Chainlink founder Sergey Nazarov on DeFi, smart contracts, and how oracles solve big problems

Chainlink founder Sergey Nazarov on DeFi, smart contracts, and how oracles solve big problems Chainlink founder Sergey Nazarov on DeFi, smart contracts, and how oracles solve big problems

Last week’s BlockDown 3.0 virtual event saw Chainlink founder Sergey Nazarov discuss the rise (and fall) of decentralized finance applications, the Chainlink protocol, and the use of smart contracts in a virtual fireside chat. Nazarov has worked on smart contracts for over seven years and has been in the blockchain space for over ten years, […]

Last week’s BlockDown 3.0 virtual event saw Chainlink founder Sergey Nazarov discuss the rise (and fall) of decentralized finance applications, the Chainlink protocol, and the use of smart contracts in a virtual fireside chat.

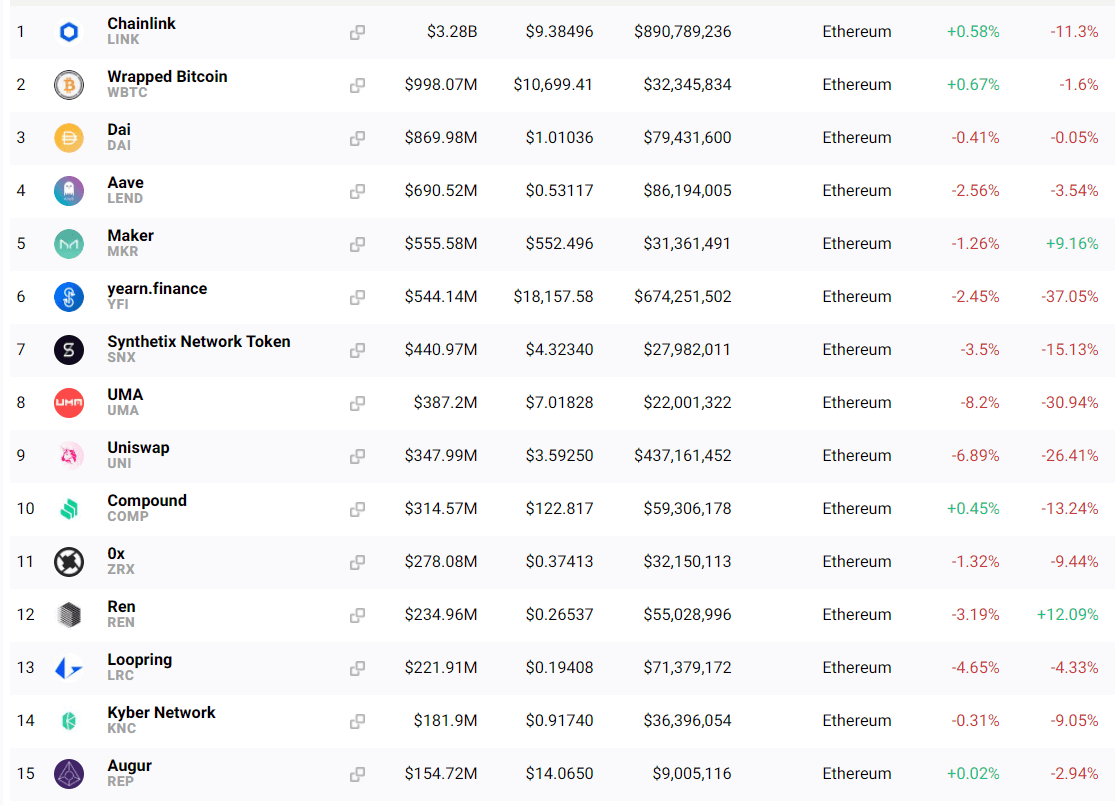

Nazarov has worked on smart contracts for over seven years and has been in the blockchain space for over ten years, starting out with mining. Chainlink, the protocol he created and maintains via parent firm SmartContract, is ranked seventh in the world by market cap and has been one of the fastest-growing cryptocurrencies by both adoption and valuation in 2020.

