Bitcoin and S&P 500 divergence echoes pre-COVID trends, potential realignment ahead

Bitcoin and S&P 500 divergence echoes pre-COVID trends, potential realignment ahead Quick Take

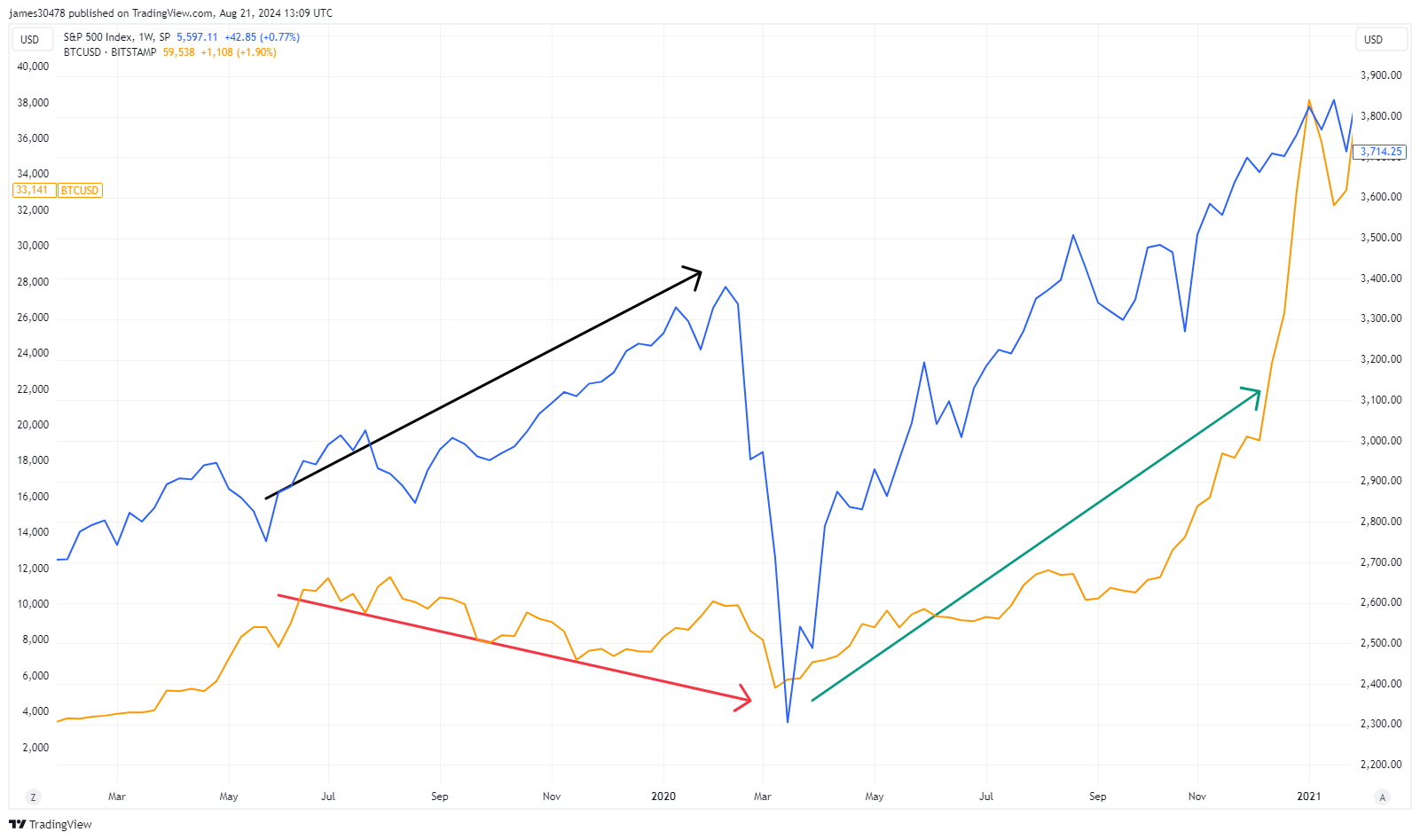

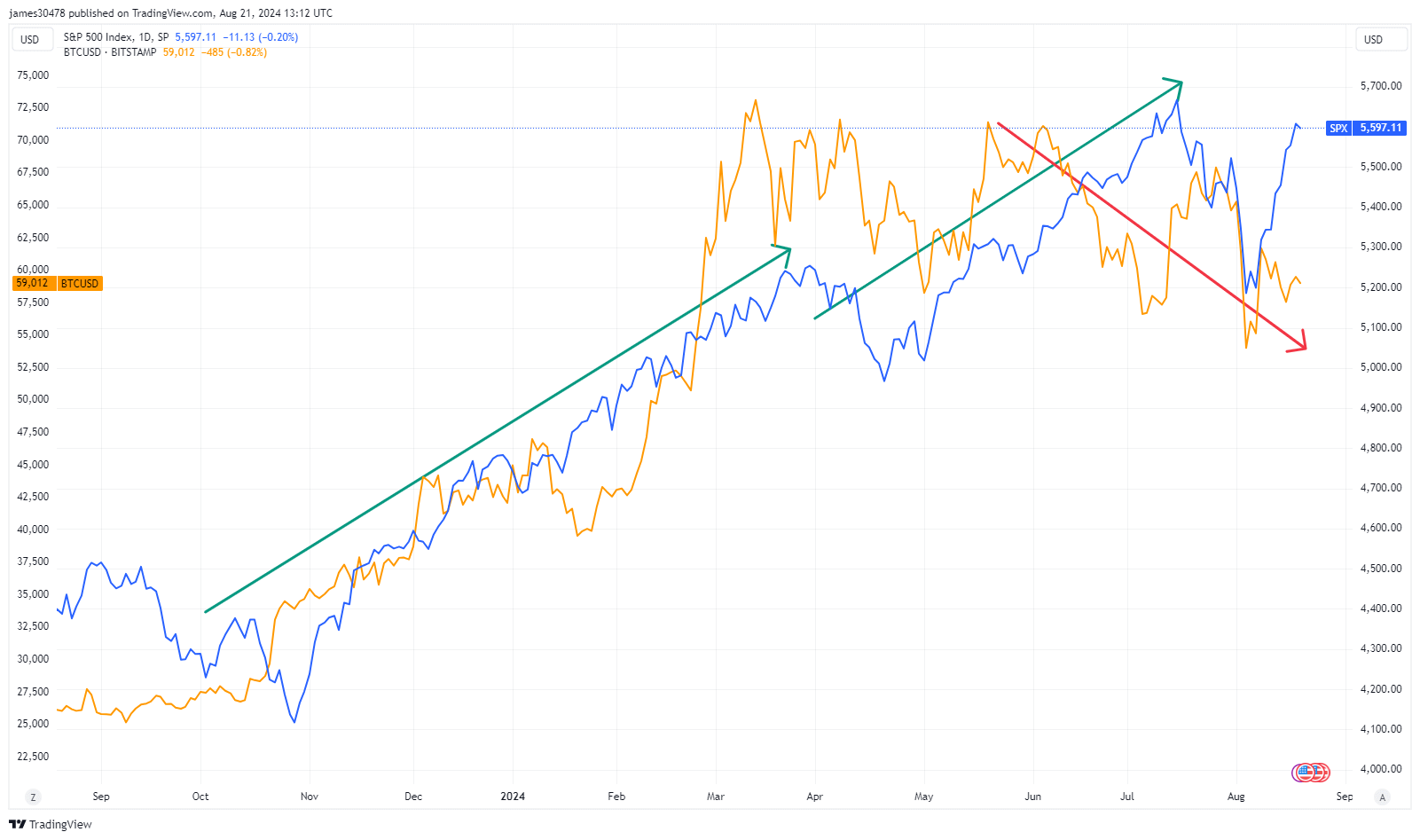

Bitcoin and the S&P 500 are currently diverging, a trend that has occurred before, most notably in 2019 leading into the COVID-19 pandemic. Back then, the S&P 500 rose from around 2,900 to 3,400, while Bitcoin fell from approximately $11,000 to below $10,000. This divergence began in June 2019, with both assets eventually converging after the market upheaval in March 2020.

The current divergence, which also started in June, mirrors past patterns where market stress, like the yen carry trade unwind, led to significant sell-offs similar to COVID-19. With Bitcoin and the S&P 500 reaching new all-time highs in March, the question now is whether Bitcoin will again realign with the S&P 500 as market conditions evolve. CryptoSlate has explored these dynamics, drawing on historical parallels to understand the potential trajectory of these assets.

CoinGlass

CoinGlass

Farside Investors

Farside Investors