‘Coldest’ crypto wallet founder Ruben Merre discusses Bitcoin as a savior, algorithmic stablecoins, and the DeFi craziness

‘Coldest’ crypto wallet founder Ruben Merre discusses Bitcoin as a savior, algorithmic stablecoins, and the DeFi craziness ‘Coldest’ crypto wallet founder Ruben Merre discusses Bitcoin as a savior, algorithmic stablecoins, and the DeFi craziness

While many of the crypto narrative these days is about “yield farming” and DeFi tokens, much of the permanence of the cryptocurrency industry relies on the pillars of providing privacy, robust tech, a strong alternative for people to be their own bank. An individual building such a solution is Ruben Merre, the co-founder and CEO […]

While many of the crypto narrative these days is about “yield farming” and DeFi tokens, much of the permanence of the cryptocurrency industry relies on the pillars of providing privacy, robust tech, a strong alternative for people to be their own bank.

An individual building such a solution is Ruben Merre, the co-founder and CEO of hardware crypto wallet NGRAVE, which calls itself the “coldest” wallet maker ever and features three products on its homepage for users looking to take the security of their coins to the next level.

He first took note of crypto for the massive price swings the industry is known for but quickly switched gears to building products and technologies for users in the space.

In a recent virtual interview with community-driven crypto edutainment channel Cryptonites, Merre sat down with Cryptonites host Alex Fazel to share his thoughts on a range of topics affecting the crypto market today — such as the significance of privacy in the blockchain industry, the rise of stablecoin, growing crypto adoption in Venezuela, and if centralized crypto finance (CeFi) has a chance against DeFi apps.

Here’s what they said.

Bitcoin as a store of value

Merre, after a brief background to Fazel, pointed out the ongoing stimulus programs in traditional markets have inflated the stock market to almost exhibiting a “bubble behavior,” which has in turn made the traditional market unattractive for retail investments if one considers risk vs. rewards.

