NFTs emerge as a portfolio saver amid crypto market downturn

NFTs emerge as a portfolio saver amid crypto market downturn NFTs emerge as a portfolio saver amid crypto market downturn

Bitwise CEO Hunter Horsely posts YTD performance data, and against expectations the Bitwise Blue-Chip NFT Index is holding up.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Against a backdrop of macroeconomic uncertainty, crypto markets are faltering. However, fund performance data from Bitwise suggests NFTs are holding up amid the uncertainty.

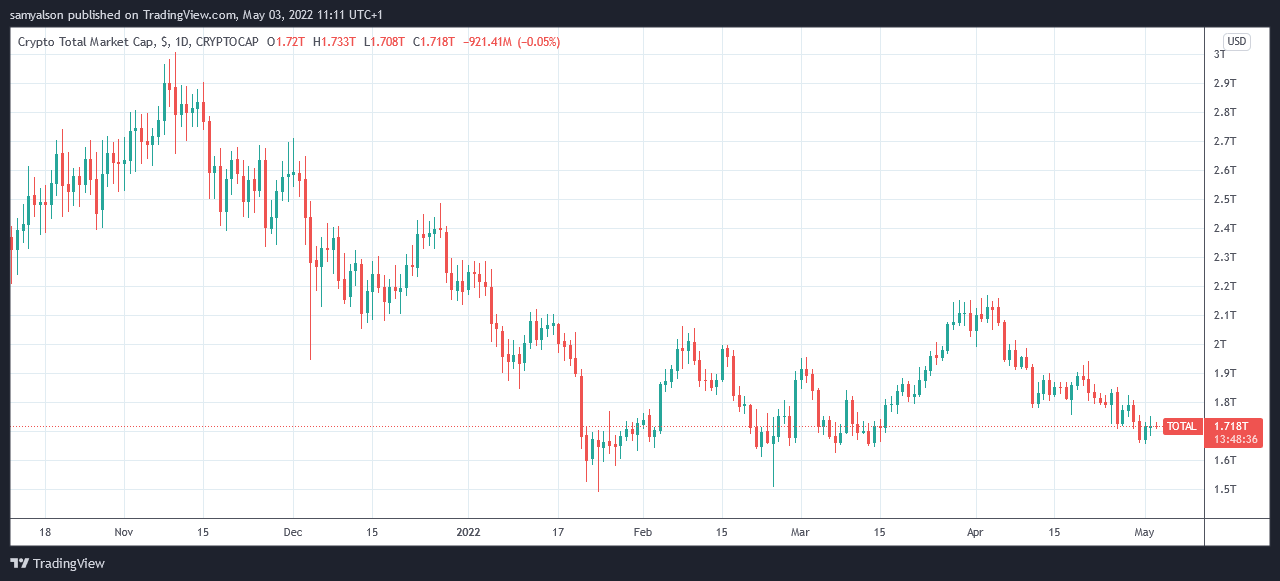

Crypto markets under pressure

Crypto markets have been caught in a noticeable downturn since the start of April. Over this period, the total crypto market cap has lost $448 billion from its local top of $2.1 trillion.

Analysts point to broader macroeconomic factors causing investor sentiment to flip risk-on. And with cryptocurrencies widely regarded as high risk, some say the bear market is already here.

The $1.6 trillion level has proven strong support, with multiple bounces at this level since mid-February. The most recent retest was on April 30, leading to a 5% upswing.

However, considering the total crypto market cap is 43% down on November 2021’s all-time high, the outlook remains grim.

Bitwise CEO Hunter Horsley tweeted YTD performance figures for some of the funds managed by the crypto asset management firm. Of those he listed, the Bitwise DeFi Index (the top three constituents are Uniswap, Aave, and Maker) showed the most significant loss at -53%.

But surprisingly, the Bitwise Blue-Chip NFT Index (the top three constituents are Bored Ape Yacht Club, CryptoPunks, and Mutant Ape Yacht Club) was the only fund in the green.

YTD:

Bitwise DeFi Index: -53%

Bitwise 10 Large Cap Index: -23%

Bitwise Crypto Industry Index (Equities): -17%

Bitwise Blue-Chip NFT Index: +16% (!!!)Crypto supposed to be more volatile, but…$QQQ: -22%$ARKK: -50%

… $AGG: -10%— Hunter Horsley (@HHorsley) May 2, 2022

Commenting on the YTD performance of the funds, one Twitter user said a scenario in which NFTs “save our portfolios” would have been laughable a year ago.

“A year ago if you told someone that all stocks & crypto would crash but NFTs would save our portfolios they would’ve laughed so hard.”

Are NFTs holding things up?

The ultimate status symbol or pointless jpegs? While it’s true non-fungible tokens serve broader purposes than just digital artworks, the debate surrounding them still continues to rage.

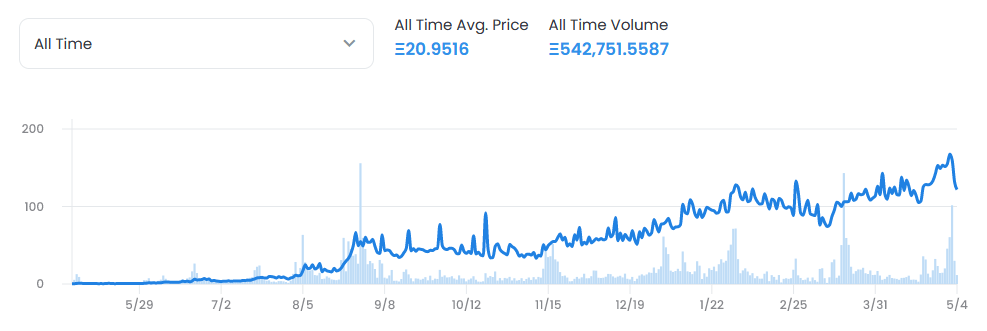

A recent Bloomberg article laid out the case for a cooling NFT market by pointing out the average selling price has fallen from $6,900 on January 2, 2022, to less than $2,000 at the start of March. In addition, total daily average sales have declined, falling from $160.2 million on January 31, 2022, to $26.2 million on March 3, 2022.

However, this pattern is not reflected in the top-tier NFT collections. The Bored Ape Yacht Club (BAYC) Collection has a current floor price of 114.3 ETH ($325,000 at today’s price). Analysis of its average selling price shows a sharp downturn since the start of May. But throughout 2022, the average selling price is still trending upwards.

As such, the data points to a split market. While averages show a decline in NFT sales price and volume, top-tier collections like BAYC are bucking the trend.

But will top-tier NFTs continue to outperform as the year continues?

CryptoQuant

CryptoQuant