC Confirmed Transactions Per Day

The number of daily confirmed transactions has also had a slight increase. There were 337,000 daily transactions on Nov. 25, 2017, between 697,000 unique addresses. Meanwhile, over the last 24-hours, there were 390,000 confirmed transactions between 600,000 addresses—representing an increase in confirmed transactions and a decrease in active addresses.

That said, many analysts believe that the number of daily transactions underrepresents the amount of economic activity occurring on the bitcoin blockchain.

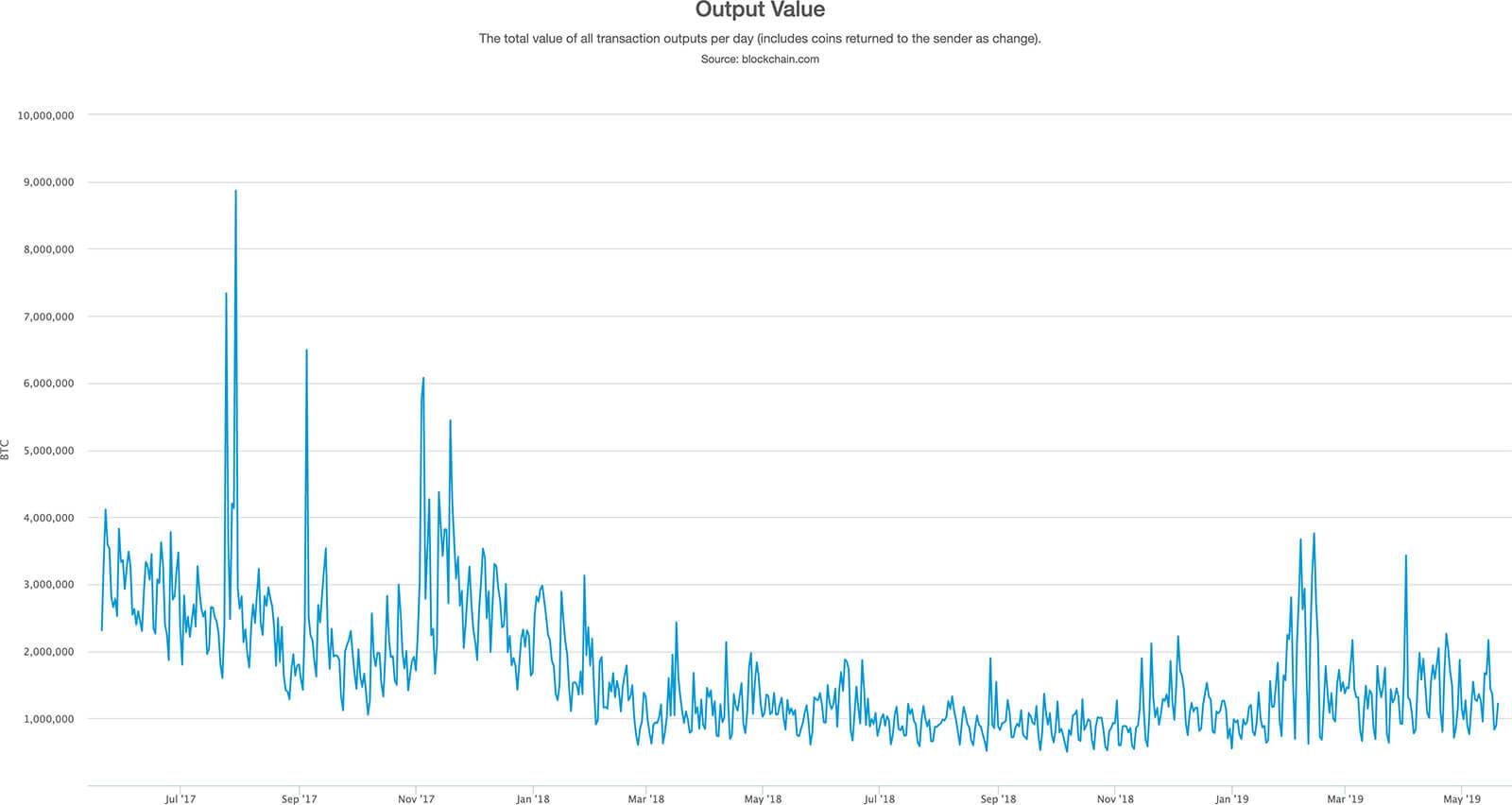

BTC Outputs Per Day

Another metric that provides better insights into the number of economic transactions on a daily basis is the number of outputs per day. Some of the big players in the crypto space bundle transactions to reduce fees, a process known as batching.

A year and a half ago, the number of outputs per day was around 865,000, which accounted for 2.9 million BTC ($2.4 billion at the time). Although there are approximately 128,000 more daily outputs now, fewer bitcoins are being transacted. At the moment, around 1.7 million BTC is being transferred, for a total value of $1.7 billion.