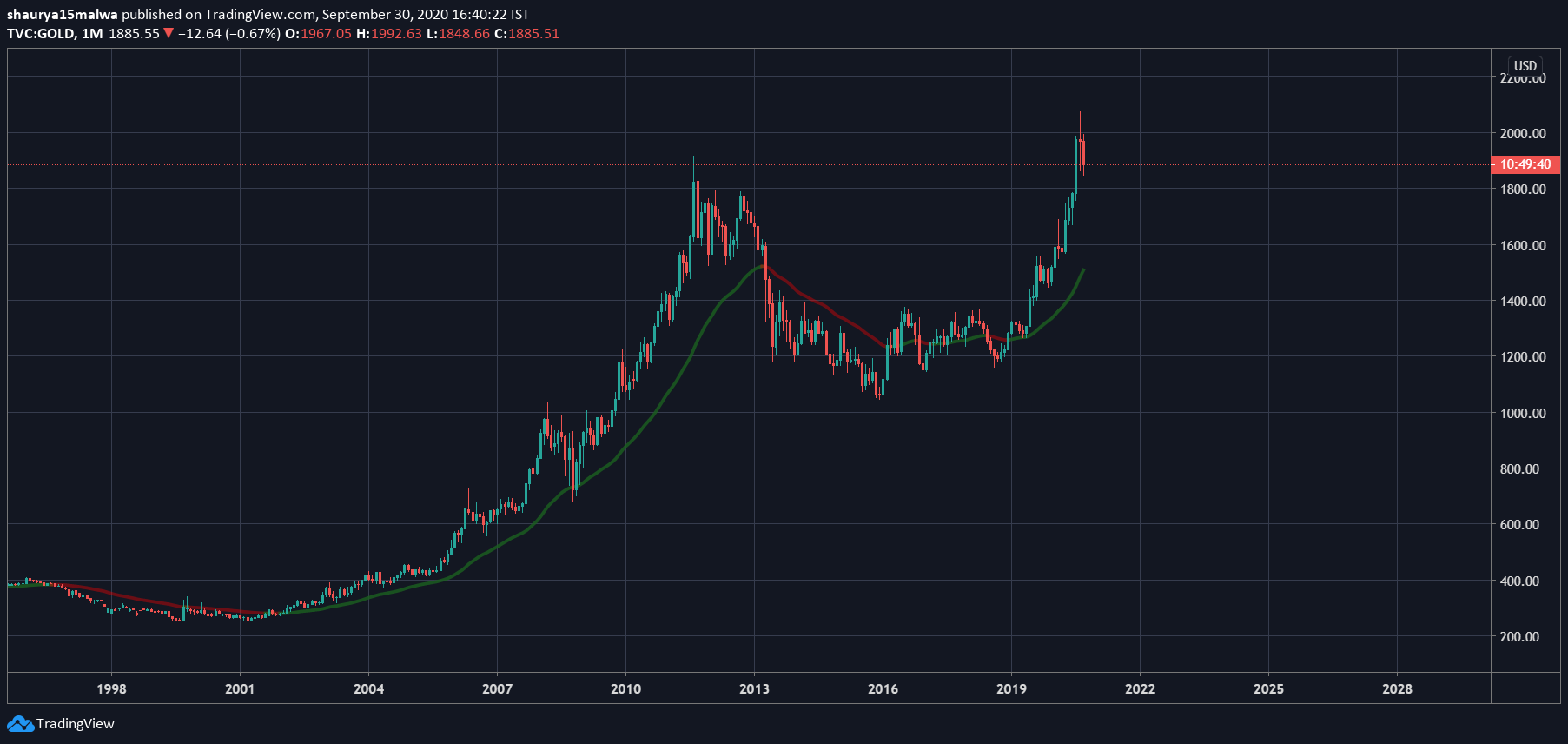

“It’s not very interesting to invest in that,” said Merre, adding that gold’s investment thesis has similarly weakened if one looks at the yellow metal’s price action of the last ten years. Holders “barely made any returns,” which made the asset unconvincing as a global hedge and, as a consequence, makes the crypto market a better bet for investors.

“You’re at 50% of the all-time high of Bitcoin, more or less. So if you think about it, risk rewards and about how small that market is. And obviously all the things you can list up as reasons,” said Merre. He added:

“I think the crypto space is one of the most compelling when it comes to a risk-reward ratio. I think it’s one of the best places to put your money today.”

How Latin America is turning to Bitcoin

Speaking of quantitative easing, Merre pointed out how similar processes in Latin American nations have led to abject hyperinflation inflation, which economic reports suggest have caused irreparable damage to the economies of those regions.

But, as a strange silver lining of sorts, such countries are actually turning to cryptocurrencies as a store of value ahead of gold and equities to protect their wealth. Merre cited recent reports, as CryptoSlate has extensively reported on, to back up his claim.

It’s also where stablecoins come in, said Merre:

“This is an investment that is expected to retain or increase in value during times of market turbulence. But if we look specifically at stable coins, then those are defined as an external reference that offers price stability.”

He added stablecoins also depend on the actual fiat they are pegged on a 1:1 ratio to: “You could even have a stable coin for the Venezuelan bolivar, but obviously, then the stablecoin wouldn’t be very stable, right?”

Merre also explained how algorithmic stablecoins work in the real world:

For example, we buy very, very long-term yield bonds or something, and we give back pure cash and banks can similarly read again because they have liquidity and they can start getting loans again and make, make money. Because basically this, this back and forth of giving some money, putting some money back, that’s what algorithmic stablecoins look like a lot. They do it automatically expand contract contracts, the monetary supply.

The $10 billion DeFi madness

Merre then shifted his focus on DeFi, the $10 billion crypto sub-sector that has lured thousands to the promises of making free millions but seems to have largely ended in despair for the retail crowd.

“DeFi is hitting, all the right buttons for speculation. Cause we’ve seen thousands of percent of yields in one day and this, and the same 99% drops a day later. So it’s, I think it’s very creepy. Um, I think you have to really watch out what you do,” said Merre.

“Nobody knows who you are in DeFi, and you can actually do a lot of it with that centralized findings of the total opposites and both have their merits. And obviously, centralized finance has matured a lot as it’s been around for a long time. And DeFi is just coming up.”

However, he suggested DeFi investments are a strategy best “left to the pros. “It’s a very crazy world. I would say,” Merre said on DeFi.

NGRAVE, the world’s coldest crypto wallet

Fazel asked Merre about NGRAVE, and especially the wallet’s many privacy-centric features for users.

“So what we’ve done is we have built offline hardware. The wallet does zero it’s right here, and it can, um, create your keys offline. It can send transactions offline. It will never connect to the internet,” explained Merre.

“It is completely immune to any kind of online attacker because nobody can attack it. There is no line of attack possible. It is also a bill from scratch to be tamper-proof. So physical attacks are also not possible and to prove the, to really prove that it’s so secure, we certified it for EAL 7, which is the highest security certification in the world.”

Merre added NGRAVE is also “all about user experience” — a simple touch screen device that users won’t “even recognize or notice that there is cryptography in the back.”

(The above is part of a Cryptonites virtual interview that you can watch in full below.)

Ro Khanna

Ro Khanna