Bitcoin is closer to a critical buy zone, but not all analysts agree

Bitcoin is closer to a critical buy zone, but not all analysts agree Bitcoin is closer to a critical buy zone, but not all analysts agree

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As Bitcoin threatens to push for lower prices, some of the most prominent analysts in the industry believe that it is getting closer to a zone that poses high levels of demand. Regardless of their positive outlook, other analysts are not as optimistic expecting a further retracement.

A critical buy zone

In a recent tweet, Philip Swift, the founder of Look Into Bitcoin, stated that Bitcoin’s price action is characterized by market cycles. These are created by periods in which investors are “over-excited” about BTC causing the price to “over-extend.” And, other periods where investors are extremely “pessimistic” about the pioneer cryptocurrency making its price “over-contract.”

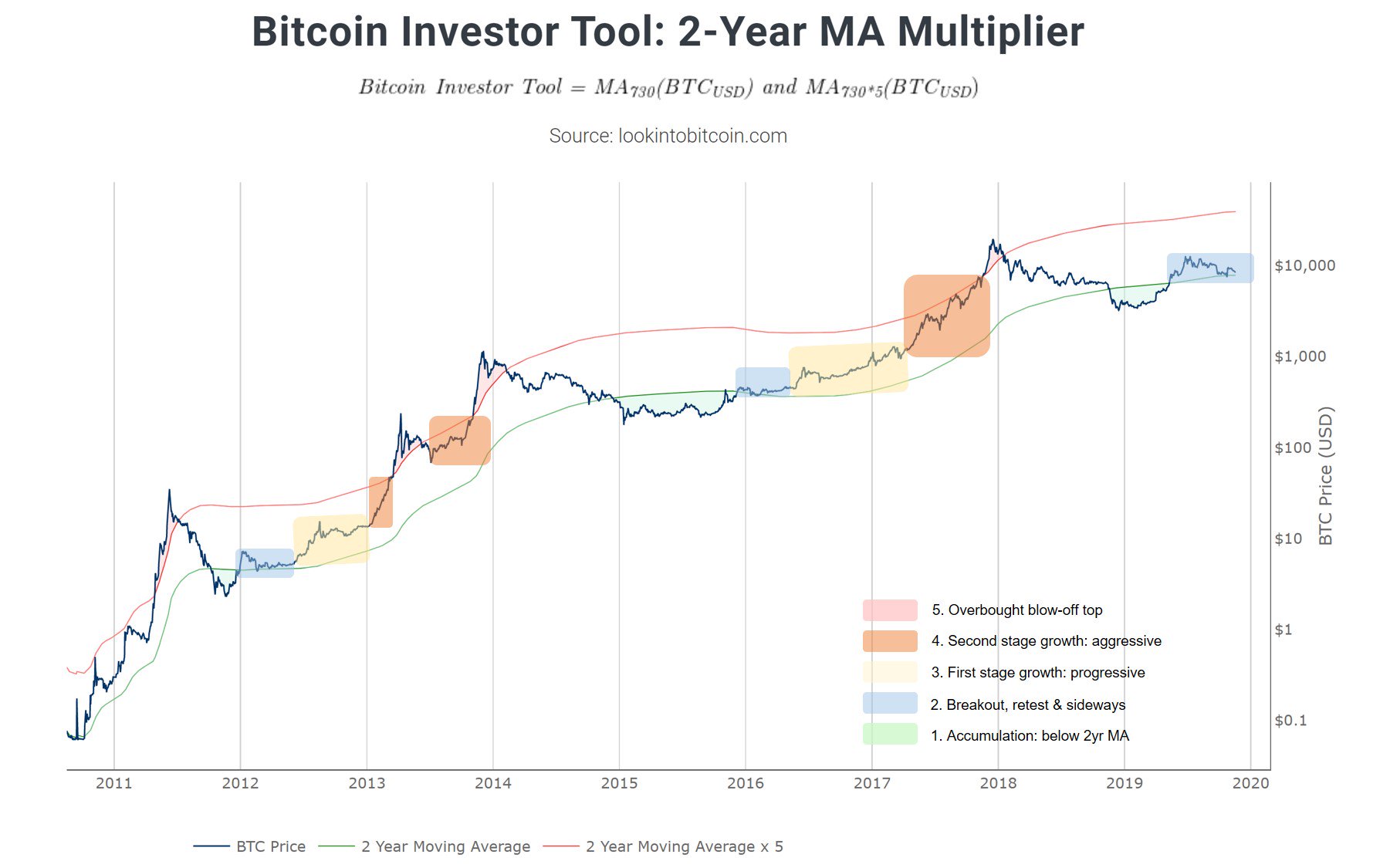

Based on the 2-year moving average (MA) multiplier indicator, Swift believes that there are five stages in every Bitcoin market cycle.