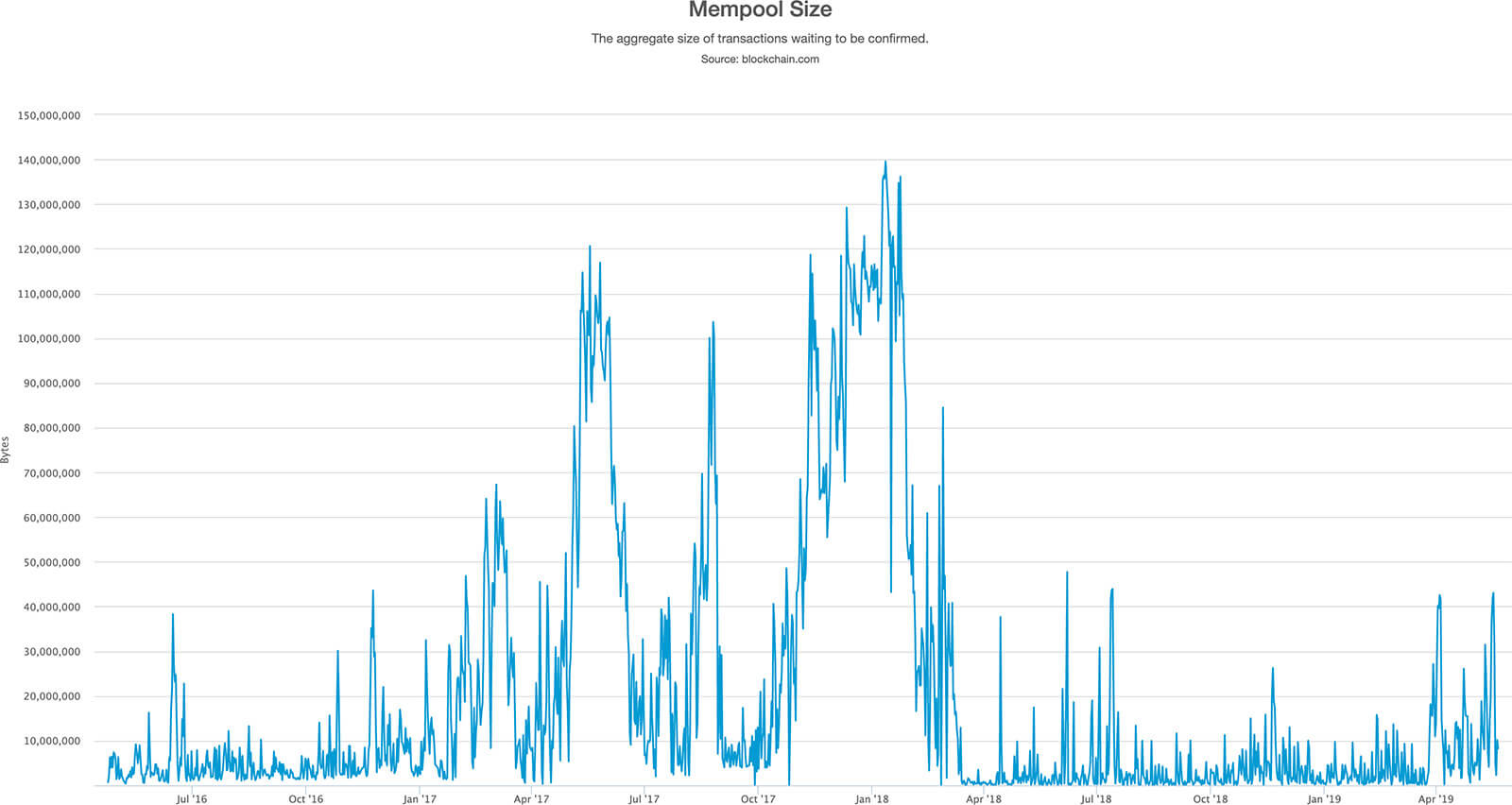

BTC Mempool Size

For bitcoin transactions to complete, they have to first get verified by all nodes. Approved transactions are then included by miners in the next block. Pending transactions are held in an area called the “Mempool.” The higher the fee on a transaction, the more likely a miner is to pull the transaction from the Mempool and include it in the next block.

During the bull market of 2017, the number of bitcoin transactions increased rapidly, congesting the Mempool. Transaction fees skyrocketed as urgent transactions competed for limited block space. On Nov. 25, 2017, the total size of the Mempool was 58 million bytes.

Since then, a number of on-chain and off-chain solutions have substantially increased Bitcoin’s transaction capacity. Even though there are more daily confirmed transactions today compared to 2017, the Mempool size is only 7.7 million bytes—an 87 percent reduction.

Bitcoin saw three technologies implemented on its protocol since 2017 which reduced fees and increased its capacity:

- Batching, the bundling of transactions has decreased the total number of transactions conducted on the Bitcoin blockchain while allowing a greater number of economic transactions to take place. Adoption of batching by major exchanges and payment processors has noticeably reduced congestion on the network.

- SegWit, or Segregated Witness, was integrated into bitcoin via soft fork on Aug. 2017. Its purpose was to remove signature data that accounted for 65 percent of the space in a given transaction, allowing more of them to fit in a block. As a result, fees decreased as more transactions could flow through the network..

