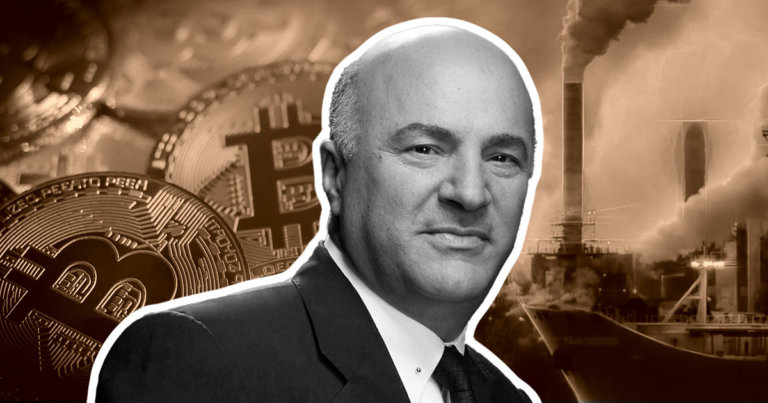

Shark Tank star Kevin O’Leary blasts “dirty” Bitcoin miners

Shark Tank star Kevin O’Leary blasts “dirty” Bitcoin miners Shark Tank star Kevin O’Leary blasts “dirty” Bitcoin miners

Mr. Wonderful recently explained why investors should shy away from “dirty” miners and turn to “new generation” mining companies.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Billionaire investor Kevin O’Leary revealed in a recent Stansberry Research interview with Daniela Cambone when will the price of Bitcoin appreciate dramatically, and why.

The Shark Tank star, also known as Mr. Wonderful, explained why he sold his exposure to “dirty” Bitcoin miners and where he reinvested the capital.

“Dirty” Bitcoin miners

Until the market is finally regulated, institutional investors are barred from direct cryptocurrency exposure, and are increasingly buying into Bitcoin equity as a proxy, explained O’Leary.

“They buy the equities of public Bitcoin mining companies–Marathon, Riot, etc,” he specified, explaining these miners keep the majority of mined Bitcoin on their balance sheets, so as time passes their stocks are trading with the volatility of the crypto itself.

“You can watch these stocks go up and down almost in complete proxy to Bitcoin,” he said, pointing to a recent Larry Fake ESG mandate that came out of BlackRock–the largest manager of sovereign wealth and pension plans.

Mr. Wonderful clarified that BlackRock demands these companies to have an ESG sustainability mandate “that can be audited,” which could put some Bitcoin miners in a rough spot.

“The Bitcoin mining industry started buying carbon credits to try and make them look like they’re green–but it’s completely unauditable,” he said, adding that “if you were to audit one of those companies–they’re gonna be way offside.”

O’Leary said he’s been “selling Marathons, selling Riots, selling all of these public mining companies,” as he is certain they are “going to get crushed” this year, with all of their “institutional following” backing out.

“Bitcoin will be mined in perpetuity somewhere,” concluded O’Leary, saying he is not very concerned about crypto mining legislation influencing the price.

The Solution

According to Mr. Wonderful, “the solution” is rising in countries like Canada, Norway, as well as across Upstate New York and West Texas.

He clarified that “these new generation miners” are setting up their Bitcoin mining operations beside clean energy sources–including hydroelectric, wind power and nuclear.

“The reason they are doing that is there’s no carbon in that equation–they don’t have to get audited, they don’t have to buy carbon credits, they don’t have to worry about it at all, and they are doing the same thing,” he noted, saying that he took the capital that he made by “selling all those dirty miners” and put it into these new companies.

“Now I know with certainty that every coin I own is mined sustainably,” he concluded, as he warned investors to “stay out of the dirty miners.

“If they tell you they’re buying carbon credits–run for the hills,” he concluded.

The price of Bitcoin

O’Leary also revealed that besides teaming up with United Arab Emirates (UAE) partners to invest in the Norway mining facility, he also took advantage of Facebook’s 30% price correction and “parked some capital” there.

The Shark Tank star also mentioned that WonderFi Technologies, which he’s a shareholder of, recently increased its footprint in Canada–acquiring Bitbuy, the first regulated crypto exchange in the country.

“You want to talk about Bitcoin going to $100,000, $200,000, $300,000–it’s going to be when institutions can finally buy it,” argued O’Leary, adding that “at some point in the next two to three years, the US regulator is going to rule on cryptocurrencies.”

He pointed out that Bitcoin could be considered as a software, and institutions are keen on owning software–they own Microsoft, they own Google.

“So it’s very easy for them to get their heads around it as soon as it’s compliant. They will buy one to three percent. And that’s when the price is going to appreciate,” he concluded.