Price Watch: Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin Keep Sinking

Price Watch: Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin Keep Sinking Price Watch: Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin Keep Sinking

Photo by 贝莉儿 NG on Unsplash

Most major cryptocurrencies, including Bitcoin, Ethereum, Ripple and Bitcoin Cash experienced additional price drops over the last 24 hours. Substantial developments continue to occur in the digital asset space despite ongoing volatility and selloffs within the market. One week ago, the global cryptocurrency market stood at $394 billion and it now stands at $371 billion, a $23 billion drop.

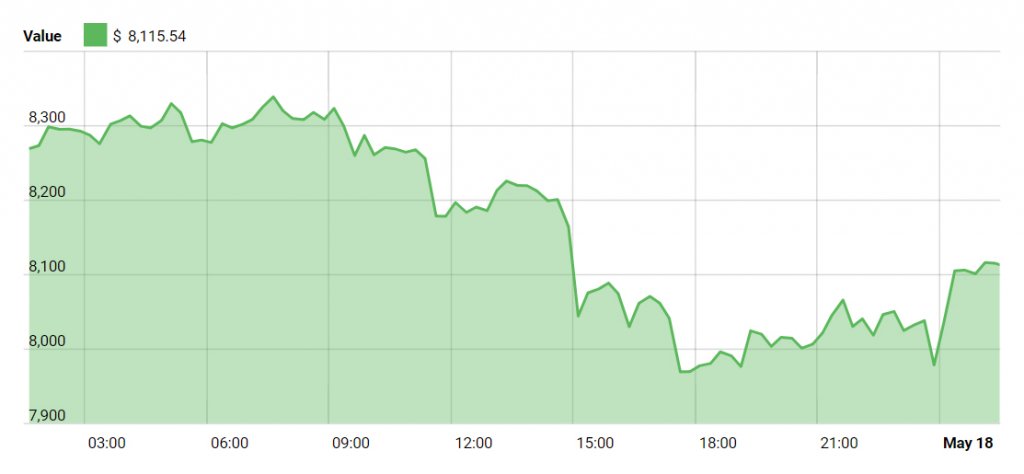

Bitcoin (BTC)

Bitcoin is trading for $8,115.54, roughly $85 less than it was during our previous price article.

Bing is following in the footsteps of tech leaders such as Google, Facebook and Twitter and announced it will phase out all cryptocurrency and initial coin offering (ICO) advertisements by late June or early July of this year (2018).

The news was announced on the Bing Ads blog. Advertising policy manager for Microsoft, Melissa Alsoszatai-Petheo explained:

“Because cryptocurrency and related products are not regulated, we have found them to present a possible elevated risk to our users, with the potential for bad actors participating in predatory behaviors or scamming consumers. To help protect our users from this risk, we have made the decision to disallow advertising. We are always evaluating our policies to ensure a safe and engaging experience for our Bing users and the digital advertising ecosystem.”

Additionally, analyst Jani Ziedins of Cracked Market was critical of the recent Coindesk Consensus Conference’s lagging ability to bring more hype to Bitcoin. He commented that the currency is well below $9,000, and has entered what he calls a period of “stalling.”

Ziedins is skeptical of Bitcoin at this price and asserts it will need to rise back up to $9,000 or run the risk of creating panic sell-offs and going back down to the $6,000 range.

“The latest rebound from the $6K lows helped rebuild sentiment,” he assured. “But expect most of those positive feelings to disappear if we stumble back into the $7K range. It often takes bubbles six to 12 months to find a bottom.”

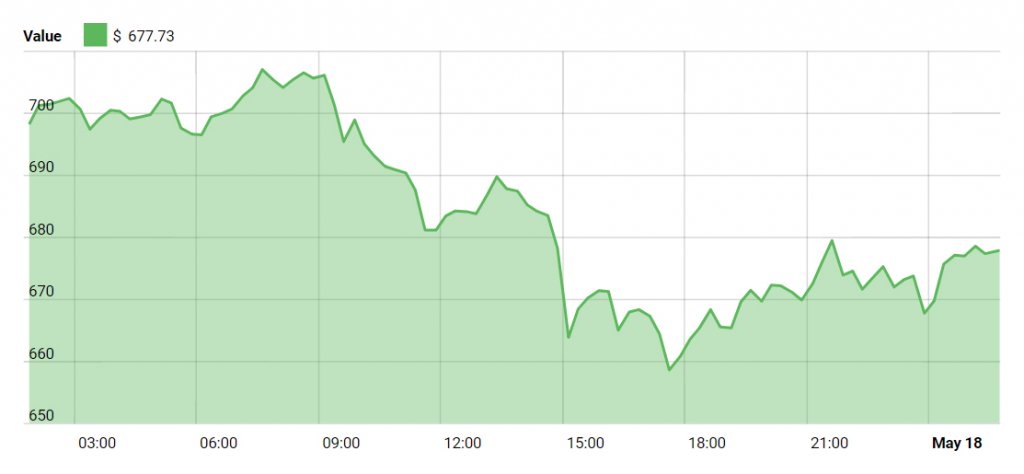

Ethereum (ETH)

At the time of press, Ethereum sits at about $677, about $11 less than the previous price piece.

Ethereum recently garnered newfound accolades in China, where it was ranked as the number one blockchain system amongst cryptocurrencies.

The China Center for Information Industry Development (CCID) – a research unit under the country’s industrial ministry, launched its monthly ratings index on nearly 30 different forms of cryptocurrency and the blockchains behind them. Ethereum earned the top spot, while Bitcoin came in thirteenth place.

This is particularly notable because the China government blocked Chinese citizens from buying and selling on exchanges in September 2017.

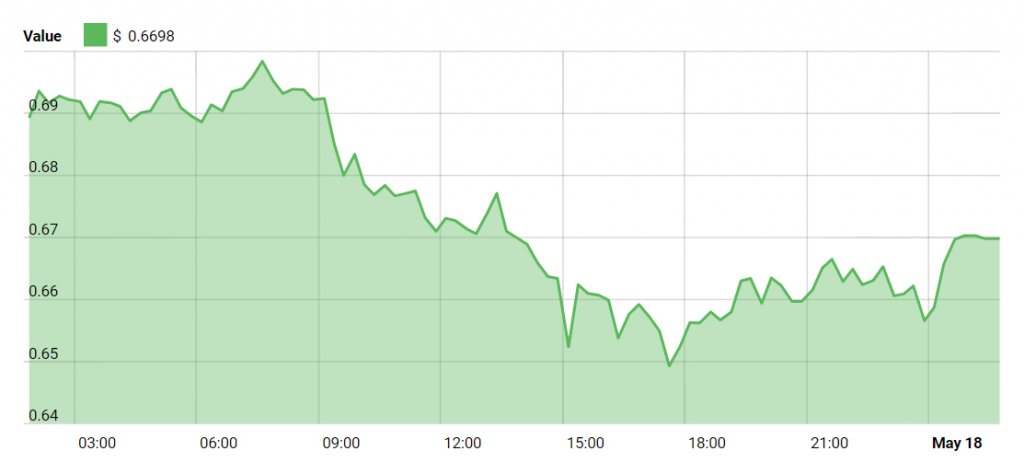

Ripple (XRP)

Ripple experienced a one-cent drop since our previous price piece and now sits at $0.6698.

