Large and small-scale investors show divergent reactions to Bitcoin downturn

Large and small-scale investors show divergent reactions to Bitcoin downturn Quick Take

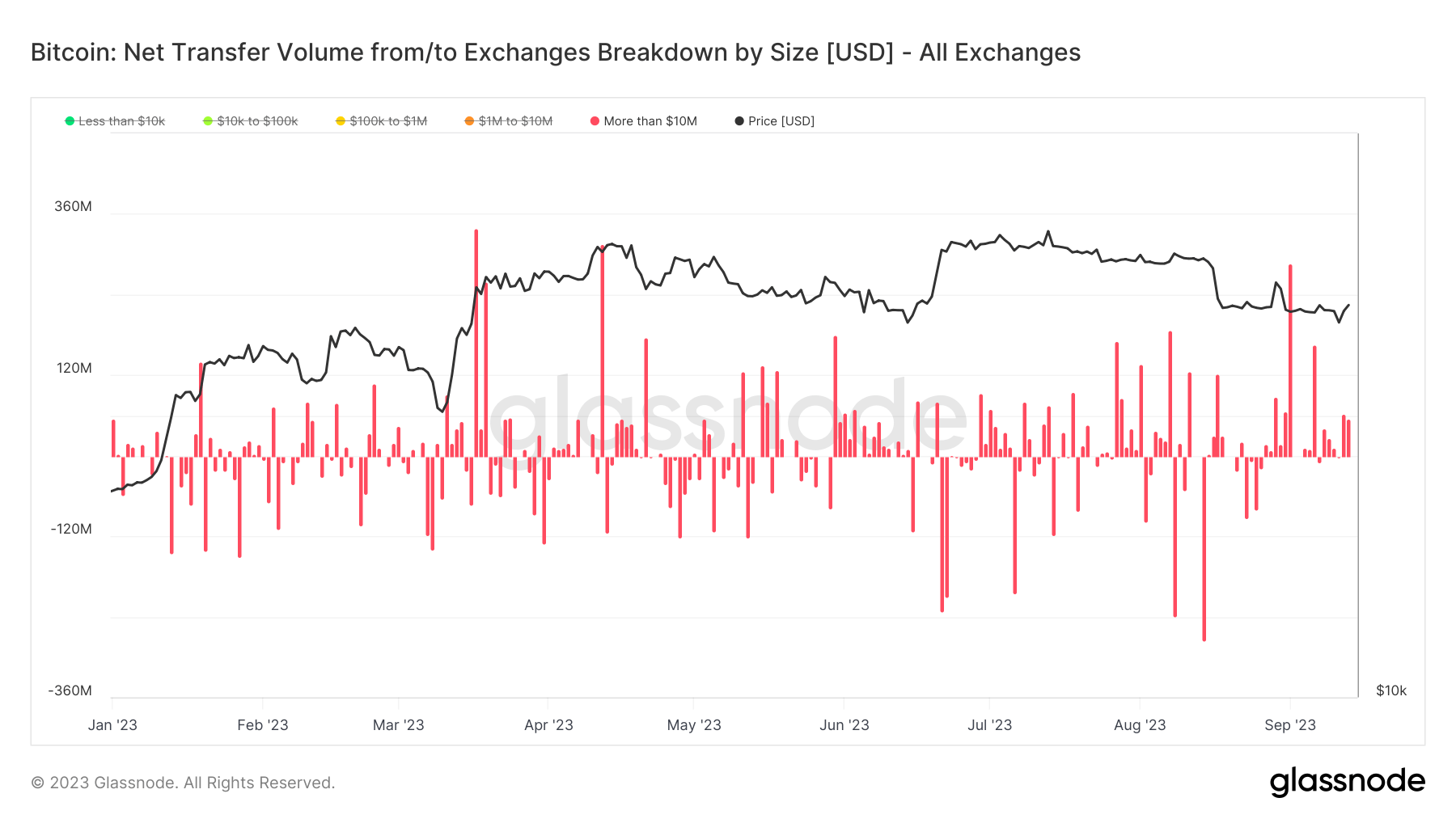

Recent data analysis reveals a fascinating trend within the Bitcoin investing landscape. For almost a month, there’s been a significant influx of Bitcoin to exchanges, particularly from investors in the $10M or more bracket. This surge comes in the wake of Bitcoin’s retracement from $30,000 to $25,000, suggesting that this cohort may have been capitalizing on the high volatility, hence designating August as a month of distribution for them.

In contrast, the investment behaviors of the cohort investing less than $10k are notably different. Year-to-date inflows to exchanges from this group don’t depend on Bitcoin’s rise but show a marked increase whenever Bitcoin experiences a dip. This trend, while contrary to the larger investors, provides an intriguing insight into how different investment groups respond to the same market conditions.

The dynamics of these diverging trends underscore the multifaceted nature of the Bitcoin market, hinting that investor behavior can vary significantly based on the scale of investment and may be influenced by factors beyond mere market fluctuations.