CME posts one of its largest volume days ever as Bitcoin marks three-month buy-streak

CME posts one of its largest volume days ever as Bitcoin marks three-month buy-streak CME posts one of its largest volume days ever as Bitcoin marks three-month buy-streak

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

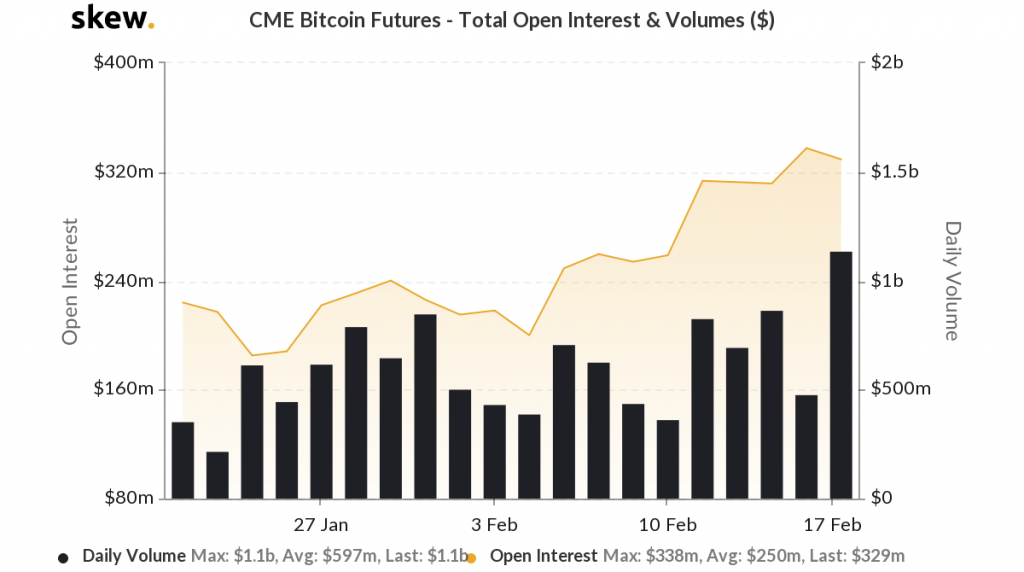

Trading volume has rocketed to a near-all-time-high on the CME cash-settled Bitcoin futures market as the number-one crypto by market capitalization continues one of its longest unbroken uptrends since the first half of last year.

Tuesday posted over 23,000 contracts, worth $1.1 billion, according to preliminary data from CME Group, the Chicago-based commodities exchange that operates the market’s most actively traded regulated Bitcoin futures contract.

The day falls just short of the contract’s all-time-high volume of $1.3 billion, posted on May 13 last year, as Bitcoin cleared its five-month high with a spirited $1,500 intraday rally—BTC then went on to rally more than 100 percent over six weeks and eventually made the high of 2019 at $13,800.

Institutional traders appear to be building momentum

Open interest has also been making strong gains on the CME contract, a promising sign for the continuation of BTC’s uptrend considering the healthy gains in volume. This metric has appreciated alongside Bitcoin this month despite minor pullbacks—a signal that institutional traders are likely betting on higher prices and opening fresh long contracts.

