Paybis: Regulated exchange for trading and liquidity services

Paybis: Regulated exchange for trading and liquidity services Paybis: Regulated exchange for trading and liquidity services

Accessing digital currency trading services is now quite easy across various climes as many new exchange services are permeating the crypto ecosystem.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Disclosure: This is a sponsored post. Readers should conduct further research prior to taking any actions. Learn more ›

The proliferation of new platforms may appear to make transacting digital assets easy, however, many are plagued with a lack of liquidity, low downtime, regulatory challenges, and other porous security inadequacies. This shortcoming created a gap amongst the existing options available to crypto users around the world.

Paybis is one of the early cryptocurrency exchanges established in 2014 by a team of crypto enthusiasts who sees the potential in the nascent industry. Since its inception, the platform has grown itself to address the fundamental challenges in the space by building its network on trust and unique service delivery.

A Peak into the Paybis Platform

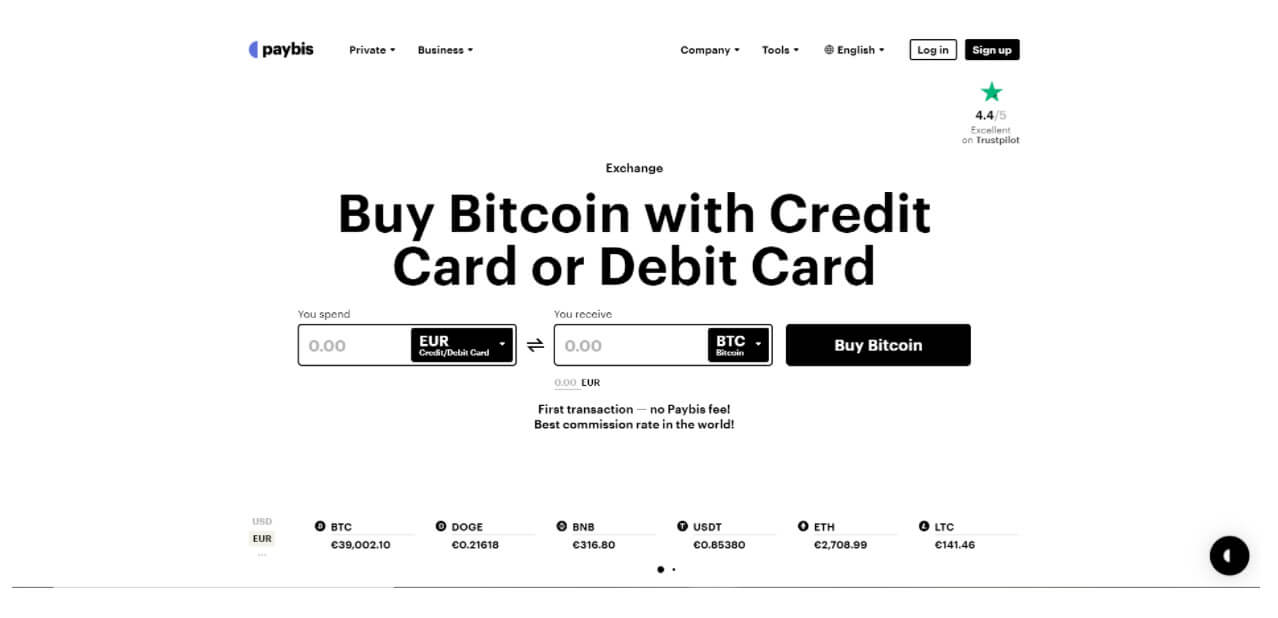

The uniqueness of every trading exchange can first be seen in the design of its platform. The Paybis website comes with a simple design with a black and white background theme for the homepage. The platform is enriched with a number of features that can help any user get started in a matter of seconds.

