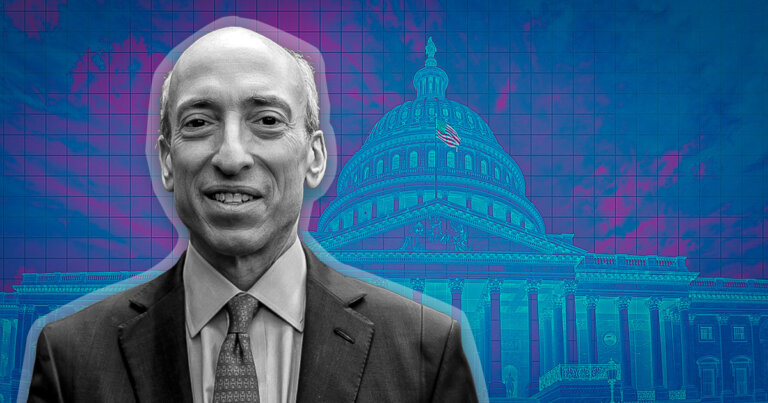

SEC chair Gary Gensler’s behavior cannot be chalked off as ‘good faith mistakes,’ says Tyler Winklevoss

SEC chair Gary Gensler’s behavior cannot be chalked off as ‘good faith mistakes,’ says Tyler Winklevoss SEC chair Gary Gensler’s behavior cannot be chalked off as ‘good faith mistakes,’ says Tyler Winklevoss

Winklevoss believes that Gary Gensler should never be allowed to hold any position of influence to prevent future misuse of government power.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The actions of the U.S. Securities and Exchange Commission (SEC) chair Gary Gensler cannot be “explained away” as “good faith mistakes,” former Olympic rower and crypto exchange Gemini co-founder Tyler Winklevoss wrote in a post on X on Saturday. He added:

“It [Gensler’s actions] was entirely thought out, intentional, and purposeful to fulfill his personal, political agenda at any cost.”

Gensler carried out his actions regardless of consequences, Winklevoss said, calling Gensler “evil.” Gensler did not care if his actions meant “nuking an industry, tens of thousands of jobs, people’s livelihoods, billions of invested capital, and more.”

Winklevoss further stated that Gensler has caused irrevocable damage to the crypto industry and the country, which no “amount of apology can undo.”

Venting his frustration, Winklevoss wrote:

“Americans have had enough of their tax dollars going towards a government that is supposed to protect them, but instead is wielded against them by politicians looking to advance their careers.”

Winklevoss believes that Gensler should not be allowed to hold any position at “any institution, big or small.” He added that Gensler “should never again have a position of influence, power, or consequence.”

In fact, Winklevoss said that any institution, whether a company or university, that hires or works with Gensler after his stint at the SEC “is betraying the crypto industry and should be boycotted aggressively.”

According to Winklevoss, stopping Gensler from gaining any power again is the “only way” to prevent misuse of government power in the future. Winklevoss has long been a vocal critic of the SEC and Gensler, who he believes uses the ‘regulation through enforcement’ doctrine.

Winklevoss is far from being the only one accusing the SEC of abusing its powers. Earlier this week, 18 U.S. states, filed a lawsuit against the SEC and Gensler, alleging “gross government overreach.”

Republican President-elect Donald Trump promised to fire Gensler on his first day back at the White House during his election campaign. The Winklevoss brothers donated the maximum allowed amount per individual to Trump’s campaign.

The SEC is an independent agency, which means the President does not have the authority to fire Gensler. However, Gensler’s term ends in July 2025.

Trump transition team officials are preparing a short list of key financial agency heads they will present to the president-elect soon, Reuters reported earlier this month citing people familiar with the matter. So far, there are three contenders for the list: Dan Gallagher, former SEC commissioner and current chief legal and compliance officer at Robinhood; Paul Atkins, former SEC commissioner and CEO of consultancy firm Patomak Global Partners; and Robert Stebbins, a partner at law firm Willkie Farr & Gallagher who served as SEC general counsel during Trump’s first presidency.

While nothing is set in stone yet, Gallagher is the frontrunner, according to the report.

CryptoQuant

CryptoQuant