Research: Russia’s Ukraine invasion led to Bitcoin’s highest sell-off in the past 2 years

Research: Russia’s Ukraine invasion led to Bitcoin’s highest sell-off in the past 2 years Research: Russia’s Ukraine invasion led to Bitcoin’s highest sell-off in the past 2 years

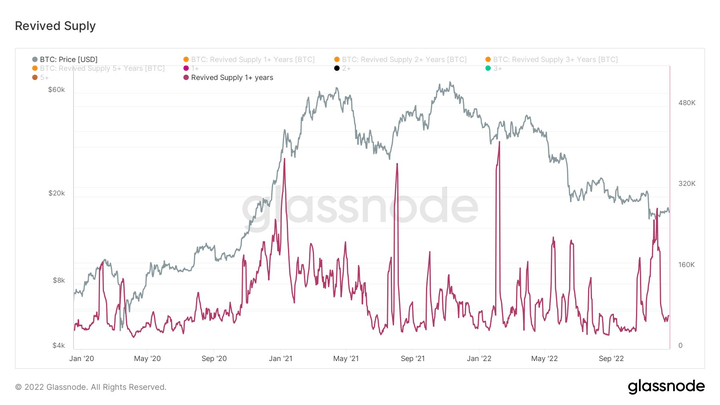

Using Glassnode's Revived Supply data, CryptoSlate discovered that Russia's Ukraine invasion led to the highest Bitcoin sell-off among long-term holders.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The last two years have been very eventful for the crypto space. The industry witnessed astronomic crypto adoption, and Bitcoin (BTC) traded at an all-time high of over $69,000.

However, despite this remarkable growth, the industry has witnessed some adverse events that have shaken investors’ confidence.

Using Glassnode’s Revived Supply data, CryptoSlate can measure the events that have led to significant sell-offs for the flagship digital asset among long-term holders.

Revived Supply is the total amount of coins that returned into circulation after being untouched for at least one year. In other words, it is the total transfer volume of coins that were previously dormant for over a year.

Long-term holders are classified as Bitcoin holders that have held onto the coin for at least six months.

The major sell-off events

Looking at events of the past two years, long-term holders sold significantly over a seven days period on four different occasions. The four events are:

- China’s Bitcoin mining ban in 2021

- The start of the 2021 bull run

- Russia’s Ukraine invasion in 2022

- FTX collapse in 2022

According to the above chart, the highest sell-off occurred after Russia invaded Ukraine. During this period, long-term holders sold off 410,000 BTC.

Other massive sell-off events happened during the 2021 bull run when long-term holders sold 375,000 BTC and during China’s ban on bitcoin mining when they sold 367,000 BTC.

The fourth-highest sell-off event since the COVID pandemic was after the FTX collapse in November. According to the chart, BTC’s revived supply during that week was 280,000 coins–Chainalysis reported that realized losses touched $9 billion, the fourth highest of 2022.

Fear made holders sell

Besides the sell-off at the start of the 2021 bull run when investors took profits, BTC’s revived supply generally peaked at a moment of fear for investors. This was when real-life events caused panic among holding, forcing them to offload Bitcoin.

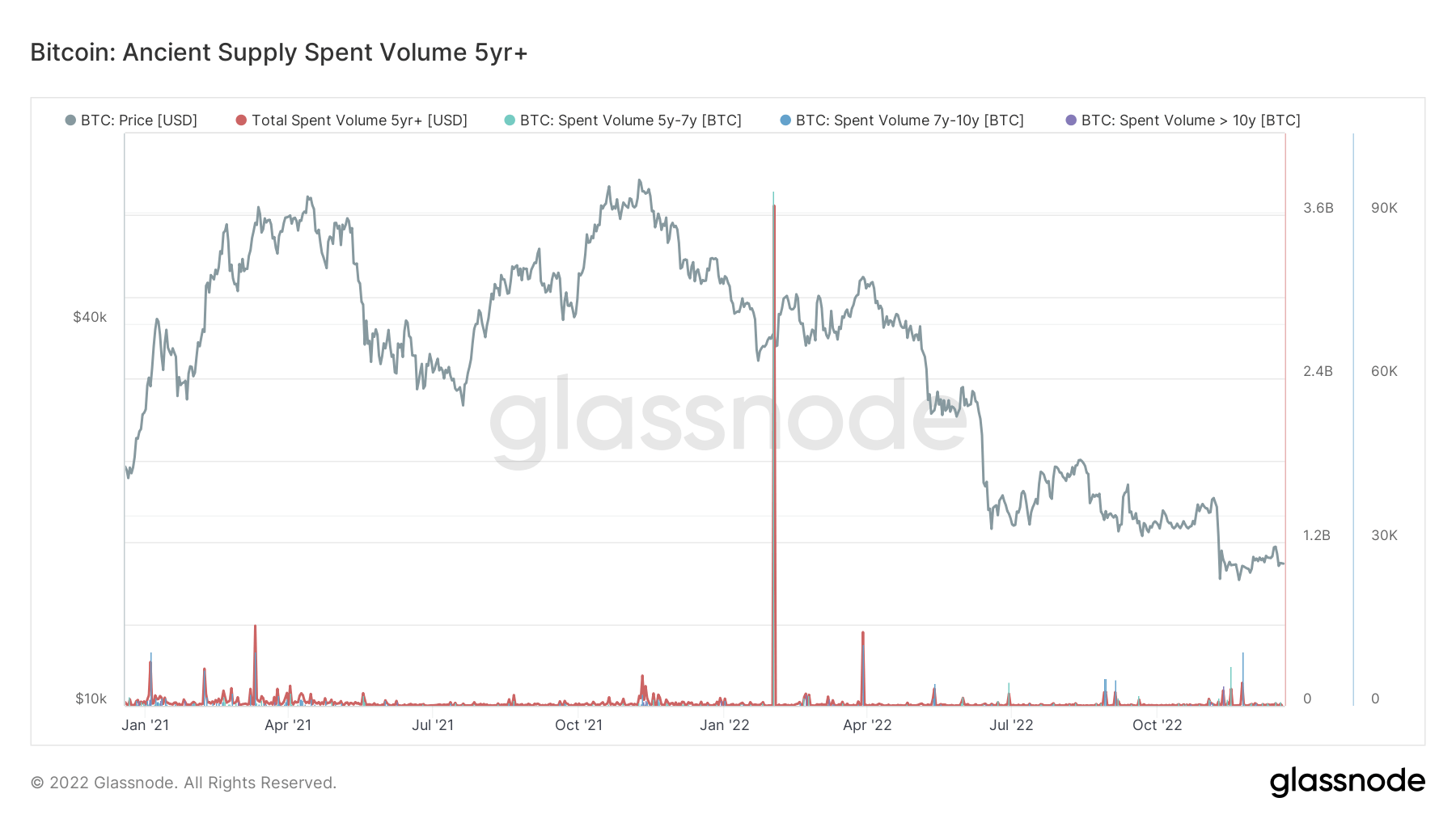

Peak fear happens when Bitcoin, which has been dormant for five years or more, gets sold. These coins are considered ancient coins, and holders must be seriously spooked to lose their conviction and sell.

Russia’s invasion of Ukraine appears to have had this effect on investors. Other events triggered sell-offs, such as the first bull run, the second bull run on November 21, and Luna’s collapse in May 2022.

In conclusion, long-term holders who sold in 2021 did for profit, while those who sold in 2022 did because of fear.