- Lightning Network (LN) is a second layer solution that uses micropayment channels to scale Bitcoin’s transaction capabilities. It allows small transactions to take place outside of the main Bitcoin blockchain at a minimal cost. LN was first proposed in 2016 and is still under development. LN allows people to create “transaction channels,” where funds can be transferred an unlimited number of times without uploading that information to the blockchain until the balance is settled. This approach can drastically speed up a transaction since it does not need to be approved by all nodes within a blockchain.

Eighteen months ago, the estimated fee paid for every transaction, depending on the confirmation speed, was around 147 to 230 satoshis per byte, equivalent to $3.11 to $4.87. The total value of all transaction fees paid to miners was 196 bitcoins or $1.6 million. This number got as high as 1,120 BTC as bitcoin was reaching its all-time high of $19,900, increasing the price of every transfer from $4 to $50.

Over time, transaction fees have experienced a steady decline in cost thanks to the different solutions mentioned above. At the present time, they only account for 44 to 87 satoshis per byte, which is between $0.82 and $1.6. The accumulated amount of money that miners are now receiving equals 112 BTC or $896,000—a 43 percent decrease.

Based on the data, it seems like as bitcoin ages it becomes faster, cheaper, and arguably more secure—getting the protocol closer to Satoshi Nakamoto’s ideal of peer-to-peer electronic cash.

Bitcoin Market Data

At the time of press 2:52 am UTC on Nov. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 8.26% over the past 24 hours. Bitcoin has a market capitalization of $153.78 billion with a 24-hour trading volume of $29.6 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:52 am UTC on Nov. 7, 2019, the total crypto market is valued at at $268.48 billion with a 24-hour volume of $89.37 billion. Bitcoin dominance is currently at 57.32%. Learn more about the crypto market ›