Real Bitcoin volume is exploding as seen in Bakkt, fueling the crypto rally

Real Bitcoin volume is exploding as seen in Bakkt, fueling the crypto rally Real Bitcoin volume is exploding as seen in Bakkt, fueling the crypto rally

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

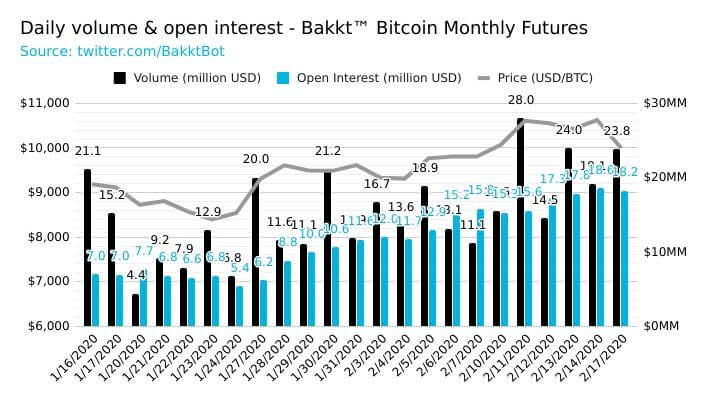

The daily volume of the Bakkt Bitcoin futures market has been on a consistent rise since mid-January. Despite the criticism of the recent rally by some investors who call it an attempt at manipulation, data shows that real volume is on the rise.

Real Bitcoin volume is rising

When volume rises in tandem with the market, it often indicates that the upsurge is backed with strong momentum.

As the Bitcoin price climbed from the $8,000s to $10,500, the daily volume of Bakkt gradually rose from around $10 million to $24 million.

The increase in the volume of Bakkt, as well as other strictly regulated futures platforms including CME Group, show that the demand for Bitcoin from both retail and accredited investors is rising.

Although most of the volume in the cryptocurrency market when the bitcoin rally was just getting started came from margin trading platforms in the likes of BitMEX, over time, spot and futures volume grew.

The expansion of legitimate volume in the cryptocurrency market provided both Bitcoin and altcoins such as Ethereum with a more solid footing to resume a bullish market structure.

What’s next?

In the short-term, traders remain divided on the price trend of Bitcoin. The volume of the dominant cryptocurrency is increasing, and technical indicators like the golden cross of the exponential moving average (EMA) show more upside potential for BTC.

In the past 24 hours, the entire cryptocurrency market has consolidated following a major rally on February 15.

One cryptocurrency trader said:

“And so, we’ve bounced on the green area around $9,450-9,500. That was heavily needed. We could still see a period of relative calm movements, before we’re either attacking the highs at $10,400 or the lows at $9,500.”

With the market structure for Bitcoin and for other major cryptocurrencies like Ethereum seemingly optimistic at a macro level, volumes across the board are expected to continue rising as the block reward halving approaches in April.

Both Bitcoin and Ethereum, which have been leading the market upsurge throughout February, have been demonstrating an extended rally with frequent pullbacks.

Minor corrections allow the market to healthily maintain its momentum without risking a significant downturn in the near-term. It also brings stability into the market, preventing abrupt instances of heightened volatility that often results in a cascade of long or short liquidations.

Bitcoin Market Data

At the time of press 2:45 am UTC on Mar. 20, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.82% over the past 24 hours. Bitcoin has a market capitalization of $177.05 billion with a 24-hour trading volume of $42.96 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:45 am UTC on Mar. 20, 2020, the total crypto market is valued at at $283.86 billion with a 24-hour volume of $165.42 billion. Bitcoin dominance is currently at 62.35%. Learn more about the crypto market ›