Aave surges 50%: What’s behind the meteoric rally?

Aave surges 50%: What’s behind the meteoric rally? Aave surges 50%: What’s behind the meteoric rally?

Image by SpaceX-Imagery from Pixabay

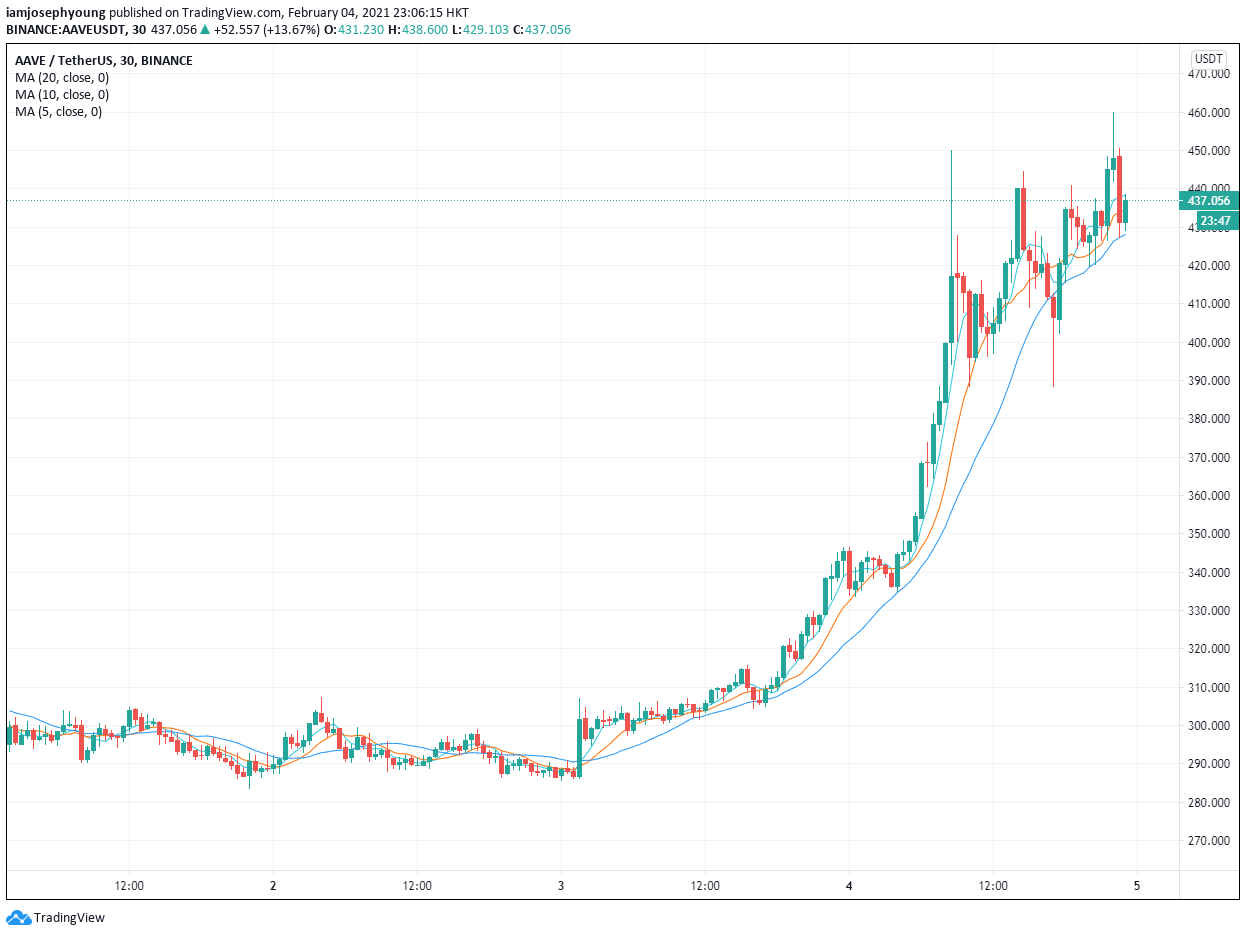

AAVE, the native governance token of the Aave lending protocol, rose by over 50% within the past day. The rally comes as the entire DeFi market sees a major rally from an overall increase in appetite for the sector.

Why is DeFi and Aave rallying?

The DeFi market has seen more traction from both retail and institutional investors.

Institutions are interested in DeFi because many DeFi projects have actual cash flow. This makes DeFi protocols comparable to conventional companies using traditional valuation models.

As the overall demand for DeFi increases, naturally, two major subsectors are seeing rapid growth: lending and oracles.

Lending platforms, such as Compound and Aave have seen a large increase in user activity and lending volume, thus causing their respective valuations to soar.

Analysts at Santiment noted that the number of AAVE whales has increased significantly in the past month. This is indicative of high-net-worth investors continuing to accumulate Aave.

The analysts explained:

“#DeFi is alive and well in #crypto, as $AAVE has skyrocketed to a +33% gain in the past day. #Aave whales, which we deem addresses holding 1,000 tokens or more (~$397k+ USD), have ballooned from 266 to 327 addresses this past month, fueling this rally.”

The continuous accumulation of AAVE by whales and high-net-worth investors, especially in the U.S., is seemingly causing the price of AAVE to increase.

Will whales buy even at a high valuation?

Currently, the market capitalization of AAVE hovers above $5 billion. Apart from Chainlink, which some consider to be a DeFi token, no other DeFi protocol has achieved a $5 billion market capitalization before.

Although the market capitalization of Aave is quite high at $5 billion, investors anticipate Aave to remain the dominant DeFi lending protocol.

If it does, with the total value locked in DeFi moving towards $40 billion, the probability of Aave reaching a valuation that allows it to become a top ten cryptocurrency increases massively.

Arthur Cheong, the founder of Defiance Capital, the largest DeFi-focused fund in Asia, said it is likely that Aave becomes more valuable than any European fintech startup by 2022.

Think it's likely $Aave will be more valuable than any European fintech startup by 2022. https://t.co/DS96JkMr86

— Arthur (@Arthur_0x) February 3, 2021

High-profile high-net-worth investors have talked about Aave in the past week as well. Billionaire investor Mark Cuban disclosed on a Reddit post that he owns the DeFi token, which many found surprising coming from a long-time cryptocurrency skeptic.

This shows that DeFi is no longer crypto native and has garnered the interest of the mainstream, as well as investors from traditional finance.

Analysts often say that traditional finance investors find DeFi more appealing than Bitcoin because they can understand the cash flow aspect of DeFi.

Over the long term, this could help buoy the overall growth of the DeFi market and the attractiveness of DeFi assets as investments.

For more information, explore more DeFi coins on CryptoSlate.

Aave Market Data

At the time of press 8:59 pm UTC on Feb. 4, 2021, Aave is ranked #14 by market cap and the price is up 49.35% over the past 24 hours. Aave has a market capitalization of $6.08 billion with a 24-hour trading volume of $2.86 billion. Learn more about Aave ›

Crypto Market Summary

At the time of press 8:59 pm UTC on Feb. 4, 2021, the total crypto market is valued at at $1.14 trillion with a 24-hour volume of $168.76 billion. Bitcoin dominance is currently at 61.30%. Learn more about the crypto market ›

Farside Investors

Farside Investors