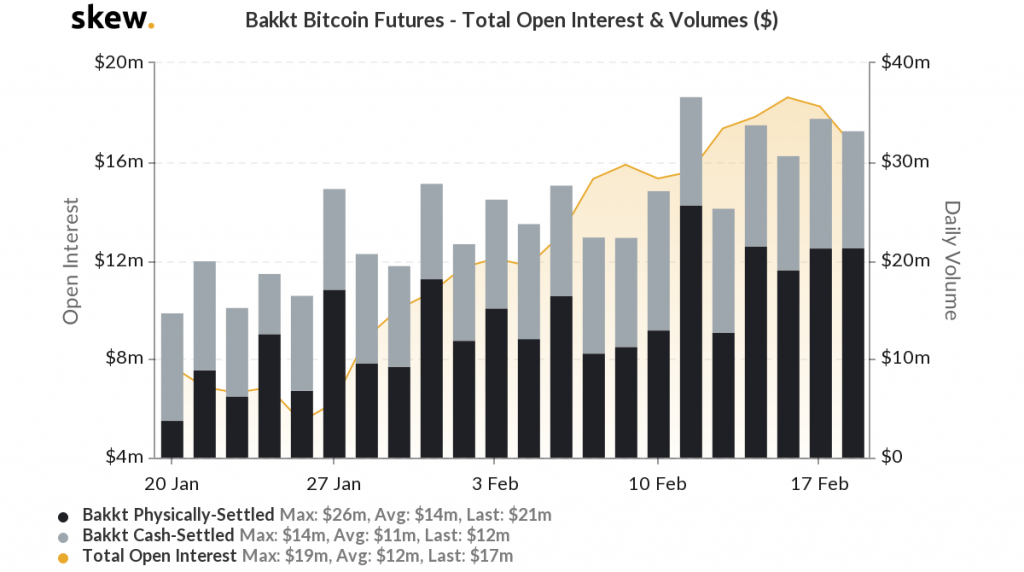

Traders over on Bakkt’s Bitcoin futures market appear to be even more confident that Bitcoin’s rally will continue. Open interest has hiked nearly 100 percent on the physically-settled and cash-settled contracts this month, accompanied by convincing increases in volume.

All of this is encouraging for what has just become a three-month bull rally, a price hike of more than 55 percent. Bitcoin has clung to a daily trendline since December 17 and along the way has exhibited balanced buy-side and sell-side delivery.

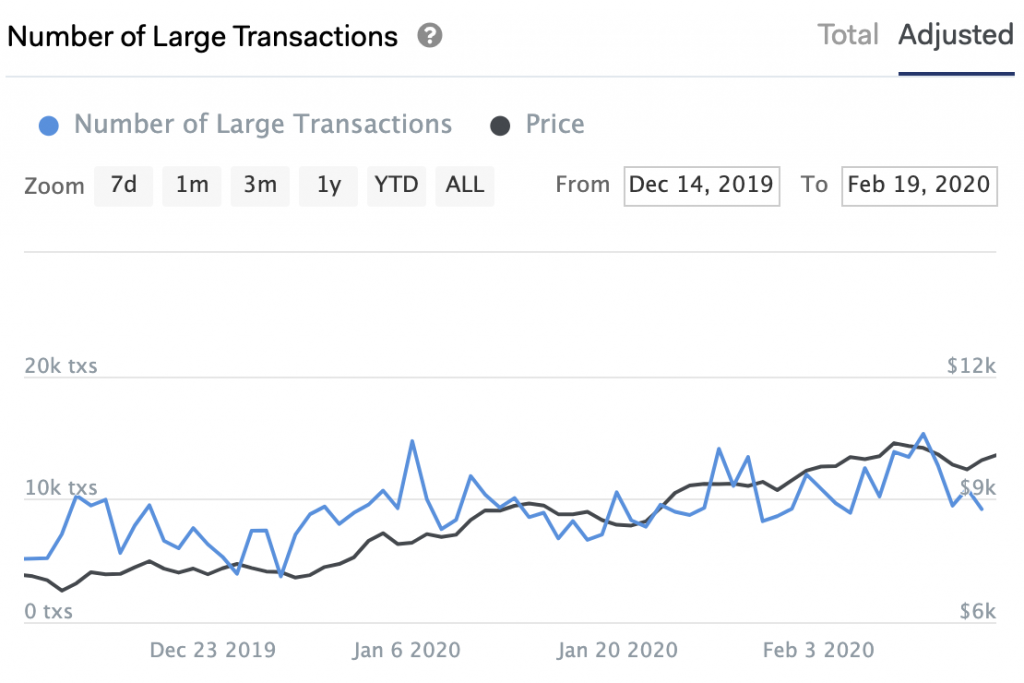

Data from IntoTheBlock reveals that over the last three months BTC has increasingly been bought in large blocks, further supporting the idea that sophisticated investors are fueling Bitcoin’s latest rise. The number of transactions greater than $100,000 has been rising steadily since late December, seemingly in sync with Bitcoin’s uptrend.

Farside Investors

Farside Investors

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)