Bitcoin allure has darknet markets jumping to record highs (and scams)

Bitcoin allure has darknet markets jumping to record highs (and scams) Bitcoin allure has darknet markets jumping to record highs (and scams)

Photo by Ethan Hoover on Unsplash

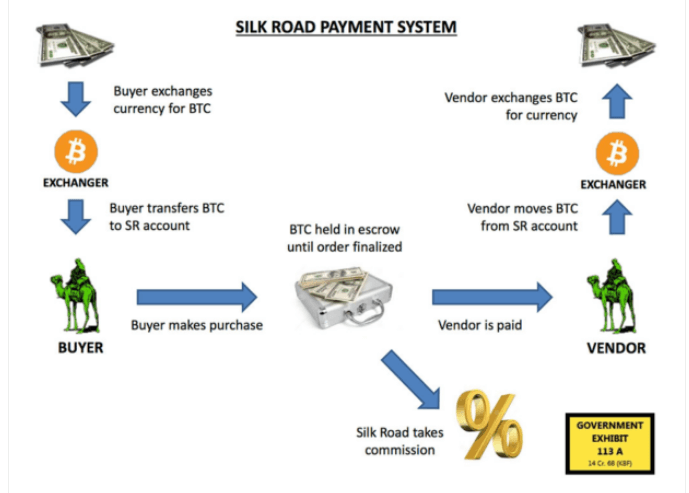

Darknet marketplaces and their operators have been the focus of authorities since the last decade. But the rise of cryptocurrencies has seemingly borne well for such illicit online shops, with a recent CipherTrace report stating they have hit record highs (both number of shops and scams) in the past year.

Crypto rise buoys darknet markets

The report comes on the back of three high-profile darknet “exit scams” in the past year. Of those, including that of Empire Market, one of the largest, longest-running, and most successful darknet markets which stole an estimated $30 million when it went offline in August 2020.

Icarus Market was another darknet marketplace that went offline recently, despite rolling out updates and earning the trust of users. “It’s probable that the large influx of new users from Empire and their deposits made Icarus ripe for a profitable exit,” opinioned CipherTrace.

The latest of such exits was on October 12, when the DeepSea market abruptly went offline, although it remains to be declared officially. Users and the forum’s moderators have concluded its status after days of no response, but the lack of an official seizure by authorities has led some to hope DeepSea could come online again.

But why do so many illicit services come online only to scam and disappear in the dark? CipherTrace provides some glimpse as an answer, “Creating a darknet market requires little upfront cost, and the potential rewards can be high—Empire market admins, for example, reportedly profited around $30 million from their exit scam alone, not including the money they made in the two years of their operation.”

It adds:

“Evolution market exited with $12 million in user bitcoin. This results in numerous darknet markets launching every year. According to CipherTrace research, there has been at least one notable darknet market launched every month on average since early 2019.”

The eventual fate of all darknet markets is to be seized, to be hacked, to exit scam, or to voluntarily shut down. “It’s most likely that the majority of darknet markets plan to exit scam from their inception, especially as a plan B if things go sideways,” the report noted.

Operating a darknet market is risky. Market operators have a long list of adversaries. They are also susceptible to attacks on their hot wallets by hackers and exist in a constant state of defense against their business, all while trying to conduct operations and build trust in the darknet space.

Darknet marketplaces hit a record high

Meanwhile, buyers of drugs, ammunition, and other banned items haven’t stopped coming despite the number of darknet “exit scams,” fraud, and other criminal outcomes increasing year-on-year, as public demand for darknet marketplaces is booming as well.

“Numerous darknet markets are launched every year and just as many are constantly exiting, being seized, or otherwise going defunct. Despite this barrage, CipherTrace has noted more dark markets online than ever before,” the report stated.

Two of such marketplaces — Lime Market and Invictus Market — launched early-September and already boast thousands of users’ accounts, indicating the demand for such services despite widespread fraud.

CipherTrace claims to currently monitor over 35 “active” darknet markets. It pointed out the growth of Invictus Market, the platform which launched in September, was buoyed by the “good reputation” of its admins among the darknet community.

Bitcoin Market Data

At the time of press 2:07 pm UTC on Oct. 27, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.95% over the past 24 hours. Bitcoin has a market capitalization of $247.92 billion with a 24-hour trading volume of $34.26 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:07 pm UTC on Oct. 27, 2020, the total crypto market is valued at at $400.63 billion with a 24-hour volume of $103.9 billion. Bitcoin dominance is currently at 61.72%. Learn more about the crypto market ›