Bitcoin’s funding suggest it has room to rally; Will it soon shatter $10,000?

Bitcoin’s funding suggest it has room to rally; Will it soon shatter $10,000? Bitcoin’s funding suggest it has room to rally; Will it soon shatter $10,000?

Image by 272447 from Pixabay

After flashing some signs of intense weakness yesterday, Bitcoin is now expressing signs of strength as it consolidates within the mid-$9,000 region.

This rebound has been incredibly positive, as it suggests that BTC’s buyers have enough strength to guard against a decline below the lower boundary of the trading range it has been caught within throughout the past few months.

This range currently exists between $9,000 and $10,000. If buyers are able to maintain this momentum, they may soon be able to catalyze a movement to the upper boundary of this long-held consolidation channel.

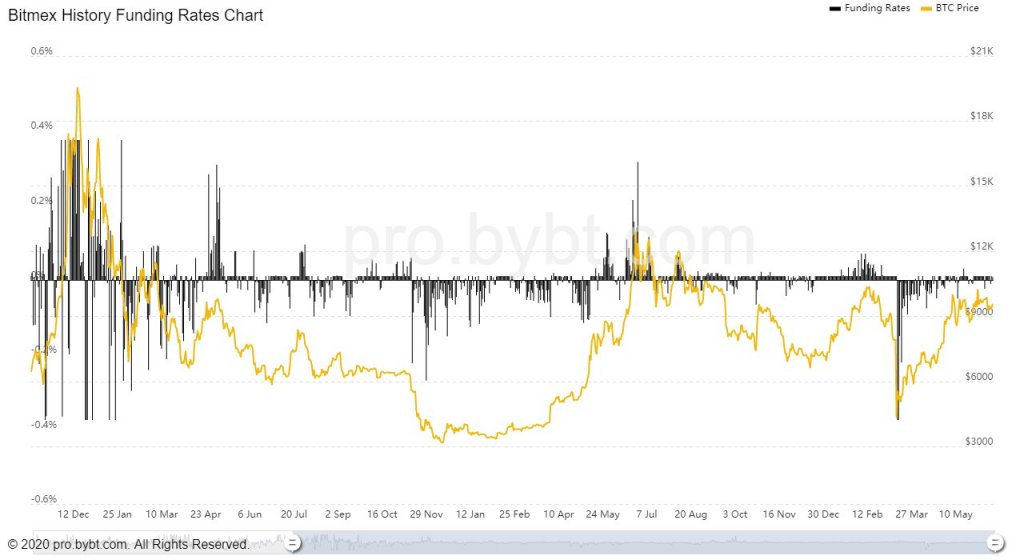

A trend seen while looking towards the benchmark cryptocurrency’s funding rates does seem to suggest that it could be positioned to see a notable upside in the days ahead.

Bitcoin’s negative funding a positive sign for buyers

Bitcoin dipped to lows of $8,900 yesterday in a sharp and sudden movement that came as a surprise to bulls.

This decline was the result of a firm rejection seen at $10,000 last week and caused a significant shift in investor sentiment.

Following this decline, however, buyers stepped up and propelled Bitcoin back into the mid-$9,000 region – where it is currently consolidating at now.

At the time of writing, BTC is trading up just over 1% at its current price of $9,500. It does face some resistance between $9,700 and $10,000 that may slow its ascent.

One factor that could suggest it has room to run in the near-term is that its funding rates have still remained negative in the time following this recent dip. This means that shorts pay out longs and is typically used as a counter-indicator by traders.

Popular pseudonymous analyst “Byzantine General” spoke about this in a recent post, explaining that he believes this provides the crypto with “room to pump.”

“Funding is usually pretty extreme on the daily before we make a significant move the other way. We haven’t seen that type of over-levering yet. So I think we still have some room to pump.”

Psychology shows why $10,000 has become such a significant resistance level

Bitcoin has posted countless rejections at $10,000 throughout the past several weeks and months. Some analysts are even pointing to the existence of a potential “triple top” at $10,500.

Philip Swift – a respected data analyst – explained that the psychological significance of the five-figure price region is what has made $10,000 such a hefty resistance level.

“If you’re wondering why we are struggling to get past $10k. Worth remembering how little time we spent above that level last bull market. Just *18 days* were spent above $10k before we topped out. So $10k is a huge psychological level…but it will break.”

That being said, once this level does decisively break, the subsequent rally could be sharp and swift – should history repeat itself.

Bitcoin Market Data

At the time of press 9:07 pm UTC on Jun. 17, 2020, Bitcoin is ranked #1 by market cap and the price is down 1.29% over the past 24 hours. Bitcoin has a market capitalization of $172.66 billion with a 24-hour trading volume of $19.24 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:07 pm UTC on Jun. 17, 2020, the total crypto market is valued at at $264.83 billion with a 24-hour volume of $66.78 billion. Bitcoin dominance is currently at 64.92%. Learn more about the crypto market ›

Elon Musk

Elon Musk

BTC

BTC