URPD metric indicates a lack of liquidity for Bitcoin below $60,000

URPD metric indicates a lack of liquidity for Bitcoin below $60,000 Quick Take

Bitcoin experienced a 4% rally on April 18, bouncing back from just below $60,000 on April 17. CryptoSlate has identified $58.8k as a major support level — which is the short-term holder realized price (STH RP) that has previously acted as support during bull runs.

If Bitcoin drops below the support level, it could signal a bearish trend, similar to the breach of STH RP in May 2021 that kicked off the bear market.

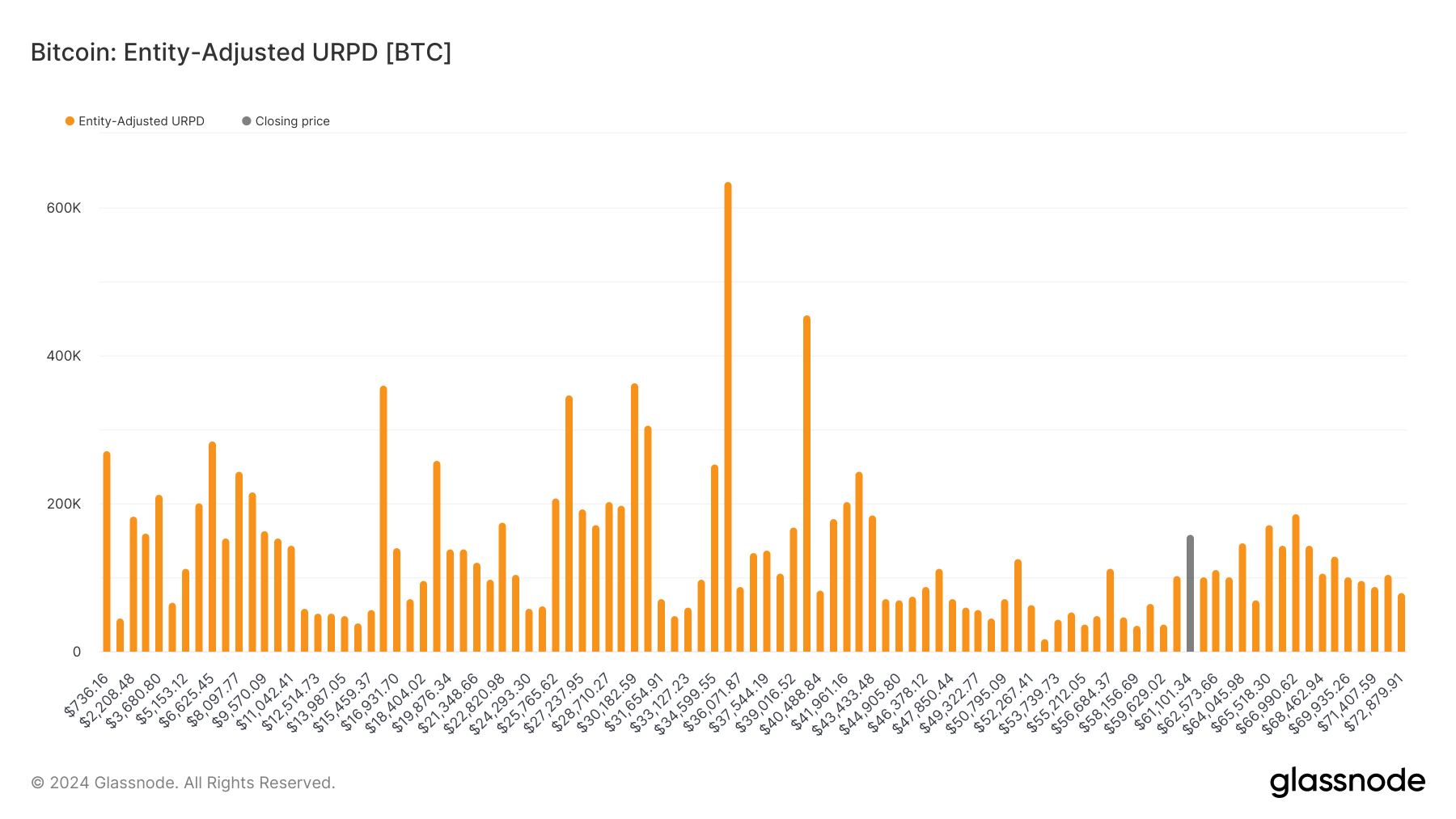

The URPD (Unspent Realized Price Distribution) metric, as defined by Glassnode, shows the prices at which the current set of Bitcoin UTXOs were created — with each bar representing the amount of existing BTC that last moved within a specific price bucket.

Interestingly, less than 5% of the Bitcoin supply is between $50,000 and $60,000 — a range that Bitcoin moved through in just two days between Feb. 26 and Feb. 28.

A significant portion of the liquidity and supply lies within the $40,000 to $45,000 range, which could be a short-term price target if the critical STH RP support is lost.