Hong Kong firm invests $38 million in BlackRock’s IBIT, highlighting appeal of US ETFs

Hong Kong firm invests $38 million in BlackRock’s IBIT, highlighting appeal of US ETFs Quick Take

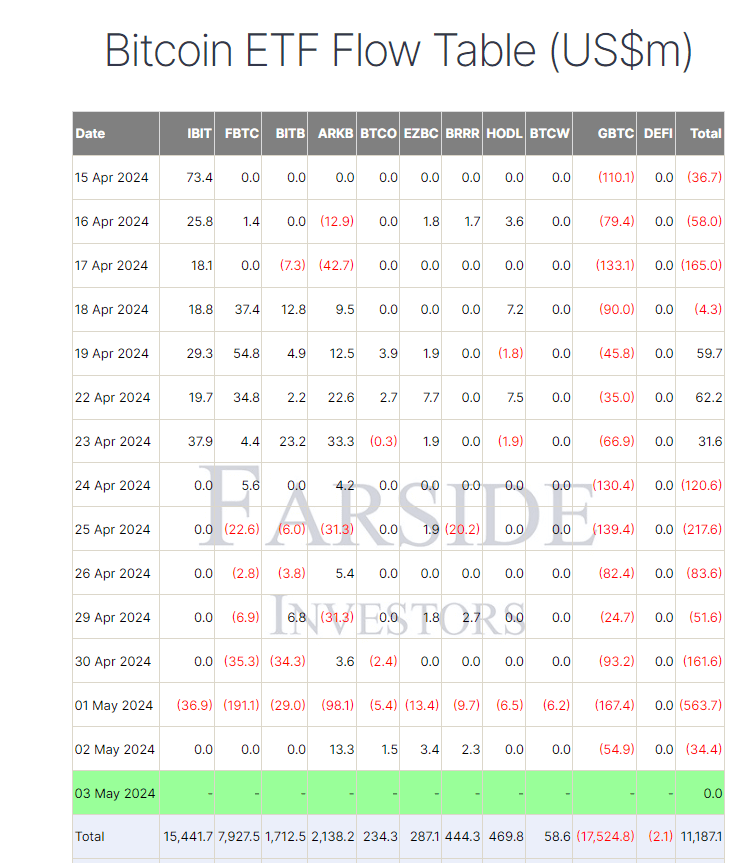

Farside data shows that the Bitcoin exchange-traded funds (ETFs) witnessed an outflow of $34.4 million on May 2. Grayscale’s GBTC was the sole ETF to experience outflows, which is an encouraging sign compared to May 1, when all ETFs faced outflows. GBTC saw an outflow of $54.9 million and currently holds 291,248 Bitcoin.

Interestingly, three of the four major ETFs, including BlackRock’s IBIT, Fidelity’s FBTC, and Bitwise’s BITB, saw no inflows or outflows. However, according to Farside data, Ark’s ARKB experienced its most significant inflow since April 23, with a $13.3 million inflow, bringing their total inflows to $2,138.2 billion.

In addition, Senior Bloomberg ETF analyst Eric Balchunas reveals that Yong Rong Asset Management, headquartered in Hong Kong, recently acquired $38 million worth of IBIT, constituting 12% of their reported holdings.

Balchunas says:

Interesting given HK has own ETFs now. But US ETFs have that irresistable combo of low fee and high volume.