More than 11.5 million Bitcoin hasn’t been moved in over a year

More than 11.5 million Bitcoin hasn’t been moved in over a year More than 11.5 million Bitcoin hasn’t been moved in over a year

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

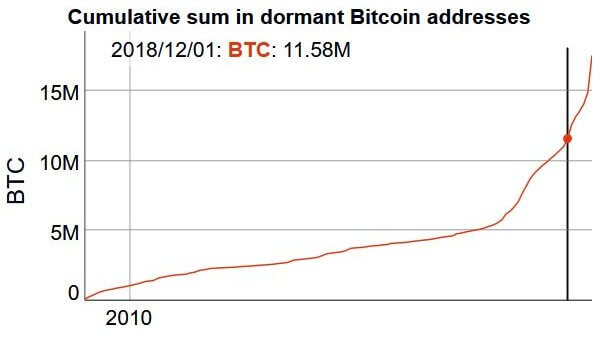

Despite Bitcoin’s incredible 85 percent price increase, more than 11.5 million Bitcoin hasn’t been moved in over a year. Crypto analyst Rhythm Trader believes the increase in hodlers is a bullish indicator for Bitcoin, as it shows most are drawn by Bitcoin’s long-term investment potential.

Fewer people moving their Bitcoin than ever before

Earlier this year it seemed that Bitcoin could do no wrong and that it was up for a historic rally that would put its 2017 boom to shame. Analysts and crypto experts had endless bullish predictions for the world’s largest cryptocurrency, as its growth metrics made a downward trajectory seem almost impossible.

Bitcoin’s latest slump seems to have challenged most of these predictions — even the staunchest Bitcoin maximalists were taking back their words and putting out more bearish forecasts.

However, one analyst is sticking by his extremely bullish prediction for Bitcoin. Crypto analyst and Bitcoin advocate Rhythm Trader believes we should be looking at those that hold Bitcoin rather than those who sell it to determine the true state of the market.

According to data from BitInfoCharts, more than 11.5 million BTC have been dormant in the past year, despite the coin’s value increasing almost 85 percent.

This, the analyst believes, shows that most Bitcoin holders are sticking by their investments as they believe in the long-term value it will bring.

But what about the lost coins?

And while many welcomed the analyst’s unlikely bullish prediction, the data used to illustrate the point doesn’t paint a realistic picture of the market.

At the end of October, Bitcoin celebrated a major network milestone — its 600,000th block was mined, putting its circulating supply at around 18 million BTC. With a supply capped at 21 million coins, its scarcity is becoming more apparent with each passing day.

Back in November, a report from CoinMetrics showed that Bitcoin’s circulating supply was significantly smaller than it should be, as it is estimated that there are more than 1.6 million coins that are probably lost forever.

With Bitcoin’s actual circulating supply pushed down to 16.4 million, having 11.5 million dormant coins mean that less than 4.9 million coins (30 percent) moved addresses or changed hands in the past year. It seems highly unlikely that all 11.5 million BTC have been deliberately left alone as a long-term strategy — a much more probable explanation is that a portion of them have been lost.

Even a much more modest estimate on how many coins are being kept as long-term investments makes an extremely bullish case for Bitcoin. If we assume that even half of the 11.5 million dormant coins are lost forever, it would mean that there are still more than 5.7 million of them being held with no intention of selling any time soon.

With an average holding time of 2.8 years according to IntoTheBlock and a steady increase in the number of hodlers, it seems everyone is anticipating a bright future for Bitcoin.