Institutional money flooded into Bitcoin before $7,000 rally, data shows

Institutional money flooded into Bitcoin before $7,000 rally, data shows Institutional money flooded into Bitcoin before $7,000 rally, data shows

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin saw a notable price surge late-last week that allowed it to surmount the resistance it was facing at $7,000 and run to highs of $7,300, which is the point at which it lost its momentum and incurred a notable rejection.

Although this movement proved to be fleeting, data seems to elucidate an interesting trend, with the sharp rise in CME futures volume and large transaction volume both pointing to the possibility that this was an institutional-driven movement.

This is further supported by the fact that open interest on Bitmex actually declined on April 2nd, showing that traders were not the suspects behind this fleeting rally.

Bitcoin’s fleeting rally to $7,300 results in consolidation

In the time following Bitcoin’s brief surge to these recent highs, the cryptocurrency has once again found itself caught within a bout of sideways trading within the upper-$6,000 region.

This appears to be the same trading range that the crypto was caught within in late-March, and the resistance in the $7,000 region has so far proven to be insurmountable for the cryptocurrency.

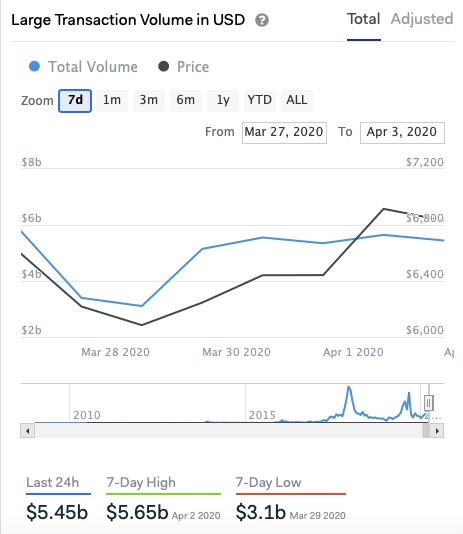

One interesting factor is that this movement came about in tandem with a sudden spike in large transaction volume.

Data from IntoTheBlock, a data and analytics platform, shows that the volume of large Bitcoin transactions – defined as those being greater than $100,000 in value – spiked from its March 29th lows of $3.1 billion to highs of $5.65 billion on April 2nd, with this data showing that large buyers were backing the movement.

CME futures volume suggests institutional buyers backed this movement

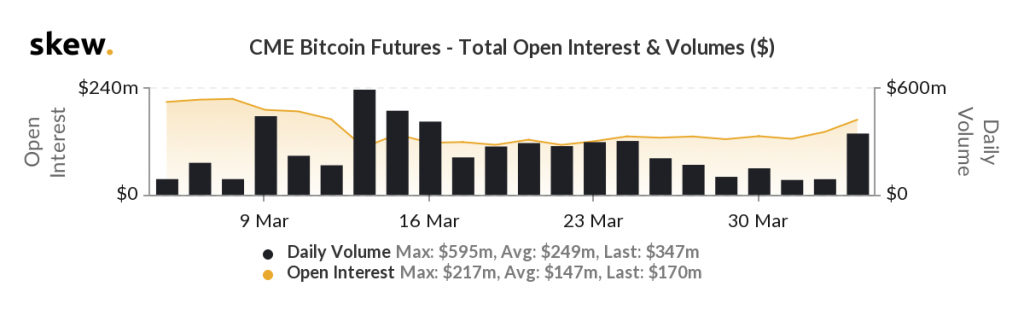

This significant buying activity may stem from large retail and institutional buyers, a notion that is further supported by the massive rise in CME futures volume, which surged from $88 million on April 1st to $347 million on April 2nd, according to data from Skew.

Because CME futures have high trading requirements and are tailored for institutions and accredited investors, the spike seen here does indicate that this rally was caused by a sudden influx of capital from non-retail investors.

Open interest on cryptocurrency platform BitMEX declined during this period, also showing that retail traders were not the ones driving the fleeting rally.

In the mid-term, this may suggest that large players within the crypto market are currently accumulating Bitcoin, potentially because they anticipate it to see further upside over a mid or long-term timeframe.

Bitcoin Market Data

At the time of press 4:27 pm UTC on Apr. 5, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.7% over the past 24 hours. Bitcoin has a market capitalization of $124.39 billion with a 24-hour trading volume of $30.8 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:27 pm UTC on Apr. 5, 2020, the total crypto market is valued at at $191 billion with a 24-hour volume of $101.51 billion. Bitcoin dominance is currently at 65.13%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)