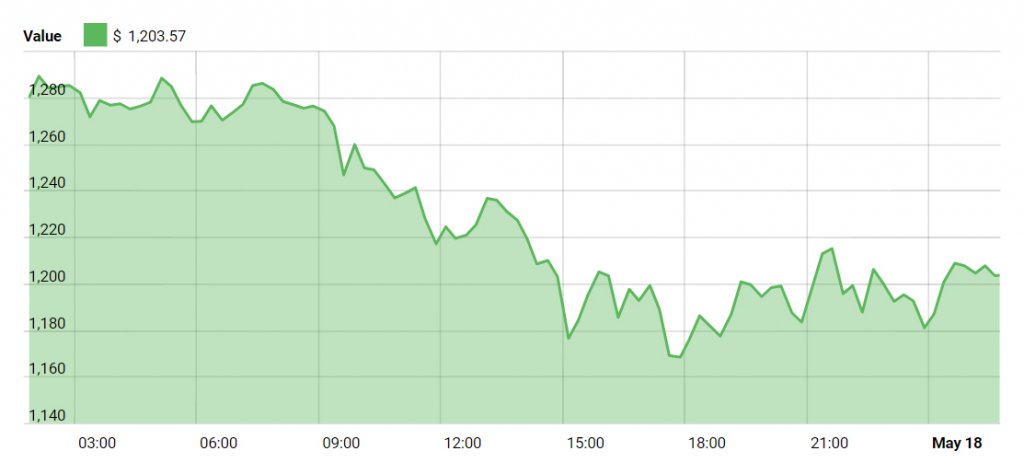

Bitcoin Cash (BCH)

BCH incurred a small drop since our last price piece after it underwent a drastic drop to the $1,200 range from $1,400. At the time of press, Bitcoin Cash is trading for $1,203.57.

Bitcoin Cash will soon undergo a hard fork and Bitcoin.com CEO Roger Ver remains bullish about BCH. Ver explained:

“The economic path that Bitcoin Cash is on is the one that led to Bitcoin’s original success. I’m incredibly bullish on Bitcoin Cash for the exact same reasons I was bullish on Bitcoin back in 2011. Bitcoin Cash works as money; Bitcoin core, sadly, no longer does.”

Litecoin (LTC)

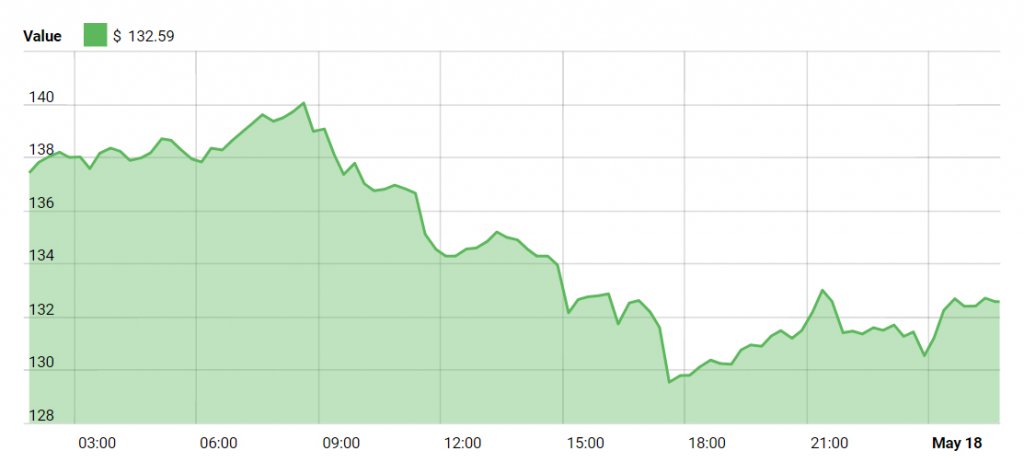

Litecoin is currently trading for about $132 and incurred a two-dollar rise since our previous price discussion.

The #paywithlitecoin campaign appears to be working as of late, as online sports-betting platform Sportbook announced it will begin accepting Litecoin through its trading platform. People can now place bets on various games and sports teams using Litecoin, and receive their winnings in cash.

Market Summary

The cryptocurrency market continues to show downward movement and the total market cap has fallen to $371 billion, approximately $3 billion less since our previous discussion. Investors are warned to do their own research and only invest what they can afford to lose.

CoinGlass

CoinGlass

CryptoQuant

CryptoQuant