US labor market and manufacturing strengthen leading to $63k bitcoin price

US labor market and manufacturing strengthen leading to $63k bitcoin price Bitcoin surged above $63,000, gaining 6.5% in 24 hours, following US jobs data and the Federal Reserve’s 50-basis-point rate cut.

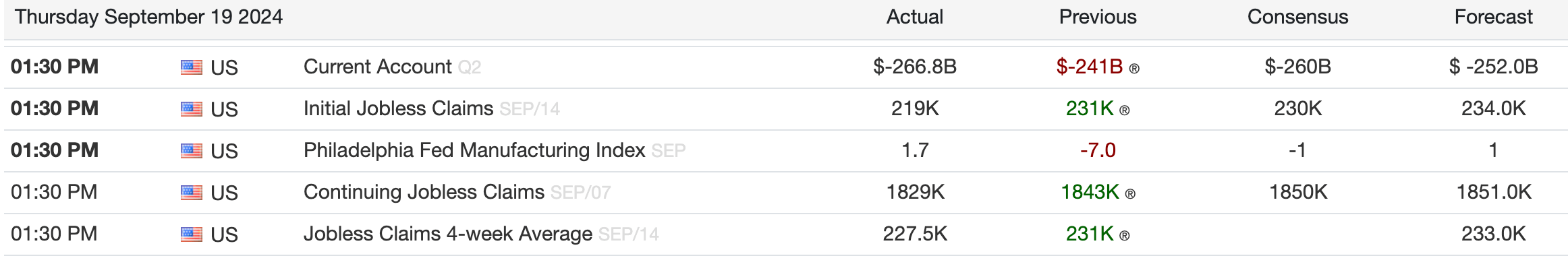

Initial jobless claims decreased to 219,000 for the week ending Sept. 14, below forecasts of 234,000 and down from the previous 231,000. Continuing jobless claims fell to 1.829 million, under expectations of 1.851 million and less than the prior 1.843 million. The Philadelphia Fed Manufacturing Index rose to 1.7 in September from -7.0 in August, surpassing the consensus estimate of -1.

These economic indicators suggest strengthening labor market and manufacturing activity, which can boost investor confidence. A robust economy may encourage investment in risk assets, including Bitcoin. Positive job numbers can lead to higher disposable income and increased market participation.

The rate cut announced yesterday by the Federal Reserve reduced interest rates by 50 basis points, leading Bitcoin to climb from $59,000 to $62,000. Lower interest rates decrease the opportunity cost of holding non-yielding assets like Bitcoin, making them more attractive to investors.

CryptoQuant

CryptoQuant