Avenue Capital CEO expects crypto selloff to continue till year end

Avenue Capital CEO expects crypto selloff to continue till year end Avenue Capital CEO expects crypto selloff to continue till year end

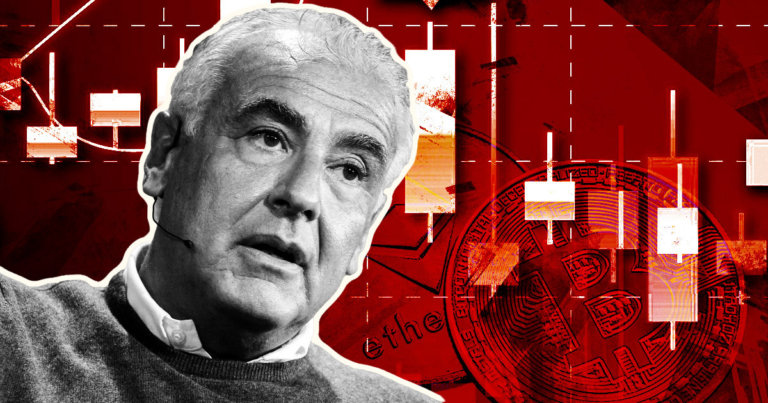

BTC is yet to bottom out, and investors should expect more selling and pain between now and the end of the year, Avenue Capital CEO Marc Lasry says.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The bearish sentiment in the crypto market is expected to continue until the end of 2022, Avenue Capital Group CEO Marc Lasry told Bloomberg.

In a June 15 interview, Lasry said it is impossible to time a bottom. According to him, nobody thought Bitcoin (BTC) – currently changing hands at $21,178.84 – could trade as low as it has. He added that crypto investors are increasingly getting nervous as most crypto tokens continue registering lower numbers each day since the start of the week.

Lasry cautioned:

You’re going to have more selling, more pain, and it will continue between now and the end of the year,

With the BTC Fear and Greed Index dropping to 7 – an extreme fear territory – Lasry believes the flagship cryptocurrency is yet to hit its bottom. To this end, he advocates for interested investors to buy into the token when they can.

Large investors feeling the pain

Following the 2021 bull rally, many experts predicted BTC would breach the $100,000 mark and even trade higher. An example is American Investment bank Goldman Sachs, which said BTC could notch $100,000 if investors considered it a store of value amid the rising inflation.

With so many bullish predictions, BTC proponents continued amassing more coins at the slightest opportunity, anticipating the 2021 bullish momentum to come back in full swing. However, what started as a slight decline from the November 2021 peak for most cryptocurrencies turned into a full-blown bear market.

Among the BTC investors that bought BTC on its way down include U.S.-based software company MicroStrategy. The firm bought 660 BTC between December 2021 and January 31, 2022. MicroStrategy proceeded to take a $205 million BTC-backed loan from Silvergate Capital in March and used the funds to purchase an additional 4,167 BTC.

Following this week’s crash, the company’s stock, MSTR, has taken a significant hit, losing 28% in premarket trading on Monday.

El Salvador is in a tighter fix after buying the dip several times since making BTC legal tender in September last year. The latest BTC purchase came in May when President Nayib Bukele announced the addition of 500 BTC to the country’s coffers.

Bukele has come under fire for steering El Salvador the BTC way after the turmoil in BTC’s market. The country currently holds 2,301 BTC purchased at an aggregate price of $30,744. With BTC slumping to $21,178.84, El Salvador has accrued losses exceeding $22 million.