KuCoin’s Bitcoin funding rate soars to 22%, suggesting bullish sentiment

KuCoin’s Bitcoin funding rate soars to 22%, suggesting bullish sentiment Quick Take

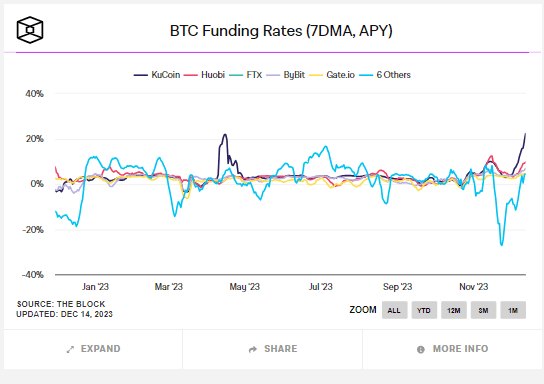

The provided graph showcases Bitcoin’s (BTC) funding rates on various digital asset exchanges, signaling the market sentiment by illustrating a 7-day moving-average annual percentage yield (APY). Noteworthy is KuCoin’s significantly higher funding rate at 22% APY, according to The Block, a positive number that suggests a bullish sentiment. This rate implies long position holders are paying a premium to keep their trades open, indicative of an expectation that Bitcoin’s price will rise.

Other exchanges aren’t far behind, each showing a roughly 5% premium in the funding rates. Once again, this is a positive sign, indicating a general bullish sentiment across multiple platforms. Traders seem willing to pay this premium based on an expectation of Bitcoin’s price increasing in the future.

The data also hints at a historical trend from March 2023, where a similar bullish sentiment was observed, suggesting it was a local top for Bitcoin at around $30,000. However, a word of caution: these high funding rates could also indicate over-leverage in the market. In such scenarios, much of the market is willing to pay a premium to maintain long positions, and this could sometimes be a precursor to a market pullback or price correction.

CryptoQuant

CryptoQuant