UK sees first positive real interest rates since 2008 as BOE outpaces inflation

UK sees first positive real interest rates since 2008 as BOE outpaces inflation Quick Take

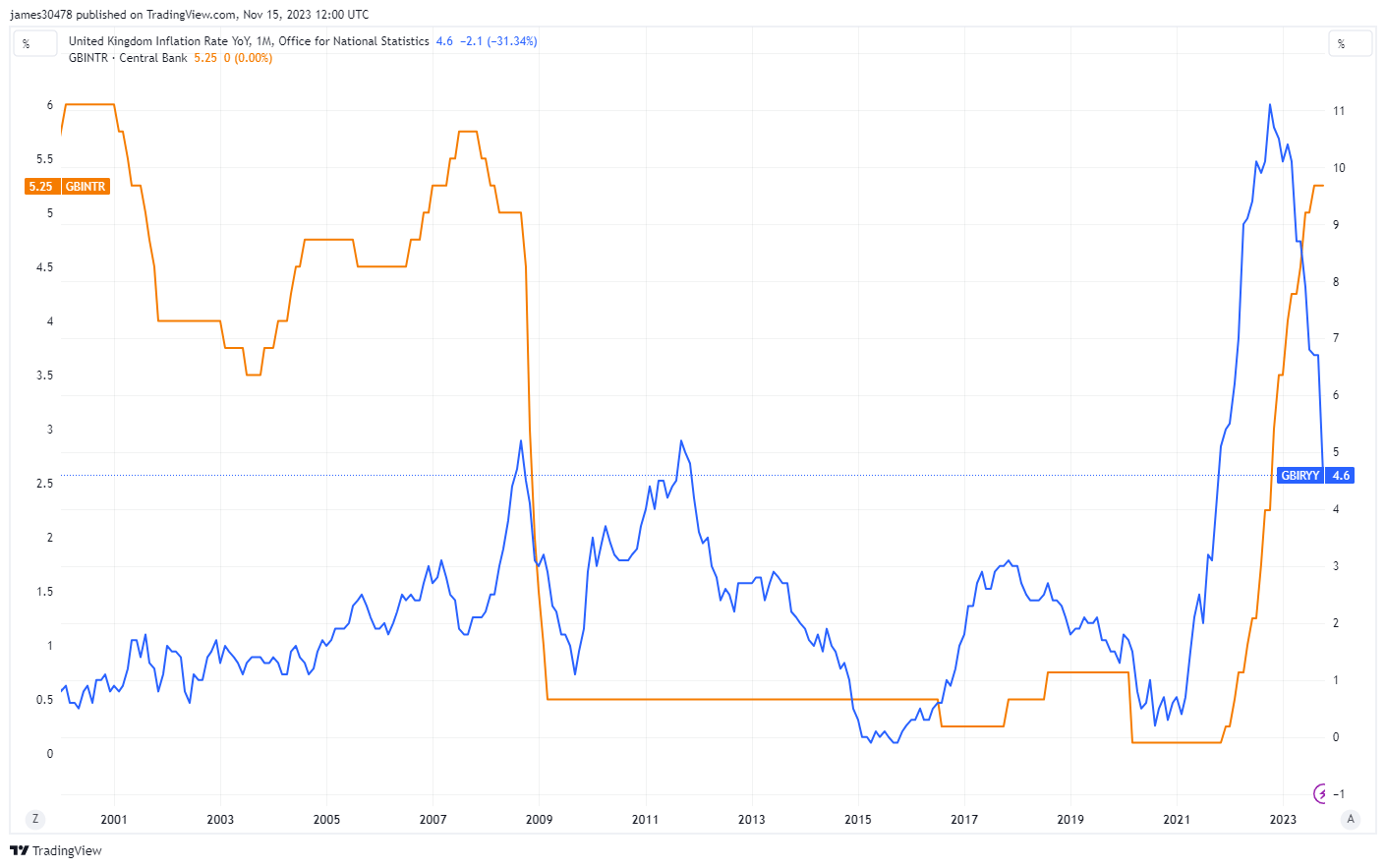

The United Kingdom is experiencing a noteworthy economic phenomenon – Positive real rates – for the first time since 2008.

This occurs when the Bank of England (BOE) interest rates surpass Consumer Price Index (CPI) inflation. Currently, the UK’s CPI inflation sits at 4.6%, while the BOE maintains interest rates at 5.25%. Comparatively, during a brief spell in 2015, but interest rates were less than 1%.

The BOE may breathe easier with this development, but it’s worth noting that the unemployment rate remains at a secular low of 4.2%. The noteworthy question is whether inflation will halt at the mandatory 2% or sink lower, potentially leading to deflation. The BOE’s ongoing challenge lies in curbing wage inflation, which remains stubbornly high in economic terms, creating an obstacle for the bank to achieve its 2% target.