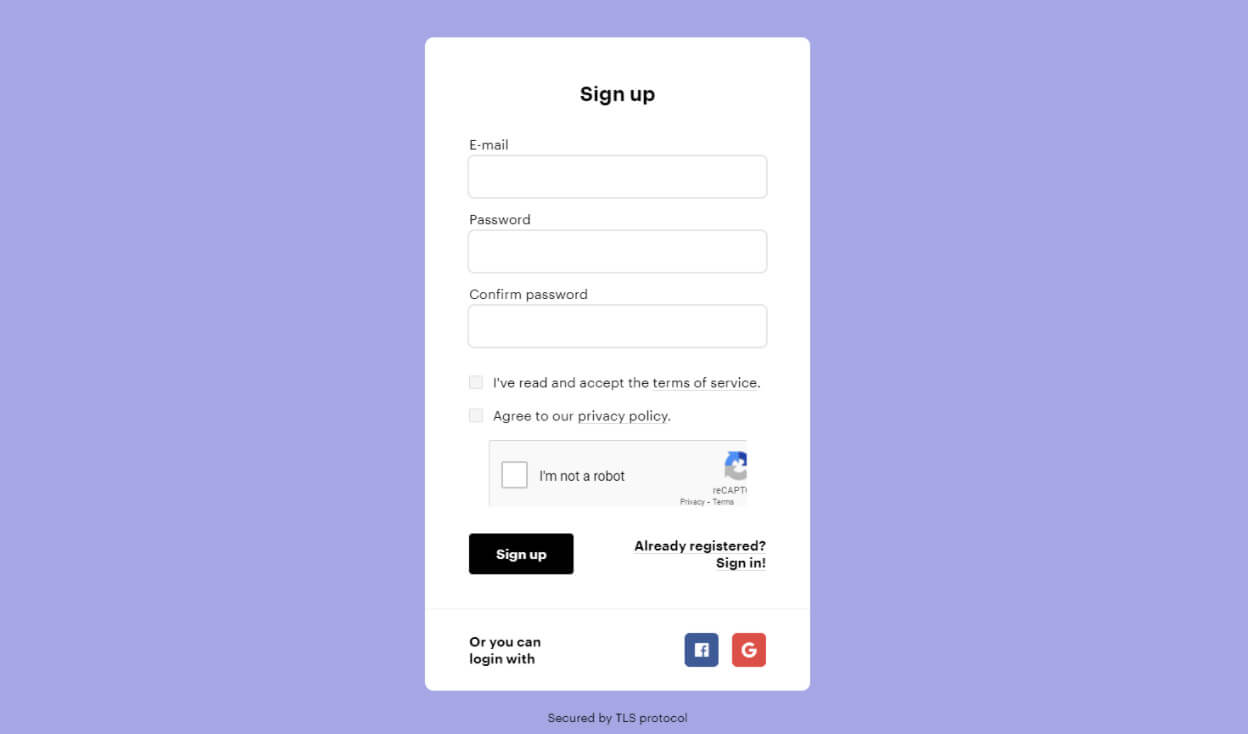

New users can register to own an account on Paybis by following the black “Sign Up” button at the top right-hand corner.

The process is simple and involves just your email address and password. You will need to read and accept the terms and conditions associated with the platform usage and also agree to Paybis privacy policy to register.

Paybis is designed to be a user-friendly platform that can serve both professional traders as well as new entrants into the space. Through the Paybis platform, you will get to know the exact amount of crypto you will get per any value of your preferred fiat currency in real-time. This calculator is visible and accessible on the homepage.

The platform and its array of features are easily available in various languages including Italian, French, and Espanol amongst others.

Paybis Product Offering

As a typical digital asset exchange platform, Paybis caters to the need of both retail and institutional investors in the space. Individuals and Companies alike can take advantage of Paybis’s unique business offering per its definitive ‘exchange’ and ‘liquidity provision’ services. Let us explore both products more closely.

Paybis Exchange Service

The Paybis exchange offering is one of its private business services available to individuals who want to purchase Bitcoin (BTC), Ethereum (ETH) or other altcoins. With the service, any qualified user can use both credit or debit cards to buy the coins of their choice. The first trade here may require the buyer to complete some necessary Know-Your-Customer (KYC) checks and there is no commission charged for the first trade.

Amongst the other benefits users will gain from buying a cryptocurrency on the Paybis platform include:

- Instant payouts: The liquidity is large and as soon as your payment is received, you get your coins immediately,

- Worldwide access with the service is accessible in about 180+ countries,

- Industry-leading and bank-grade security, and;

- Responsive customer support working round the clock.

- The option to purchase a wide variety of tokens, and the plans to list the following tokens in the coming weeks; USD Coin, Chainlink, SHIBA INU, Uniswap, Aave, Dai, Compound, Maker, Yearn.finance, SushiSwap, Wrapped Bitcoin, Enjin Coin, Chiliz, Basic Attention Token, Perpetual Protocol, Swipe, Curve DAO Token, Numeraire, Holo, Kyber Network Crystal Legacy, and The Sandbox.