The first one occurs when Bitcoin moves below the 2-year MA, which is considered the “accumulation” phase. The second stage, “breakout,” happens when BTC moves above the 2-year MA. During this period, the price of this crypto tends to move sideways and retest the support given by the 2-year MA. The third one, dubbed the “first stage of growth,” takes place as Bitcoin starts to move away from the support level and pushes for higher prices. On the fourth stage, BTC moves in an upward direction more “aggressively” and is considered as the “second stage of growth.” Finally, Bitcoin goes through an “overbought blow-off top” stage where its market value is considered overpriced as it trades above the “2-year MA x5.”

According to Swift:

“Buying Bitcoin when the price drops below the 2-year MA has historically generated outsized returns. [Meanwhile,] selling Bitcoin when the price goes above the 2-year MA x5 has been historically effective for taking profit.”

At the moment, Swift believes that Bitcoin is on the “breakout” stage of its market cycle. And, there is no need to panic about the current price action.

He said:

“Overall, patience is the key requirement right now. As is being aware of emotions such as apathy and fear. So far in this cycle, everything continues to go to plan for Bitcoin.”

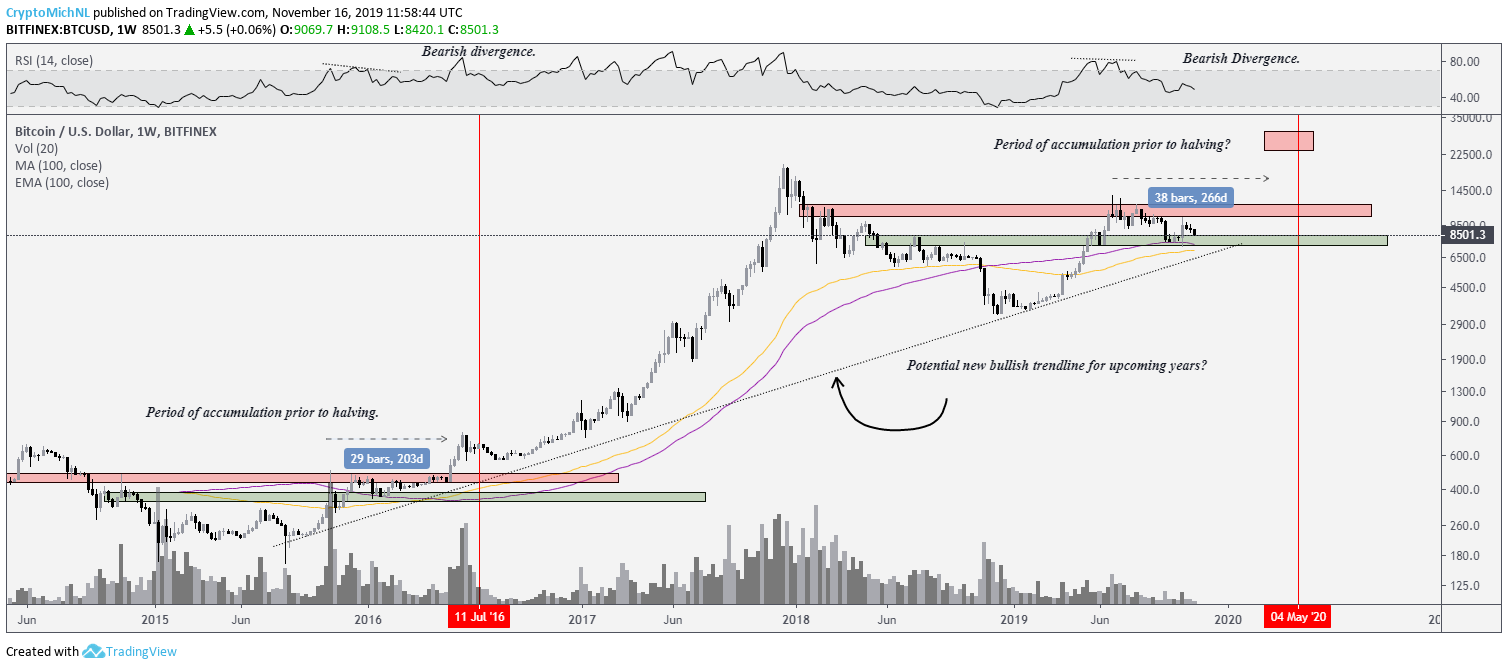

Along the same lines, Michaël van de Poppe, a student of economics and business at the University of Amsterdam, declared that from a macro-perspective Bitcoin is following the same path of its last cycle. Van de Poppe said that BTC tends to move the same way it does in the past. As a result, he thinks that this crypto is contained within a trading range between $11,800 and $7,300.

The Amsterdam-based trader expects Bitcoin to continue to trade within this range until the upcoming halving of 2020. This event could generate a spike in volume that gets this crypto to break out of the range to hit a target of $25,000.

Moreover, DaveTheWave, a well-known technical analyst in the crypto community, said that Bitcoin could be bottoming soon based on a fractal related to the bull market of 2017. As BTC approaches the 50 percent Fibonacci retracement level, the odds for a strong bounce off this area increase, according to Dave.

