SVB shut down, Powell has to decide between a new financial crisis or raising inflation target: MacroSlate Weekly

SVB shut down, Powell has to decide between a new financial crisis or raising inflation target: MacroSlate Weekly SVB shut down, Powell has to decide between a new financial crisis or raising inflation target: MacroSlate Weekly

Banks halted on exchanges, bank runs, BTC drops below $20k and an indecisive market for 25 or 50bps rise

Federal Reserve. Remixed by CryptoSlate

TLDR

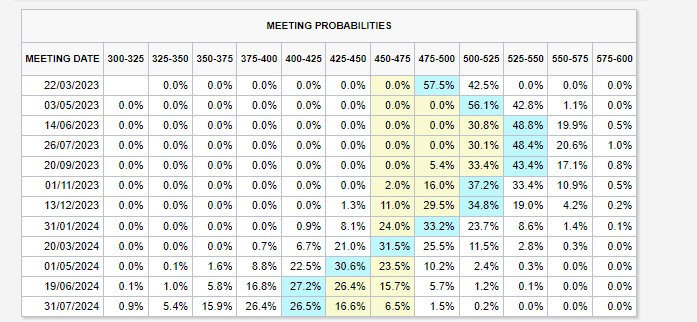

- At the upcoming Federal Open Market Committee (FOMC) meeting on March 22, a 25 basis point rate hike is the favored probability.

- A terminal fed funds rate of 5.50% with a 25bps cut at the end of the year

- The Unemployment Rate went up to 3.6% from 3.4%

- GBTC discount narrows after SEC hearing, up 7% in the past five days

- Second largest Bitcoin liquidation this year that sent Bitcoin down below $20,000

US

SVB Bank Run

SVB Financial Corp (SIVB) saw a 60% decline in share price on March 9 while seeing shares plummet a further 40% on March 10. A deposit run that led to the forced selling of assets after a tax loss of $1.8 billion. The bank is seeking over $2.25 billion, which had a knock-on effect on the banking sector as the top 4 largest banks saw $52 billion wiped out of the market cap.

This contagion spread to many other banks, including First Republic and Signature Bank, that were all halted on the exchange.

SVIB was closed by California Regulators; this was the largest bank failure since the Great Recession. It was also the 18th largest bank in the U.S. by total assets.

As a result, the 2-year treasury yield dropped 45 bps from yesterday’s high, the biggest drop since 2008.

Unemployment Rate

The unemployment rate came in slightly higher at 3.6% than the estimated 3.4%, while the U.S. economy created +311,000 jobs but was forecasted at +205,000.

Fed Funds Rate

As a result of the above, on top of Powell testifying to both the Senate and the House, the markets flopped between 25 and 50 bps for the upcoming FOMC meeting and a terminal rate that continued to change. Ending the week, the market is pricing in a 25bps rate hike with a terminal rate of 5.50% and then a 25bps cut at the end of the year.

All eyes turn to a Consumer Price Index (CPI) print looming on Tuesday.

UK

Indecisive BOE

The Bank of England (BoE) continues to flip-flop between overtightening and inflation running riot. To show how split the BoE is, BoE policymaker Catherine Mann spoke about the dangers of a falling currency which will see a risk of importing inflation. While Swati Dhingra, another BoE policymaker, warned about the issues of “overtightening” and believed a better strategy would be the hold policy steady.

As a result, the pound went to year-to-date lows against the dollar at 1.18 but did rally to 1.20 at the end of Friday’s close.

China

Last weekend’s announcement of China targeting a 5% growth target was disappointing. Many analysts expected something closer to 6%, as 5% was the lowest projection in over a quarter of a century.

China, like Japan, has also been a proponent of stimulus, but this is to keep the real estate market intact. Local governments and developers face excessive debt loads while property valuations deflate.

The Wall Street Journal reported that a third of major cities struggle to manage huge interest payments while outstanding debt exceeds over 120% of last year’s income.

Japan

Friday was Governor Kuroda’s final meeting; The Bank of Japan (BOJ) left policy unchanged, giving the new governor, Ueda, an incredibly difficult task of the long-standing stimulus policies. Changed governor, but policy stayed the same,

Japan’s fourth quarter GDP showed the economy had stagnated, taking any immediate pressure off the BOJ to make any changes to the policy.

CryptoQuant

CryptoQuant