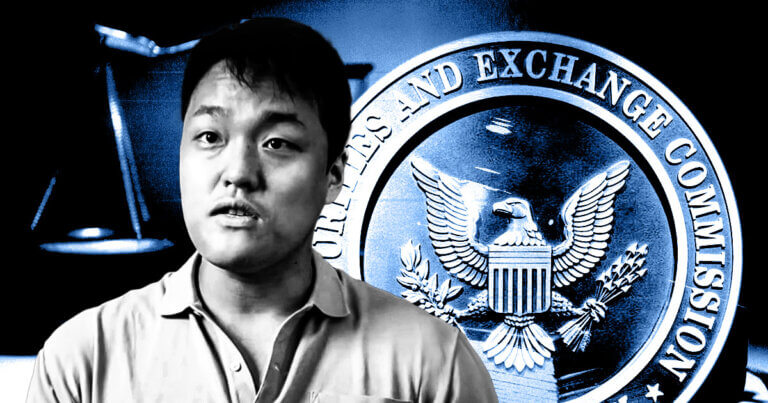

Terraform Labs, Do Kwon reach tentative settlement with SEC to end civil lawsuit

Terraform Labs, Do Kwon reach tentative settlement with SEC to end civil lawsuit Terraform Labs, Do Kwon reach tentative settlement with SEC to end civil lawsuit

The details of the settlement have not been made public as of press time.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Singapore-based Terraform Labs and its founder, Do Kwon, have reached a settlement agreement with the SEC to end the civil lawsuit filed in the US over allegations of defrauding crypto investors.

The development comes after a jury in the US District Court for the Southern District of New York found the company and Kwon liable for civil fraud in April.

The details of the settlement have not been made public as of press time. The tentative settlement was disclosed on a court website. US District Judge Jed Rakoff has asked both the SEC and the defendants to submit supporting documents by June 12.

Civil lawsuit

The SEC accused Kwon and Terraform Labs of misleading investors about the stability of their stablecoin, TerraUSD, and falsely claiming that their blockchain technology was used in a prominent Korean mobile payment app.

The alleged fraud led to the collapse of TerraUSD and the network’s native token LUNA in May 2022, which resulted in estimated investor losses exceeding $40 billion. The SEC described the incident as a massive deception that wiped out tens of billions in market value almost overnight.

The SEC had sought significant financial penalties, including the relinquishment of $5.3 billion in profits deemed ill-gotten and fines totaling $520 million for Terraform Labs and Kwon.

However, Kwon and his company argued that the maximum fines allowable were significantly lower, at $3.5 million for Terraform Labs and less than $1 million for Kwon.

Kwon’s imprisonment

Kwon, who faces related criminal charges in both the US and South Korea, has denied any wrongdoing. He was arrested in Montenegro in March 2023 after he tried to fly out of the country using fake documents.

Since his arrest, Kwon has been awaiting extradition after serving a sentence in Montenegro. Montenegrin authorities have yet to determine whether he will be sent to the US or South Korea.

The settlement represents a significant step in addressing the fallout from one of the most notable collapses in the crypto market and highlights the SEC’s commitment to holding parties accountable for fraudulent activities in the crypto space.

Deribit

Deribit