On smart contracts

Nazarov started off by explaining the role of smart contracts in today’s world, “Smart contracts are the most advanced form of digital agreement out there, they provide guarantees something that will happen. Other agreements are run by centralized entities, eg AirBnB or Uber, insurance, the global financial system.”

He noted that the world of such “brand-based contracts” is going to be slowly or quickly going away. “The reason you can believe in the contract is because there’s a logo. These are assumptions that people make when the market is good,” Nazarov shared, adding:

“But cyclical booms and busts that go in these spirals of devaluation, in those circumstances people value transparency that comes with smart contracts.”

Nazarov stated that contracts that work in low systematic ways — such as the financial crisis of 2008 that Bitcoin was borne out of — were flawed because those contracts had no transparency of underlying value, which in turn led to a “cyclical boom and bust.”

However, fully automated smart contracts of today are different, as they can now offer agreements that didn’t exist previously. “You’re a farmer but if you don’t have insurance you can’t be a farmer anymore and you have to migrate to a city and your whole life changes,” explained Nazarov.

He added, “Now have smart contracts in a place where you can provide these farmers with insurance. If you can automate agreements with weather data, then you don’t need a local legal system. Get relevant guarantees you need to have that form of agreement.”

The data-oracle problem

Nazarov then shared how oracles — decentralized third-party services like which provide verifiable and reliable data into a blockchain — helps solve much of the issues related to a breakdown of a service operating on the blockchain.

“More and more data appearing, more data, more capacity to automate, second systems like ours are continually improving and are reliable enough to trigger a reliable outcome,” he noted.

“This is a problem we work on that is how do you prove to a contract that something happened.”

The above, for Nazarov, is an eventual move into real-work applications like crop insurance. “I am excited to see more and more real-world applications of data that can eventually be tokenized and used as collateral,” he noted.

On-chain verifiable randomness — a protocol to ensure true randomness — on blockchain games like PoolTogether and ChainFaces is yet another application, the Chainlink founder stated.

This usage of data, in turn, allows users to prove the status of collateral relevant to the mortgages, which could have even prevented economic downturns, as per Nazarov.

“Proof of reserve would have solved the 2008 financial crisis,” he opinioned.

He added, “Smart contracts evolve because the systems we have are at the limit and that’s a good thing. Now, people are solving scalability. When that’s solved you’ll see even more use cases. The majority of them will need data inputs.”

“We’re making the Chainlink system more scalable. You’ll see a variety of use cases, preventing various types of fraud, such as online click fraud.”

DeFi…adoption imminent but short-term pain

Coming to the DeFi market, which has boomed in Q3 of 2020 but has seen a cool off in the past month, Nazarov stated the broader ecosystem had both a “compelling slow case and fast case.”

“The slow case ecosystem has reached critical mass. Even with only $10 mil in defi you already see people with successful teams, getting funding to grow and building next-gen smart contracts,” he stated.

Nazarov added, “[The] space has reached a size where you can have niche defi projects that become highly successful, can now be successful in building something that’s not just about a token, but it’s about building a use case.”

However, he cautioned:

“Think we’re on schedule for quite a big bust, going to be very frightening. One positive that might come out of it and if blockchains are well made enough – which I think they are – people will in their sensitivity come to realize on a macro level that blockchains are the safety net against this extreme boom and bust cycles.”

But that’s not to suggest that DeFi is a lost cause. “The fast case will be very scary, and from the point of view of the blockchain industry, it could lead to mass adoption. Every year I’ve said this will be the year for bc solutions. We’re definitely seeing an acceleration in [both] the slow case and fast case,” Nazarov concluded.

(The above is part of a BlockDown fireside chat available for streaming below.)

CoinGlass

CoinGlass

Farside Investors

Farside Investors