The Paybis exchange service is non-custodial, meaning you will need to access the platform with third-party wallet services like Metamask or Trust Wallet. Customers are completely free to choose the wallet of their choice.

Paybis Liquidity Service

This is the business offering of the trading platform that is available to institutional firms. The use cases of crypto is growing today, and a number of firms are beginning to provide services in the new space. However, the liquidity demand is a drawback for most outfits that provides services that requires digital assets.

As listed on the Paybis website, companies that can make use of the liquidity service include but not limited to:

- Banks

- FinTech

- Payment Processors

- E-money Companies

- Affiliate Programs

- OTC desks

- The gaming industry, and;

- Trading Platforms

Instead of battling the hassles and the financial demands of finding liquidity, Paybis can step in and provide the right liquidity through an API that can easily be integrated with the institutional customer’s website. The Paybis offering comes with a 99.9% uptime and as such, the fear of service downtime or liquidity inaccessibility will be reduced.

Additionally, onboarding is simple and the pricing for the service is generally below the industry standards.

Other Attractions of the Paybis Platform

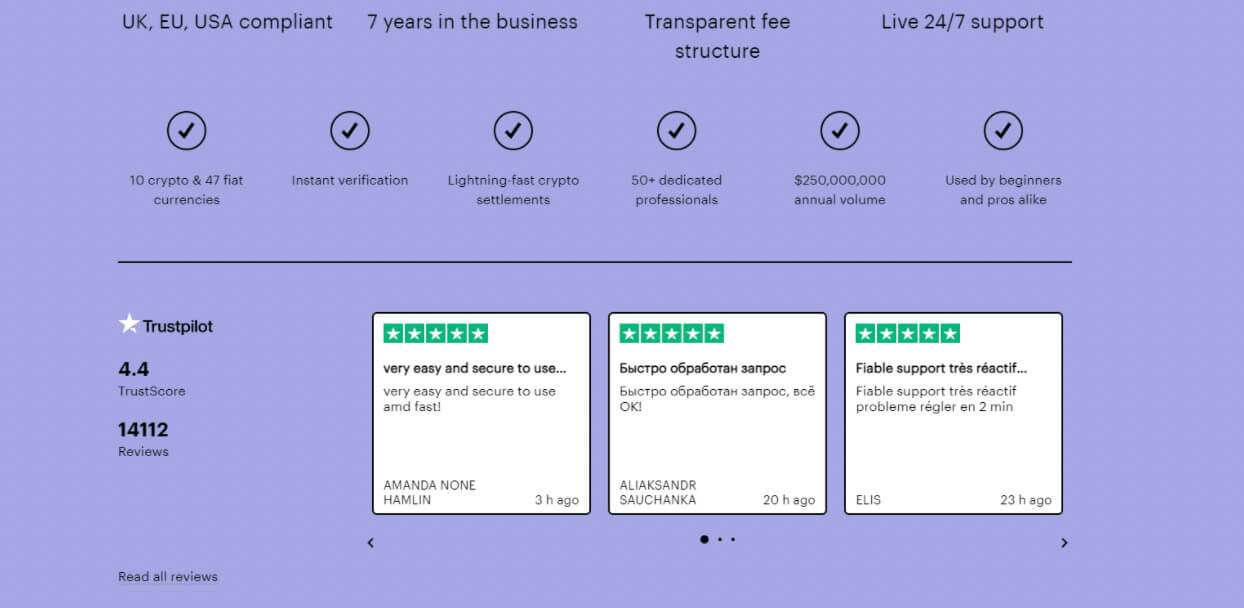

The cryptocurrency ecosystem is a dynamic one with new regulations, products and consumer demands. The ability to adapt and persistently thrive for the past 7 years in the presence of these changes have made the Paybis platform a trusted name in the industry. This trust is confirmed by over 14112 reviews on Trust Pilot with a TrustScore of 4.4 stars.

In all, there is customer protection for Paybis users as the firm is licensed both in the EU and the United States. Paybis has the authorization to conduct business in about 48 US states and it has the Money Service Business registration license with the FinCEN Department of the Treasury, United States of America.

For more information, visit paybis.com.

Disclaimer: This is a sponsored post brought to you by Paybis.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass