Bank of Tokyo-Mitsubishi Prepares to Launch First Bank-Issued Crypto

Photo by Dil Assi on Unsplash

Bank of Tokyo-Mitsubishi UFJ, one of the world’s five largest banks, confirmed it is currently working toward its own cryptocurrency launch. Mitsubishi UFJ Financial Group stated in late May of 2018 that it is conducting research on blockchain technology, and will release a proprietary cryptocurrency by 2019.

According to a recent report published by Japanese new media outlet NHK, the Bank of Tokyo-Mitsubishi “MUFG” cryptocurrency project will officially launch in 2019.

Mitsubishi Crypto Project Officially Announced

Mitsubishi’s cryptocurrency solution has been in development for almost two years — Japanese new media outlet NHK reported in 2016 that the financial giant planned to carry out a large-scale trial of its own crypto-token as early as 2019, with a pilot program expected to involve 100,000 Mitsubishi UFJ Financial Group account holders.

According to the report, participants in the cryptocurrency trial will install a smartphone app that will convert fiat currency deposits into a unique crypto token called “MUFG,” to be worth 1 yen. MUFG will potentially be used to make payments at restaurants and retailers, or transfer currency to other trial participants.

Ripple : Mitsubishi UFJ Financial Group, "MUFG"

Digital Transformation

MUFG Coin – New digital currency & smart contract network

Evaluation of blockchain technology#Ripple #XRP pic.twitter.com/nShYCR8hzs

— Bank XRP (@BankXRP) May 16, 2018

A response from the Bank of Tokyo-Mitsubishi UFJ published by Reuters subsequent to the 2016 announcement stated that while the bank is currently engaging in research, no official statement had been released:

“Regarding the speculation (in) media reports, these reports are not based on any announcement by MUFG, and the details have not been decided. However, we can only say that it’s true that MUFG is conducting demonstration experiments on the ‘Coin’ within the company utilizing a blockchain technology.”

It appears, however, that the 2016 predictions of MUFG token functionality were highly accurate — Bank of Tokyo-Mitsubishi UFJ’s officially announced that the trial will indeed involve 100,000 customers, allowing MUFG users to convert fiat to the new crypto-token directly and use it to purchase goods and services via a smartphone app.

Mitsubishi UFJ Financial Group is a member of the R3 Consortium, working alongside Credit Suisse, Goldman Sachs, and Barclays to develop blockchain solutions for the banking industry. The bank outlined the benefits of distributed ledger tech and the new MUFG token in a recent announcement:

“The group is now even actively exploring other potential uses including a project known as the ‘MUFG Coin’; where blockchain technology could be applied for a variety of everyday financial needs, such as withdrawals and deposits to transactions and payments. Potentially this coin could have large-scale commercial potential, as well serving small-scale retail bank customers.

Banks Adopt Blockchain Technology

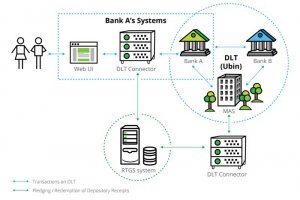

Japan isn’t the only country boasting rapid large-scale adoption of blockchain technology in the finance sector. Singapore’s Central bank began a collaborative distributed ledger tech project intended to bring payment settlement and securities on to the blockchain in 2016 called “Project Ubin,” operating with the stated goal of establishing domestic inter-bank payments using a central bank issued SGD equivalent.

Singapore Central bank chief fintech officer stated in 2017 that the MAS seeks to break new ground in blockchain innovation regardless of the uncertain regulatory status of cryptocurrency:

“Don’t fear doing experiments and don’t fall into traps of signaling policy changes. Some regulators are afraid to do experiments because of this tremendous external pressure on them. We are trying to drive that culture globally.”

With both Singapore and Japan leading the way in finance industry blockchain adoption and banks worldwide beginning to use Ripple as a cross-border payment settlement instrument, it’s clear that the traditional financial paradigm is being heavily disrupted by blockchain-driven decentralization.

Deribit

Deribit