This is also near to what the technical analyst calls the “buy zone of the logarithmic growth curve.” The logarithmic growth curve has served as support and resistance throughout Bitcoin’s history. And, now it could serve as a rebound zone to potentially take this cryptocurrency to resume its uptrend.

Expecting more downside

Despite the positive views of these analysts, Tone Vays, former VP at JP Morgan, ensured in his latest analysis that Bitcoin was bound for a further downward movement. As BTC began losing the $8,500 support level, Vays estimated that it is going to continue plummeting to reach the support cluster around $7,200.

Vays said:

“The only thing that I would expect for this week is that Bitcoin is going to go lower. If it indeed goes lower, there is going to be reasonable support around $7,200. This price level is supported by the 50-week moving average and the 61.8% Fibonacci retracement level.”

A move down to the $7,200 level could also create a double bottom pattern. Investopedia defines a double bottom as a technical formation that anticipates a change in trend and a momentum reversal from bearish to bullish. Yet, Vays does not see it this way. He believes that double bottoms are not effective and if Bitcoin goes down to $7,200, it would likely “go lower.”

He added:

“The death cross between the 128-day MA and the 200-day MA is the major thing that is going to happen in the near future. The longer Bitcoin stays below the 200-day MA the more time this MA has to level-off and start to turn down. When the 200-day MA starts to turn down things do not end well.”

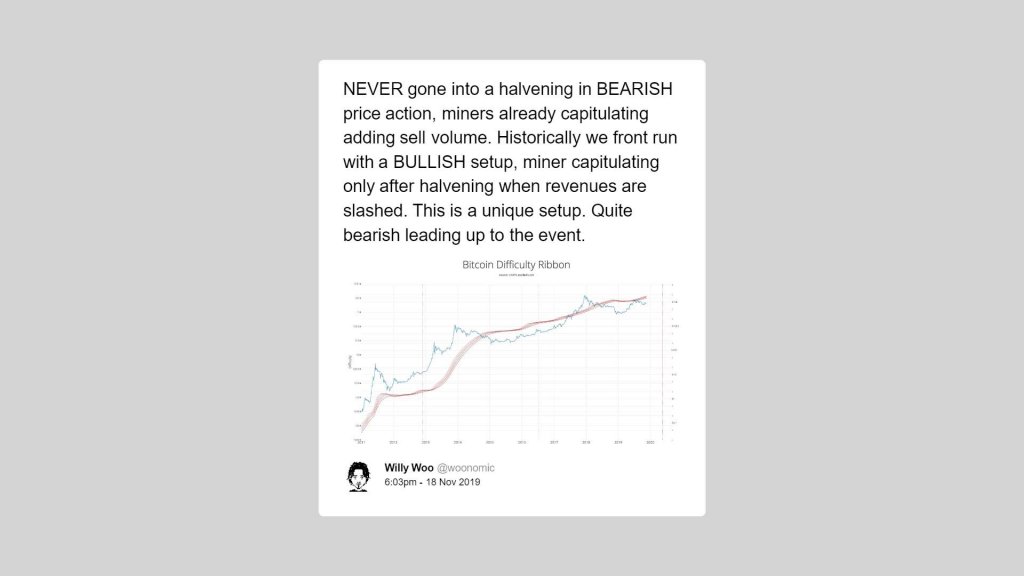

Additionally, Willy Woo, a partner at Adaptive Capital, recently pointed out that this could be the first time that Bitcoin is looking bearish on its run-up to the upcoming halving. He stated that the current scenario is a “unique setup” on BTC’s history, which is “quite bearish.”

Woo stated:

“Historically everyone draws these nice picture perfect front-running pumps 6-months before the halvening. They fail to notice that was under bullish price action.”

Woo added that the recent downward pressure that took Bitcoin from nearly $14,000 to $7,500 is causing miners to capitulate. This could ignite a sell-off taking Bitcoin into lower lows. The analyst does not expect prices to rise in anticipation of next year’s halving due to the selling pressure.

He concluded:

“I expect way more volatility. Short term bearish is all I’m saying. And don’t expect price will repeat past halvenings.”

Moving forward

The opposing views that the renowned analysts previously mentioned have about the future price of Bitcoin reflect what most investors are thinking about the current state of the market.

In the long-term, most of the people invested in the industry believe that Bitcoin has the potential to reach all-time highs as its technology matures and becomes widely accepted. Tim Draper, an American venture capitalist, told BLOCKTV on Sept. 13 that BTC is preparing for mass global adoption, which would push its price higher.

Draper stated in the interview:

“$250,000 means that Bitcoin would then have about a 5% market share of the currency world and I think that maybe understating the power of Bitcoin.”

However, from a short-term perspective, it seems like BTC is bound for further correction to at least $7,200. And, if the selling pressure behind it increases the losses could be greater.

Speaking to CNBC’s “Squawk Box” in late October, CEO at Galaxy Digital Michael Novogratz argued that while “he wants [Bitcoin] to hold [at the current price levels],” his next downside target was $6,500 — approximately 20 percent underneath the current price of $8,140.