As bitcoin smashes past $8,000 retail interest begins surging, new momentum?

As bitcoin smashes past $8,000 retail interest begins surging, new momentum? As bitcoin smashes past $8,000 retail interest begins surging, new momentum?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

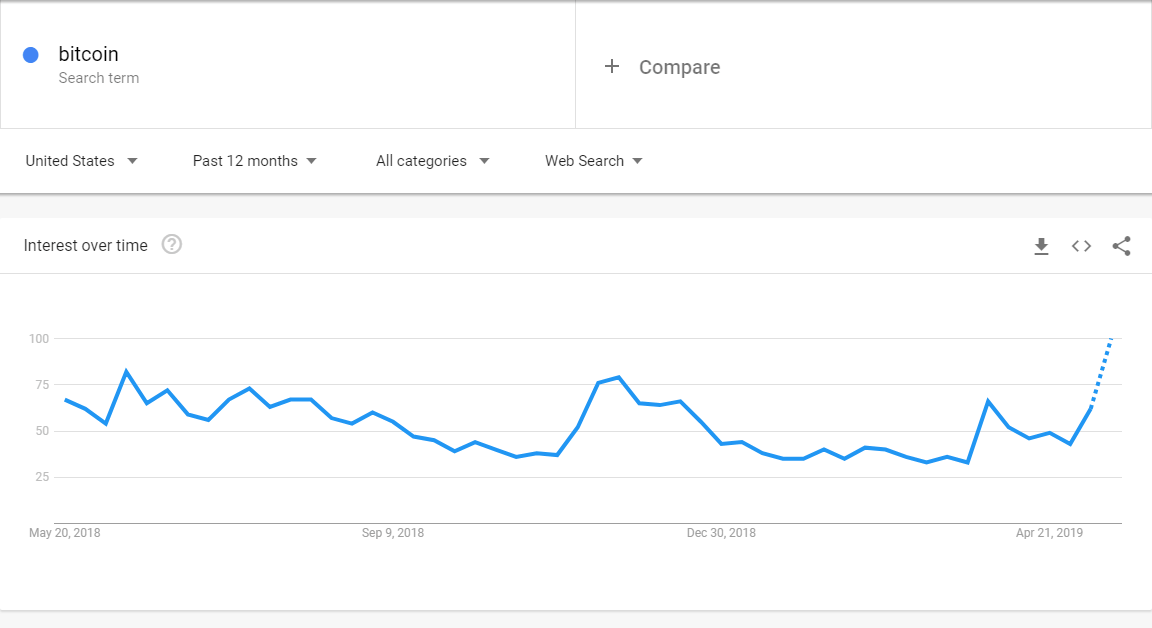

As bitcoin initiated a powerful recovery to $8,000 over the weekend, the interest towards the dominant crypto asset on Google Trends spiked to April 2018 levels, demonstrating a noticeable increase in demand from retail or individual investors.

Google Trends for the keyword “bitcoin” is spiking

Major markets in the likes of South Korea have also begun to show a clear rise in interest from individual investors.

The rally of bitcoin and the rest of the crypto market in recent weeks has mainly been attributed to the increase in the inflow of capital from institutional investors as seen in the spike in the daily volumes of the CME bitcoin futures market and Grayscale’s Bitcoin Investment Trust (GBTC).

If retail interest in bitcoin rebounds in the weeks to come, it may establish the foundation for new momentum for the crypto market.

Will bitcoin rally lead to the recovery of alternative crypto assets?

Year-to-date, most major crypto assets such as litecoin, bitcoin cash, EOS, and BNB have recorded gains in the range of 140 percent to 400 percent against the U.S. dollar.

However, from their all-time highs, the majority of crypto assets have underperformed with many cryptocurrencies down by nearly 90 percent from 2017 highs. Against BTC, most crypto assets have also performed quite poorly in the past 16 months.

According to a cryptocurrency trader @SatoshiFlipper, with BTC recovering to $8,000 quickly after plunging to $6,400 on May 17, alternative crypto assets are likely to continue rising against the U.S. dollar in the near-term.

The trader said:

“The rest of this year will be characterized by rapid $BTC advances, healthy corrections and periods of sideways price action, when #altcoins will fly. Put that nonsense rhetoric about waiting for capitulation and still not making our bear market lows away. Wrong cycle. Full on degen alternative cryptocurrency season still on track for June. Next few weeks, as BTC finds a range, we’ll continue to see the popular altcoins bounce back 1st. In June, ALL altcoins across the board will bounce back hard. More disbelief on its way.”

Previous bull cycles of bitcoin have occurred around a year before its scheduled block reward halving. In May 2020, bitcoin is set to see its block reward halved, which would decrease the rate in which new BTC is produced.

As the scheduled block reward halving nears, based on fundamental factors, the momentum of BTC is likely to be sustained.

One concern of investors is the rate in which bitcoin and the crypto market have been recovering and some have suggested that a gradual climb from the current point, having already recorded large gains, would be ideal.

David Tawil, the president of ProChain Capital, told Bloomberg in April:

“Certainly, an investor would much rather see a gradual rise with constant floors in terms of downside being established, as opposed to a very, very quick run-up. It could be easy come, easy go.”

Ethereum, XRP, and Others Up 8%+

On the day, Ethereum, XRP, and other major crypto assets have risen by at least eight percent against the U.S. dollar following bitcoin’s strong nine percent rally.

Bitcoin Market Data

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 9.33% over the past 24 hours. Bitcoin has a market capitalization of $141.64 billion with a 24-hour trading volume of $23.24 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $249.39 billion with a 24-hour volume of $78.25 billion. Bitcoin dominance is currently at 56.56%. Learn more about the crypto market ›