Largest Bitcoin Mining Pools Gutted as Bitmain Reels

Largest Bitcoin Mining Pools Gutted as Bitmain Reels Largest Bitcoin Mining Pools Gutted as Bitmain Reels

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The two largest Bitcoin mining pools, BTC.com and Antpool, have lost a large chunk of their hash power over the crypto winter. The two Bitmain owned pools signaled the mining market’s implosion, culminating in Bitmain laying off 50 percent of its workforce.

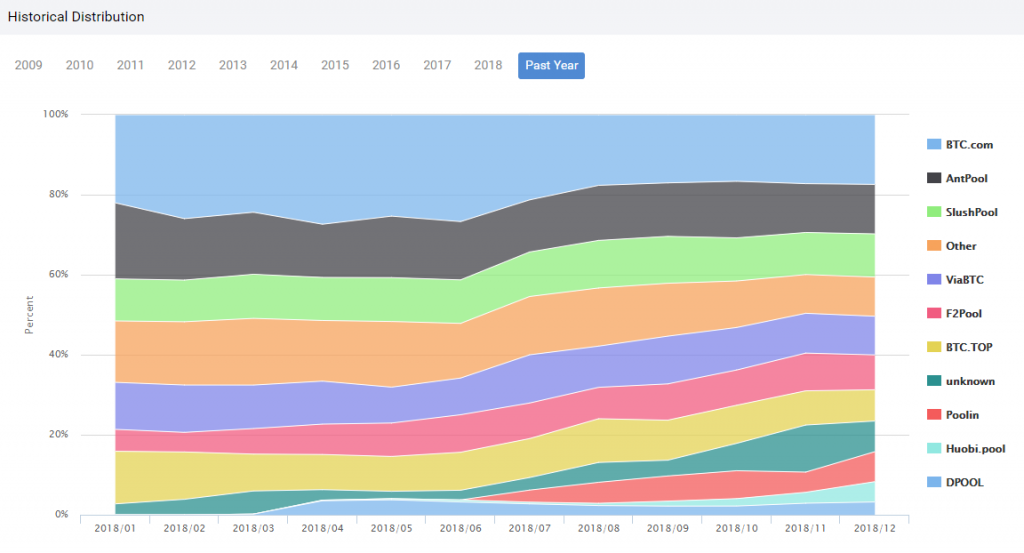

At the beginning of 2018, Bitmain’s mining pools BTC.com and Antpool were the go-to destinations for miners. Collectively, both pools controlled an alarming 41 percent of all Bitcoin hash power.

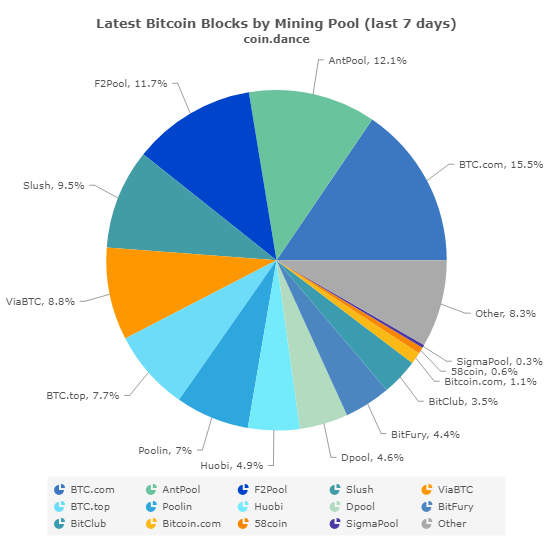

If Bitmain’s November hash rate disclosures are accurate, the giant controlled a total of 4.5 percent of all Bitcoin mining.

Going into 2018, many miners were anticipating crypto prices to continue appreciating, or at the very least remain stagnant. The aftermarket price of graphics cards, a common piece of mining equipment, reflected this dynamic: one Nvidia GeForce GTX 1080, a high-end piece of GPU mining equipment, was selling in stores for $549 but was trading at over $1,000 on the open market. Most electronics stores were picked dry of equipment, and mining hardware in the entire industry was selling at a steep premium.

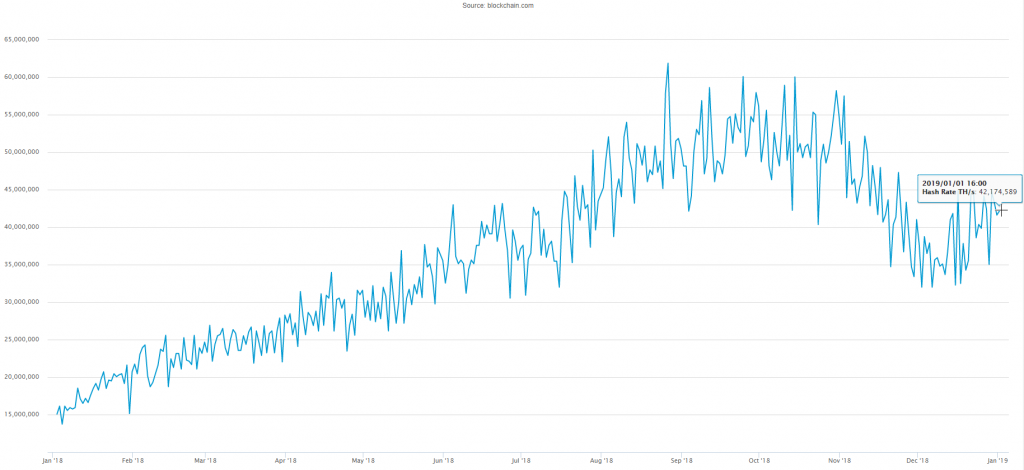

However, the market decline reversed the trend. Cryptocurrency returns shrank in relation to prices. And, in many mining facilities, the cost of electricity and upkeep outweighed revenue. Bitcoin’s price deterioration from $13,800 to $3,800 meant that miners had to decommission electricity-hungry machines, sell out-dated hardware, and in some cases, even file for bankruptcy.

How Mining Pools Work

Mining pools are collections of miners—in exchange for a small fee, these miners can reduce the volatility of bitcoin payouts. Usually, for an average miner, it will take a year or more to solve the Bitcoin algorithm and reap the jackpot of 12.5 BTC ($48,000).

Instead, these miners group together to earn BTC rewards consistently. If any single miner in a pool discovers a correct solution, then that reward is split with all other participants proportionate to their hash power contribution.

Bitmain Loses its Grip on Mining

Bitmain is losing its grip over Bitcoin’s network. Bitmain’s two mining pools, BTC.com and Antpool, have shrunk to just 30 percent of the overall market; a 27 percent relative decline since the beginning of the year.

Meanwhile, the overall network hash rate has not contracted in line with price, and instead trailed price decreases by several months. This means that many miners may have operated at a loss before shutting down their rigs, and now at the trough of the market are finally shuttering facilities.

It appears that Bitmain is winding down operations to reflect current market conditions. These changes are reflected in the dominance of Bitmain’s mining pools. If prices remain stagnant, then miners will continue to bleed. However, if bitcoin performs well in 2019, it will breathe new into the industry as rigs come back online by the thousands.